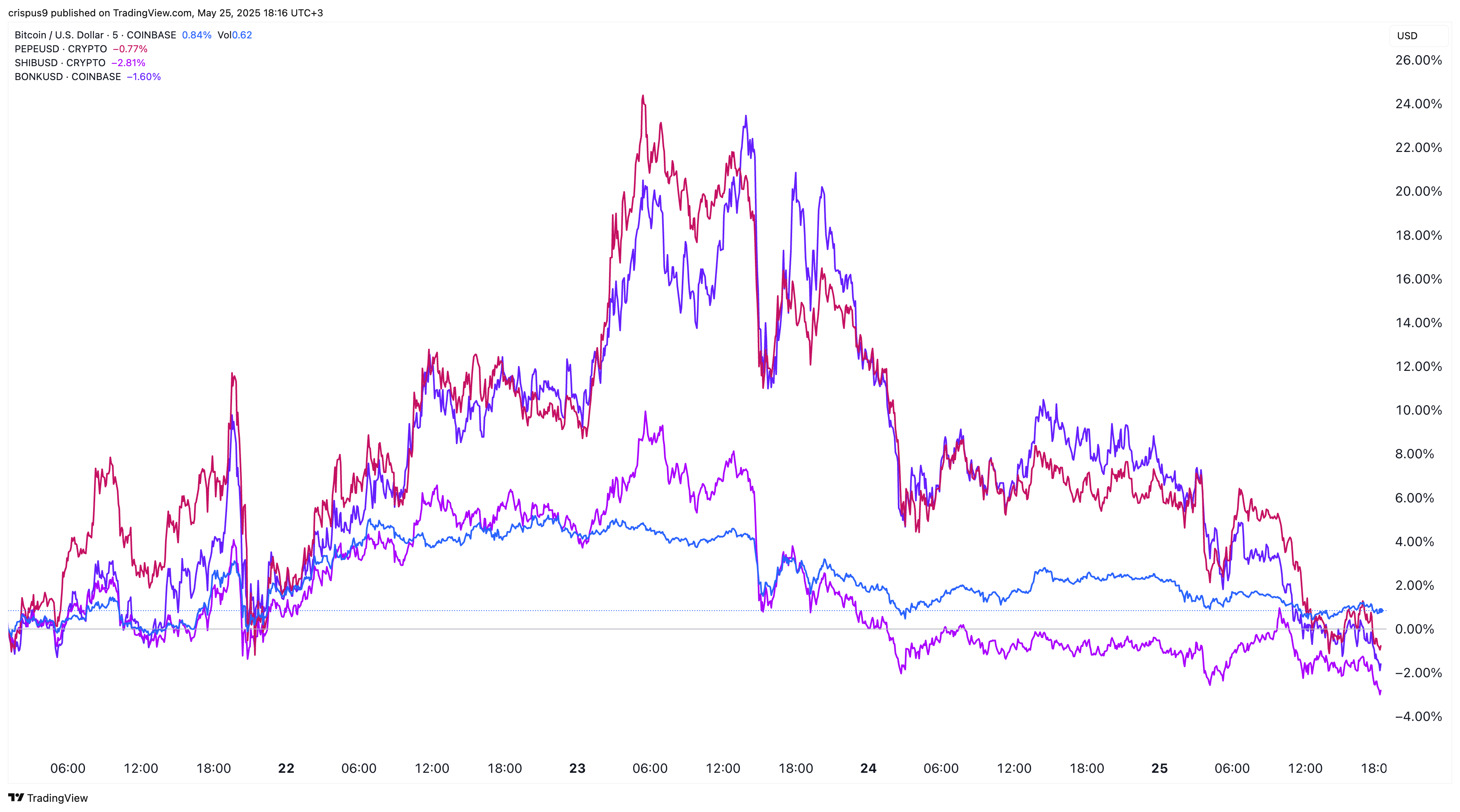

Bitcoin and altcoins such as Pepe, Bonk, and Shiba Inu experienced a pullback over the weekend as last week’s momentum faded, and traders took profits. The Bitcoin price retreated from a record high of $112,000 to $107,000.

Pepe Coin price crashed from $0.00001625 to $0.00001295, while Bonk and Shiba Inu fell to $0.000020 and $0.000014, respectively. This article examines the top three factors influencing Bitcoin and altcoins such as Pepe, Bonk, and Shiba Inu this week.

Donald Trump Trade War

One of the top reasons Bitcoin and top altcoins plunged was that Donald Trump “restarted” his trade war on Friday. In a Truth post, he noted that the US would impose a 50% tariff on European goods, which would affect a trade relationship worth over $1.6 trillion in annual trade.

Therefore, Bitcoin, altcoins, and the stock market will react to any developments in trade. Signs of de-escalation are bullish, as observed recently when the US reached a deal with China.

READ MORE: HYPE Price Prediction: Rare Pattern Points to Hyperliquid Token Hitting $50

FOMC Minutes

The other potential catalyst for Bitcoin and other altcoins will come out on Wednesday when the Federal Reserve publishes minutes of the last meeting. In that meeting, the Fed defied Donald Trump’s requests and decided to leave interest rates unchanged at 4.50%.

These minutes will offer insight into what the Fed deliberated on in that meeting and provide hints on what to expect in the near term. Analysts anticipate the Fed will maintain rates in upcoming meetings and implement a cut in September if inflation continues to decline.

Historically, Bitcoin and altcoins like Shiba Inu, Pepe, Bonk, and Cardano react to these minutes. They rise when the minutes point to a rate cut and vice versa. These minutes, however, will likely have a minimal impact on the coins since the market has already priced in no cut in the June meeting.

READ MORE: This New XRP ETF is Firing on all Cylinders Despite a 1.89% Fee

Bitcoin and Altcoins Expected to React to NVIDIA Earnings

The final catalyst for altcoins and Bitcoin prices will be the upcoming NVIDIA earnings on Wednesday. NVIDIA is the second-biggest company globally with a market cap of over $3.2 trillion. It is also the biggest driver of the US stock market because of its role in the artificial intelligence industry.

A strong report will likely boost stock prices, indicating continued strength in the AI industry. A higher stock market will benefit cryptocurrencies since the two asset classes correlate closely.