The XRP price could be at risk as the number of active addresses declines and inflows into a recently launched Ripple ETF slow. Ripple token plunged to $2.10 as the crypto market crash intensified. It has dropped by over 38% from its highest point this year and is hovering at a key support level.

New Ripple ETF Inflows are Soaring

The Teucrium 2X Long Daily XRP ETF (XXRP) was launched with a bang in April, such that its total assets surged to over $100 million within weeks.

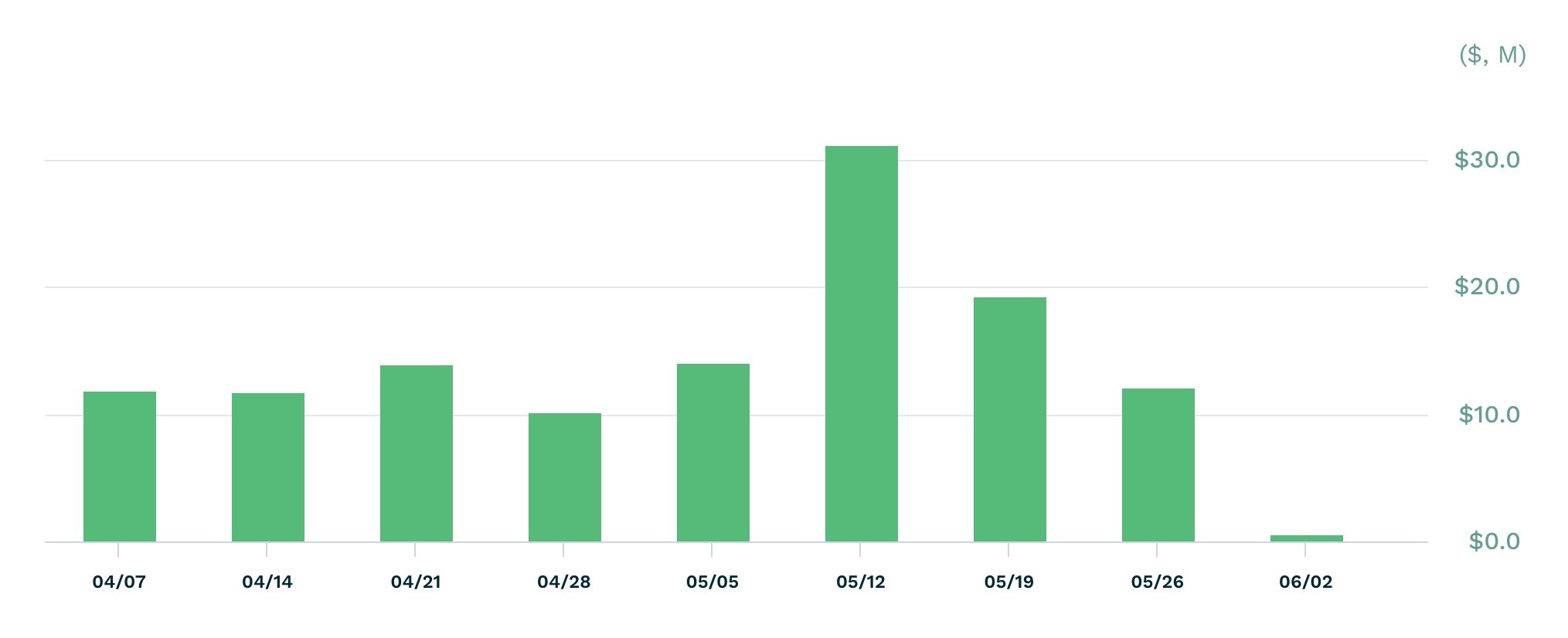

Recently, however, there are signs that the trajectory has cooled, as the XRP price has dropped slightly. Its weekly inflows surged to $31 million in the second week of May, and have pulled back since then. It had inflows of $19.3 million the week after and $12.1 million the previous week. It has now attracted just $600k in inflows this week.

XXRP ETF inflows have plunged because of the ongoing crypto market crash that has pushed most altcoins lower. This fund is highly vulnerable to a crash due to its use of leverage to optimize returns. For example, the XXRP price has declined by 14% over the last five days, as XRP has fallen by approximately 7%.

The XRP price has also plummeted as on-chain metrics indicate slow growth. Data shows that the daily active addresses plummeted to 37,000 on Friday, down from the year-to-date high of over 612,000.

Furthermore, on-chain data indicate that some traders have begun to capitulate and sell their tokens. The 180-day dormant tokens in circulation jumped to 400,000 from this week’s low of less than 50k. That is a sign that investors who bought in this period have started selling. With the network’s realized profit/loss being in the red, there are signs that this is happening at a loss.

XRP Price Prediction

The daily chart shows that the XRP price has been under pressure in the past few months. It has now formed a descending triangle pattern, a popular bearish continuation sign. The lower side of this triangle is at $1.9650, which connects the lowest swings since December last year.

XRP has also formed a descending trendline that connects the highest swing since January. Therefore, the most likely scenario is where it plunges, potentially to the support at $1.6116, its lowest point on April 7.

READ MORE: ONDO Coin Nearing Make-or-Break Support: Will it Bounce or Fall?