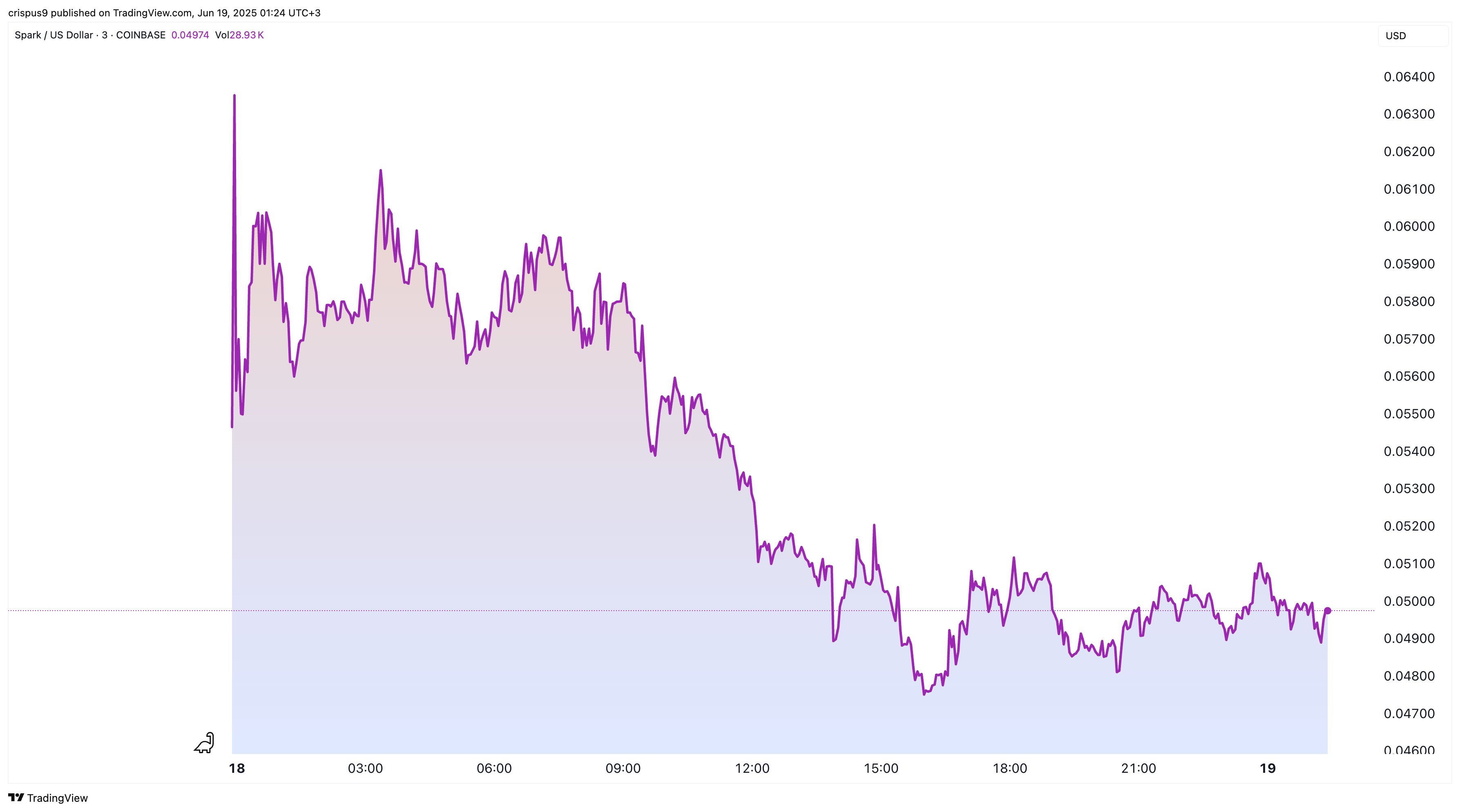

The Spark crypto price crashed as one of the most anticipated airdrops of the year flopped. SPK token plunged to a low of $0.047 on Wednesday, down sharply from its post-listing high of $0.06675.

This article explains why the Spark token may rebound and why Bitcoin Pepe (BPEP) is a top coin to watch.

Why Spark Crypto Price Crashed

Spark is one of the biggest players in the decentralized finance (DeFi) industry. DeFi Llama data indicate that it has a total value locked (TVL) of over $6.5 billion, making it the fifth-largest platform after Aave, Lido, EigenLayer, and Ether.fi.

Spark operates a platform that lets users earn interest on their USDS and USDC. Its savings account has over $3 billion in assets. Additionally, it operates SparkLend, which allows users to borrow at reasonable interest rates.

Spark crypto token plunged after its airdrop for three main reasons. First, the airdrop happened during a crypto crash, with Bitcoin and most altcoins being in the red. In most cases, newly listed tokens drop if the broader crypto market is in a sell-off.

READ MORE: XRP Price Prediction: Top 3 Reasons Ripple Will Surge 46% Soon

Second, the Spark token retreated as some of the airdrop recipients sold their tokens. It is common for many holders to sell their tokens after an airdrop to avoid further losses or as part of a portfolio management strategy.

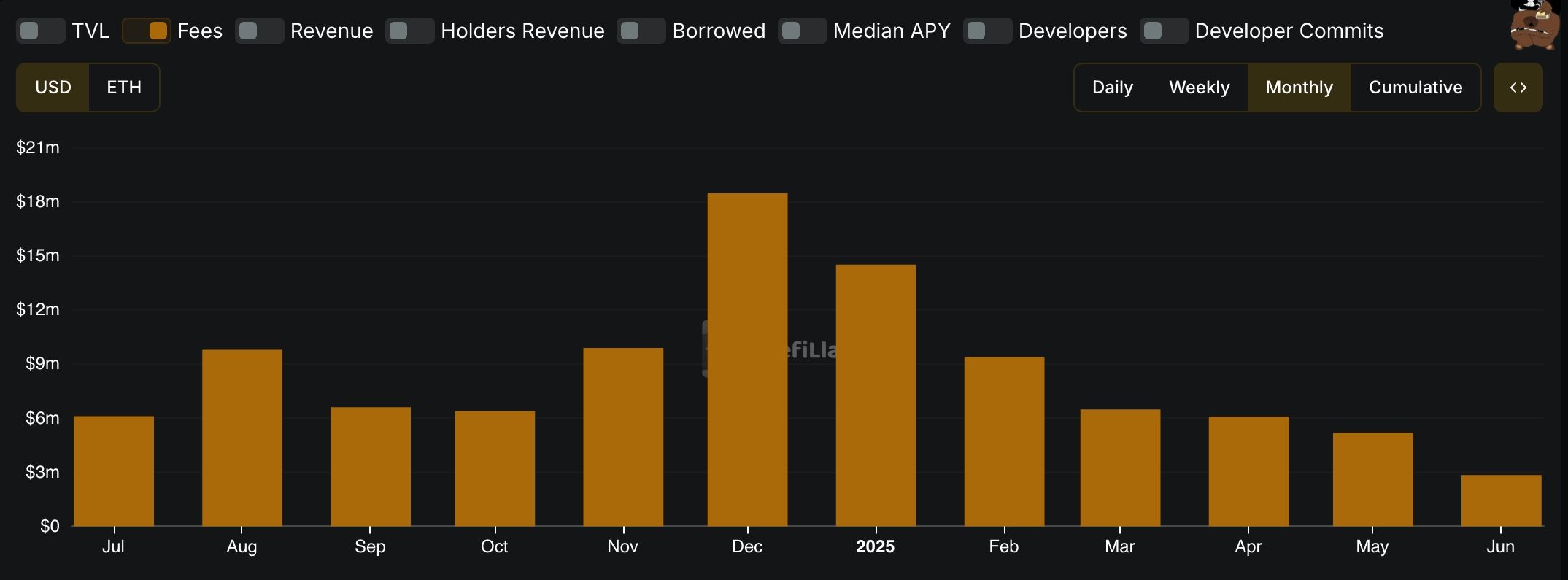

Third. Spark crypto dropped as data showed that its monthly fees were in a downtrend. It made $5.19 million in fees in May, down from $6.08 million in the previous month and $18.4 million in December.

Why SPK Token May Rebound

There are four main reasons why the Spark token may bounce back. First, it will recover in sync with the crypto market rebound. History shows that Bitcoin and most cryptocurrencies recover after a major black swan event.

For example, they all rebounded after Trump’s Liberation Day speech in April and the Russian and Ukrainian war. Such a rebound will push more tokens, including Spark, higher.

Second, Spark’s network is doing well, with the total value locked (TVL) jumping to over $6.2 billion, higher than $2.1 billion in April, a sign that demand is surging.

Finally, Spark is highly undervalued, as its fully diluted valuation (FDV) is $498 million. In contrast, Sky, which has a smaller TVL, has an FDV of over $2.34 billion. Similarly, Morpho has an FDV of $1.34 billion, while Ether.fi has $1 billion.

READ MORE: Pepe Price Prediction: Rare Pattern Points to 56% Surge as Whales Buy

Bitcoin Pepe Surge Accelerates

Meanwhile, crypto traders are moving to Bitcoin Pepe, a project that has gone viral and is firing on all cylinders. It just crossed the $15 million mark, making it one of the fastest-growing token sales of the year.

Bitcoin Pepe has gained further traction after the developers announced the first two exchanges that will list it: Uniswap and BitMart. More tier-1 exchanges are expected to be unveiled later this month, a move that may lead to increased traction among investors.

Bitcoin Pepe aims to become a major player in the meme coin industry by creating a layer-2 network for Bitcoin’s network. It aims to achieve what other players in the cryptocurrency industry, such as Babylon Protocol, Solv Protocol, Ordinals, and Core, have accomplished.

Babylon and Solv Protocols make it easy for investors to stake Bitcoin, while Ordinals became successful Bitcoin NFTs. Core has become a top Bitcoin layer-2 network.

Bitcoin Pepe, on the other hand, focuses on meme coins. This will create a layer-2 network that will make it easy for users to generate and trade Bitcoin NFTs. Its developers believe that it can achieve and even surpass the success that Solana has achieved. You can buy Bitcoin Pepe here.