Cardano price crashed to a crucial support level today, July 1, as concerns about its ecosystem and whale dumping continued. ADA token dropped to a low of $0.54, a make-or-break support level. It has dropped by 36% from its highest point in May.

Cardano Price Crashes Amid Whale Dumping

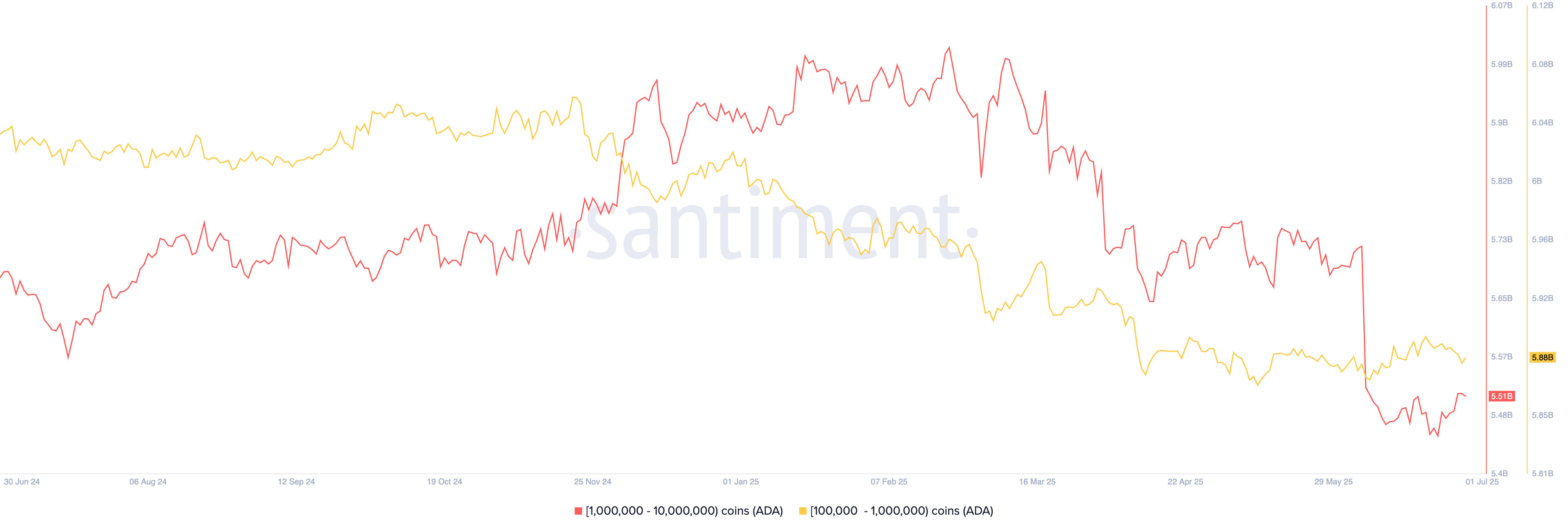

The ADA price has been in a strong downtrend this month, as third-party data indicates that whales have continued selling it. Cardano addresses with between 1 million and 10 million coins have reduced their holdings to 5.51 billion, down from 6.01 billion in January.

Similarly, ADA holders with between 100k and 1 million coins have reduced their holdings to 5.88 billion, down from 6.06 billion in October last year. Whale dumping is one of the riskiest things in fundamental analysis since it signals that the top holders are capitulating.

Cardano whales have likely dumped it because of its lagging growth. For example, data show that the number of daily active addresses has plunged to 16,000, down from 60,000 in May. These active addresses are significantly small for a cryptocurrency valued at over $20 billion.

The same is true with the fact that Solana has a DeFi TVL of just $300 million and $31 million in stablecoins.

Cardano whales have also dumped it due to the numerous failed promises made by Charles Hoskinson. For example, he has long talked about a potential partnership with Chainlink that has yet to materialize. He also hyped a VIP meeting earlier this year that yielded nothing.

Further, Cardano’s promise to integrate with Bitcoin is yet to bear fruit. Moreover, protocols that enable Bitcoin staking, such as Babylon and Solv, already exist.

READ MORE: SRM Entertainment Announces $100M TRON Treasury Strategy

ADA Price Technical Analysis

The daily chart shows that the ADA price has been in a downtrend in the past few days. It has moved below the 50-day and 25-day Exponential Moving Averages (EMA), a sign that bears remain in control.

Cardano has also formed an inverse cup-and-handle pattern, a popular continuation sign. Therefore, a break below the cup’s lower side at $0.519 will validate it and indicate further downside, potentially to last November’s low of $0.317, a 41% decline from the current level.

Bitcoin Pepe Gains Steam

Meanwhile, Bitcoin Pepe, a token priced at $0.04, is gaining traction as demand from investors jumps. Data on its website shows that it has raised over $16.2 million, making it one of the top presale tokens of the year.

Bitcoin Pepe’s momentum has increased lately after the developers began unveiling their exchange partnerships. They have already said that BitMart and MEXC will list it on day one.

Bitcoin Pepe has also hinted that more exchanges were coming. Some of the potential names are OKX, Bybit, and BingX. There are also chances that the likes of Coinbase and Binance will list it soon.

Bitcoin Pepe’s demand has surged as it aims to disrupt the crypto industry by developing a layer-2 network for meme coins on Bitcoin’s network.

This launch is notable because layer-2 projects have become highly popular among investors, while meme coins have a market capitalization of over $60 billion. Buy Bitcoin Pepe here before the next price increase.

READ MORE: PENGU Price Surges on Game Launch & ETF Hype: Is $0.025 Next?