The Dogecoin price has crawled back over the past two weeks as the crypto market rally gained steam. DOGE has jumped by over 40% from its lowest point in June, and is hovering at its highest level since May 30. This article explains why Dogecoin is ready to surge as whales buy.

Dogecoin Price Technical Analysis Points to a Surge

The daily timeframe reveals that the Dogecoin price has risen in the past two weeks. While this recovery is a positive one, it has underperformed other cryptocurrencies, such as Ethereum and Pepe.

However, the coin’s rally is likely to accelerate in the coming weeks, as it has formed the highly popular double-bottom pattern at $0.1485. This pattern’s neckline is at $0.2596, its highest point so far this year in May.

DOGE price has moved above the 50-day and 100-day Exponential Moving Averages (EMA). Moving above these averages is notable and indicates that bulls are taking control.

READ MORE: Pepe Price Prediction: Set to Surge Amid a Supply Squeeze

The Relative Strength Index (RSI) and the MACD indicators have pointed upwards. This is usually a sign that the coin is gaining momentum.

Therefore, the token will likely continue rising as bulls target the double-bottom’s neckline at $0.2596, which is approximately 22% above the current level.

A surge above that level will point to more gains, potentially to the 50% retracement point at $0.3300, about 55% above the current point.

On the other hand, a move below the 50-day moving average at $0.1835 will invalidate the bullish DOGE forecast and signal further downside.

Dogecoin price chart | Source: TradingView

Whales are Buying as Open Interest Rises

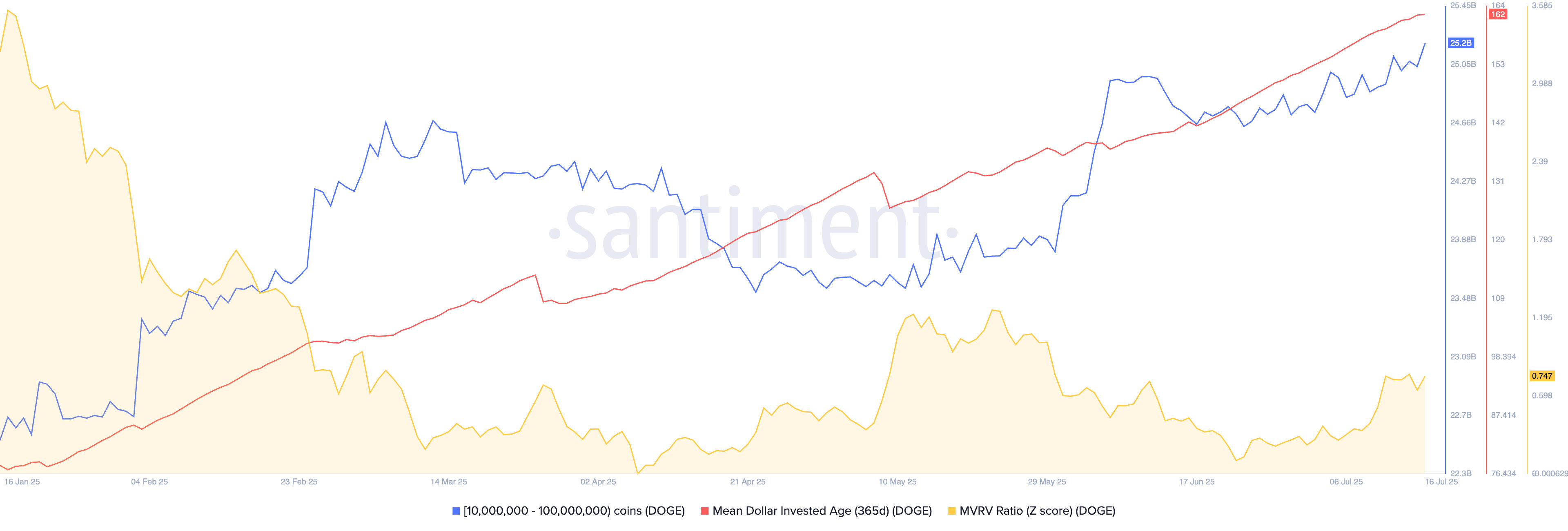

The Dogecoin price is rising, as on-chain data suggests increased whale accumulation. Data compiled by Santiment shows that DOGE holders with between 10 million and 100 million coins have increased their positions to 25.2 billion from 23 billion in April. Whale purchases are a sign that these investors expect the coin to continue rising over time.

Another important on-chain data shows that long-term investors are no longer selling their coins. The 365-day Mean Dollar Invested Age (MDIA) has soared to 162 from the year-to-date low of 78.

The MDIA is a popular metric that examines the average age of every dollar invested in the market capitalization of a coin. A high number means that the age is increasing, and it is a sign that these investors are holding the token.

Another key DOGE metric indicating a surge is the MVRV Ratio (Z score), which has remained below 1. This shows that the current market cap is lower than the realized value, suggesting that the coin is poised for a rebound due to its current low price.

READ MORE: Dogecoin Price Prediction: Classical Pattern Points to a DOGE Surge