The altcoin season index is in an uptrend this week as many crypto tokens gained steam and Bitcoin remains on edge. It jumped to close to 60 as the crypto Fear and Greed Index soared. This article explores why tokens like Zebec Network (ZBCN), UMA (UMA), Drift Protocol (DRIFT), and Spark (SPK) are going up.

UMA Price Surges as Polymaket Buys QCX

The UMA token price jumped sharply, reaching its highest point since February 1 this year. It has soared by over 110% from its lowest point this year, increasing its market cap to more than $112 million.

UMA price surged after Polymarket acquired QCEX, a company regulated by the Commodity Futures Trading Commission (CFTC). This $112 million deal will help the company bring its solutions to the United States. In a statement, Shayne Coplan, Polymarket’s founder, said:

“Demand is greater than ever — not just in user growth and trading volume, but in how mainstream audiences are turning to Polymarket to separate signal from noise, bias, and speculation.”

UMA price jumped after this buyout because it is the main oracle provider for Polymarket. Its solution helps to authenticate the validity and accuracy of all predictions. It also features tools to facilitate dispute resolution within the platform. As such, investors believe that its utility will explode higher after this buyout.

Drift Protocol Price Jumps as its Volume Soars

The Drift Protocol token jumped sharply this week, hitting its highest point since May 1. It has jumped by over 100% from its lowest point this month.

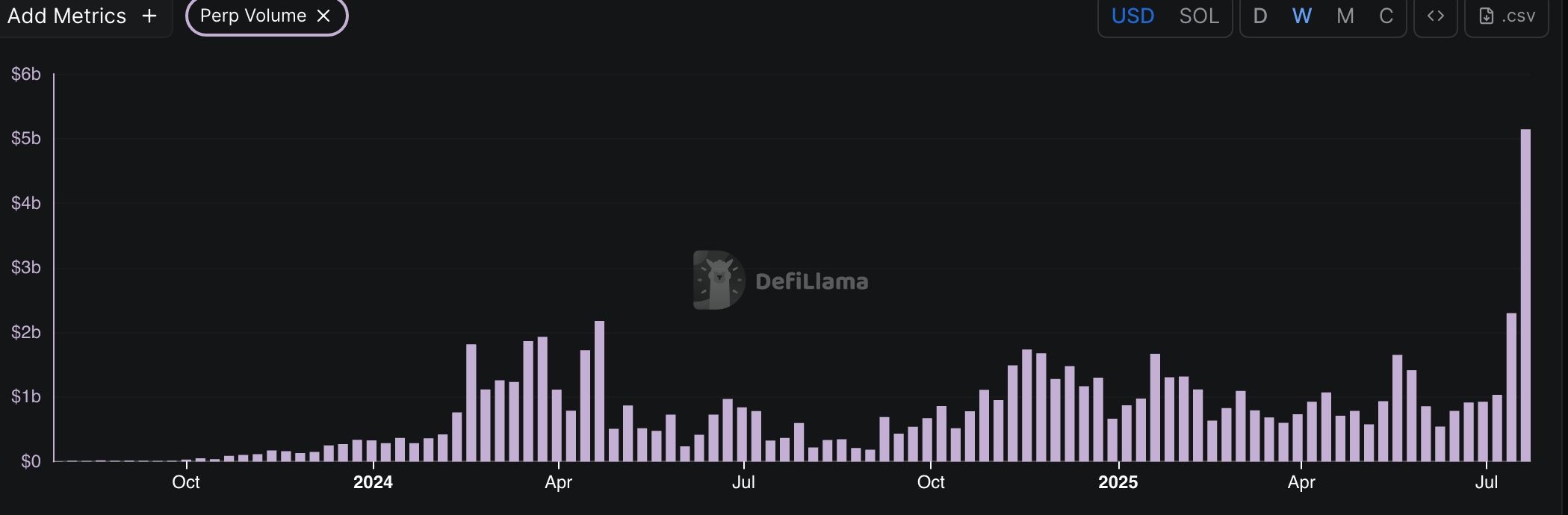

This surge occurred as data indicates that its network is expanding. According to DeFi Llama, it has become the fourth-largest player in decentralized perpetual futures trading within the crypto industry, following Hyperliquid, Jupiter, and edgeX.

Drift Protocol handled over $5.14 billion in volume in the last seven days and over $9.68 billion in the last 30 days. As the chart below shows, its weekly volume skyrocketed to a record high, a trend that may continue during this bull run.

READ MORE: I’m Skipping IBIT ETF Stock for This Underrated Bitcoin Fund

Zebec Network Jumps After Algorand News

Meanwhile, the Zebec Network (ZBCN) price continued to rise this week, reaching a high of $0.0040, its highest point since June 25. It has jumped by over 72% from its lowest point this month.

The ZBCN price jumped after the developers unveiled their June report, which showed robust network growth. It then accelerated this week after announcing its planned integration with Algorand, one of the top layer-1 networks.

The integration means that the ALGO token will be added across all its card and payroll tools. It implies that ALGO holders will be able to spend their coins wherever Mastercard is accepted.

Spark Price Surges Amid Network Growth

The recently launched Spark token rebounded sharply, as we had predicted here. It jumped to a high of $0.05, up by over 75% from its lowest level this year.

This rebound happened as investors bought the dip following its airdrop in June. The dip-buying is happening because Spark is one of the biggest players in DeFi, with over $11 billion in assets.

$4 billion of its assets are in the Spark Liquidity Layer, while $2.4 billion and $4.96 billion are in its savings and SparkLend, respectively. Spark price also jumped as the total staked SPK tokens jumped to a record high of 120.6 million SPK.

READ MORE: Cardano Price Prediction: Will ADA Rise Ahead of NIGHT Airdrop?