Aave price has remained under pressure in the past few weeks despite the ongoing robustness in the ecosystem. It plunged to a low of $273, down by 30% from its highest point this year. It has also formed a risky pattern, pointing to more downside.

Aave Price Technical Analysis

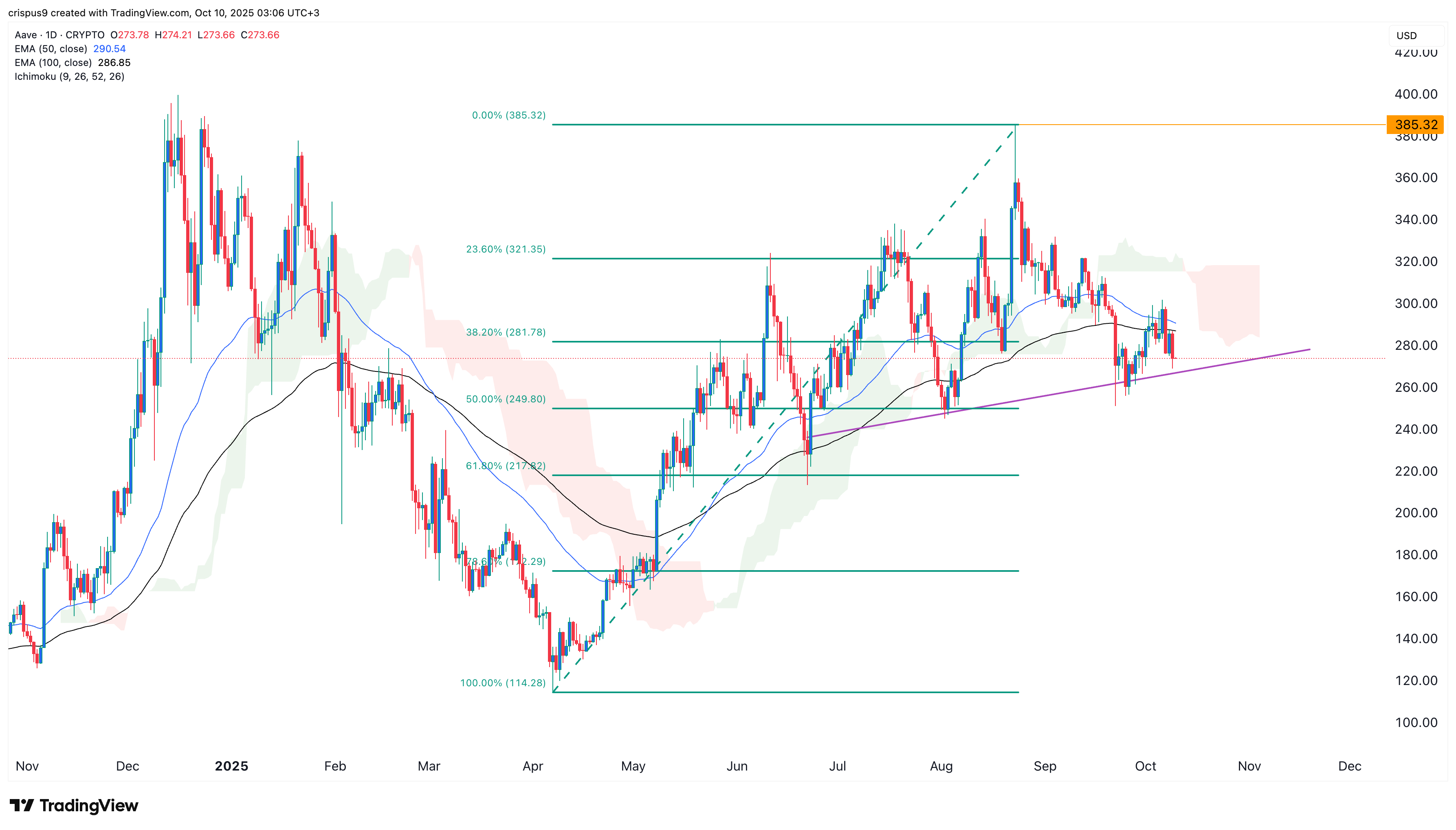

The daily timeframe chart shows that the Aave crypto price has pulled back in the past few months. It dropped from a high of $385 in August to the current $273.

Aave price has moved below the 50-day and 100-day Exponential Moving Averages (EMA), which are about to have a bearish crossover, commonly known as a mini-death cross.

Worse, the coin has formed a head-and-shoulders pattern, which is one of the most bearish signs in technical analysis. It is slightly above the ascending trendline that connects the lowest swings since June.

The Relative Strength Index (RSI) has dropped, while the price moved below the 38.2% Fibonacci Retracement level. It also moved below the Ichimoku cloud indicator.

READ MORE: Ethereum Price Elliot Wave Analysis as ETH ETFs Hit $15B Milestone

Therefore, the token will likely have a strong bearish breakdown despite its strong fundamentals. A move below the neckline will point to more downside, potentially to $250, the 50% Fibonacci Retracement level.

A move below that level will indicate further downside, potentially to $200. All this will be confirmed if it drops below the ascending trendline.

Will Improving Fundamentals Boost the Aave Token?

AAVE’s weak technicals are a significant contrast to its strong technicals. One of these is a recently announced deal with BlockDaemon.

This deal will bring institutional access to decentralized finance lending markets. Aave Vaults will serve as the primary lending partner within Blockdaemon DeFi Widget, which is part of its earnings stack. In a statement, Blockadaemon’s CEO said:

“With this strategic partnership, institutions can now gain direct access to Aave’s DeFi markets through Blockdaemon’s market-leading infrastructure, opening new avenues for growth across top crypto assets and stablecoins.”

More data shows that the Aave network is growing, with the total value locked (TVL) being at a record high of $43 million, up from $20 billion in January this year.

One notable part of Aave’s platform is the recently launched Horizon RWA market. The network has now achieved a market size of $204 million, with the total borrowings standing at over $54 million.

Aave is making substantial sums of money. It made $13.4 million in September from $13.2 million in the previous month.

READ MORE: Chainlink Price Prediction: Why LINK is About to Soar