Since launching 12 years ago, Bankless Times has brought unbiased news and leading comparison in the crypto & financial markets. Our articles and guides are based on high quality, fact checked research with our readers best interests at heart, and we seek to apply our vigorous journalistic standards to all of our efforts.

BanklessTimes.com is dedicated to helping customers learn more about trading, investing and the future of finance. We accept commission from some of the providers on our site, and this may affect where they are positioned on our lists. This affiliate advertising model allows us to continue providing content to our readers for free. Our reviews are not influenced by this and are impartial. You can find out more about our business model here.

How to Buy Avalanche (AVAX) in 2025

Avalanche is a lightning-fast, scalable smart contract platform that allows you to “Create Without Limits”. Avalanche enables Web3 developers to create and deploy advanced decentralized applications (dApps) using the protocol’s advanced “subnets”.

With a vibrant community, sustainable technology and a constantly growing ecosystem, Avalanche is poised for long-term success. But what if you’re not a developer and you still want to get involved with the protocol? Thankfully, Avalanche’s native cryptocurrency AVAX allows users to participate in network governance, pay for transaction fees and secure the blockchain through staking.

So, interested in learning how to buy Avalanche crypto tokens? Keep reading for an in-depth, beginner-friendly guide to purchasing AVAX for the first time.

An Overview of How to Buy Avalanche in 5 Steps

To buy AVAX, follow this simple step-by-step guide:

- Do your research – Research Avalanche and any exchanges you’re interested in

- Create an account – Create an account at your chosen exchange

- Deposit funds – Use your preferred payment method to add fiat to your account

- Buy AVAX – Visit the “Avalanche (AVAX)” market page and click “Buy” or “Trade”

- Store AVAX safely – Once purchased, transfer your AVAX to a non-custodial wallet

Where to Buy Avalanche Crypto in 2025

If you want to know how to buy Avalanche coins, you’ll need to find a centralized exchange that suits you. There are other options – some of which we’ll touch upon below – but a centralized exchange is typically the go-to choice for new investors; they’re user-friendly and the exchange will complete a lot of the process on your behalf.

1. Coinbase

If you’ve heard about crypto, you’ve probably also already heard about Coinbase. Available in more than 100 different countries, Coinbase has a quarterly trading volume of more than $180 billion.

Coinbase is designed with users in mind, and the site makes it incredibly easy to buy, sell and trade cryptocurrencies. You can use your desktop or take advantage of the Coinbase iOS and Android mobile application, and Coinbase allows you to place single, one-time orders or set up recurring buys – the latter is a great option for investors interested in dollar cost averaging into positions.

If you have slightly more experience, Coinbase Advanced offers some enhanced trading tools, while Coinbase One is a monthly subscription that allows you to trade with zero fees.

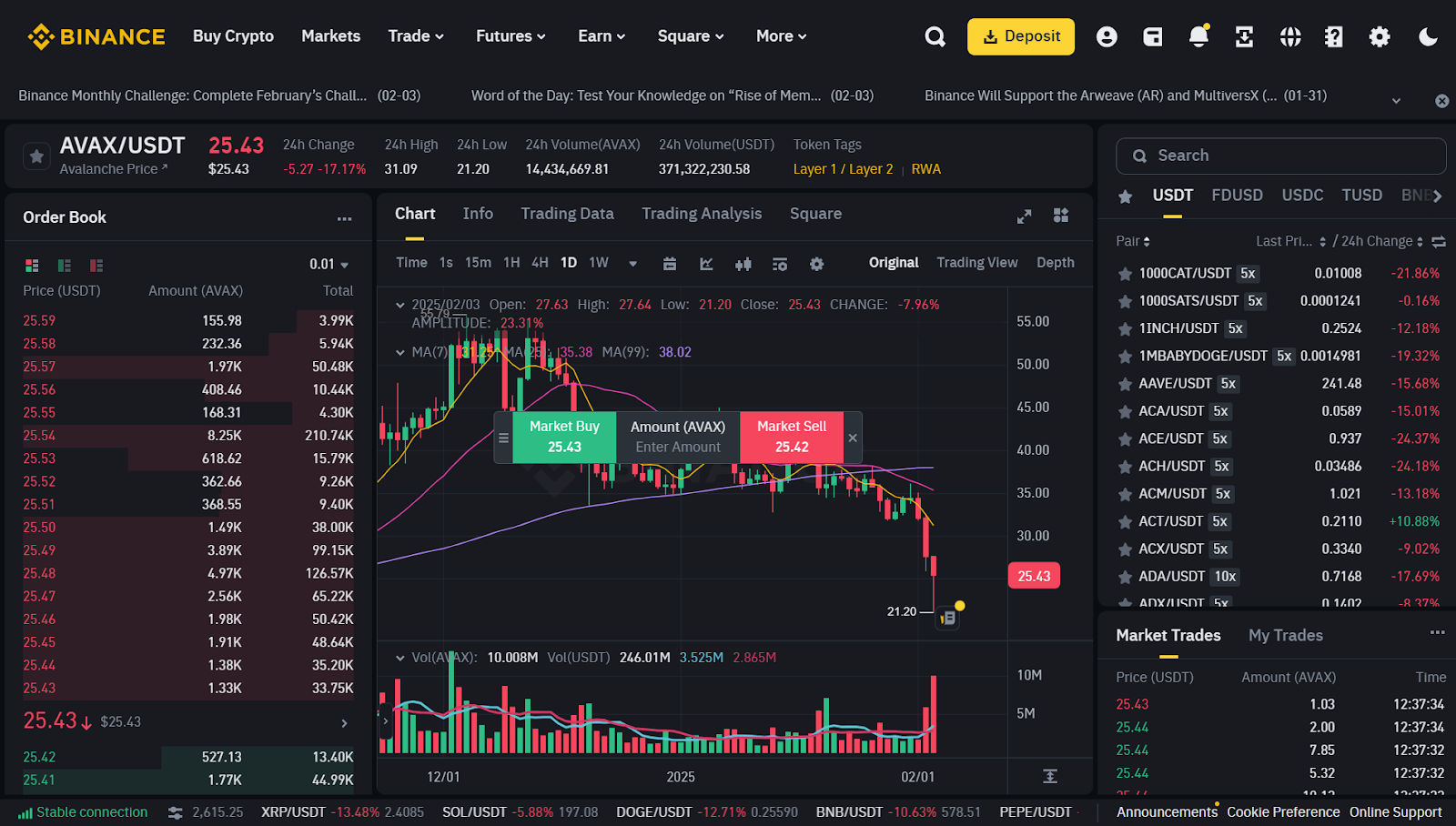

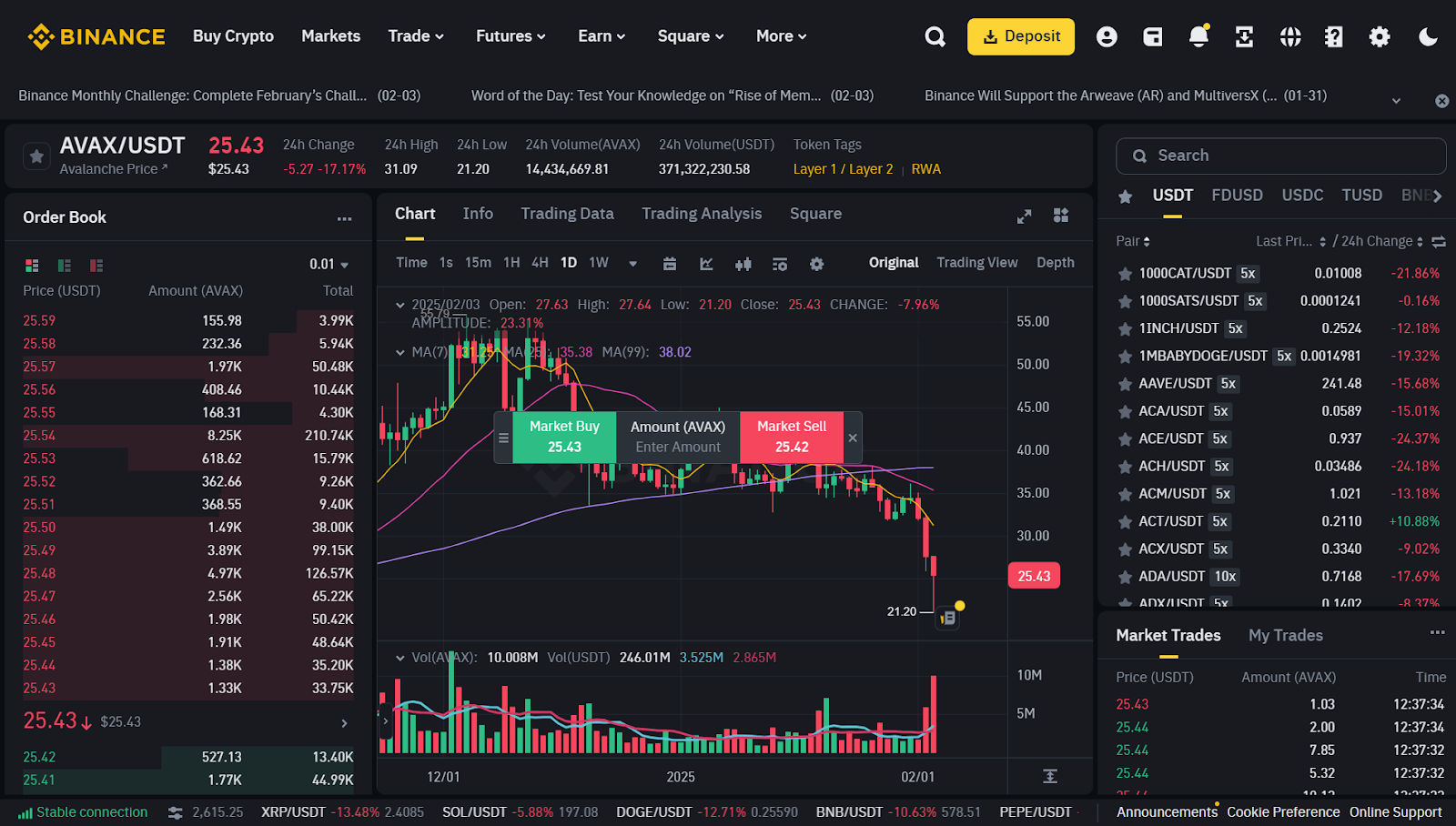

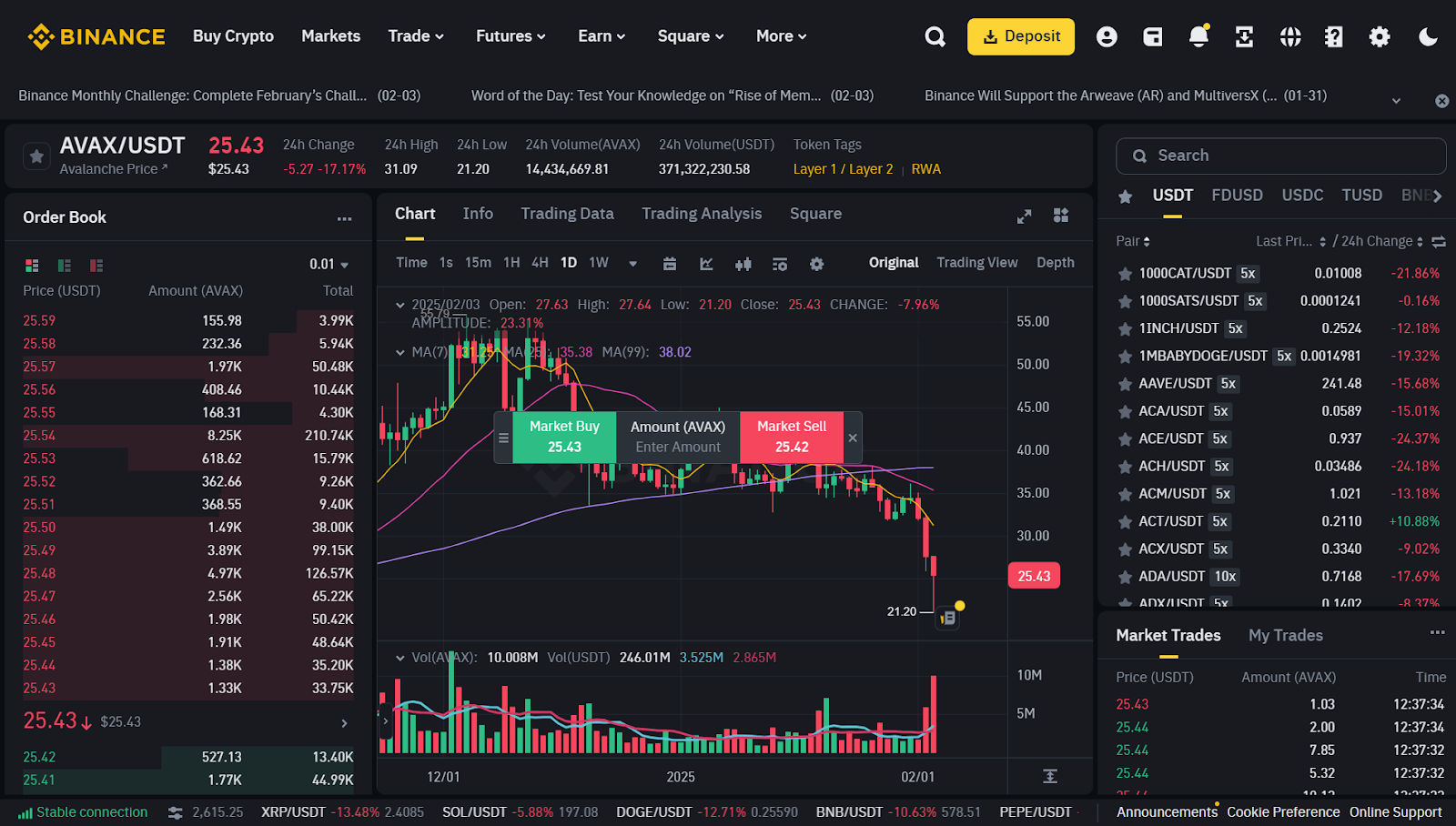

2. Binance

Binance is one of the most popular options for buying Avalanche (AVAX). With over 250 million users registered around the world, Binance has cemented itself as the top centralized exchange. Users can buy and sell hundreds of different cryptocurrencies, including AVAX, using the Android or iOS app.

It may not quite be as user-friendly as Coinbase, but Binance is still fairly intuitive to use and you can buy Avalanche tokens within just a few steps. Binance also has some good features for more experienced traders, so it could be a good option for those that have a better understanding of the cryptocurrency space.

Better still, Binance has an “Earn” function that allows users to put their cryptocurrencies to work. Thankfully, this includes Avalanche, which users can stake on the Binance platform for up to 174% APR! This does involve taking advantage of Binance’s “Dual Investment” feature, although it’s also possible to earn up to 5% on your AVAX holdings using the exchange’s “Simple Earn”.

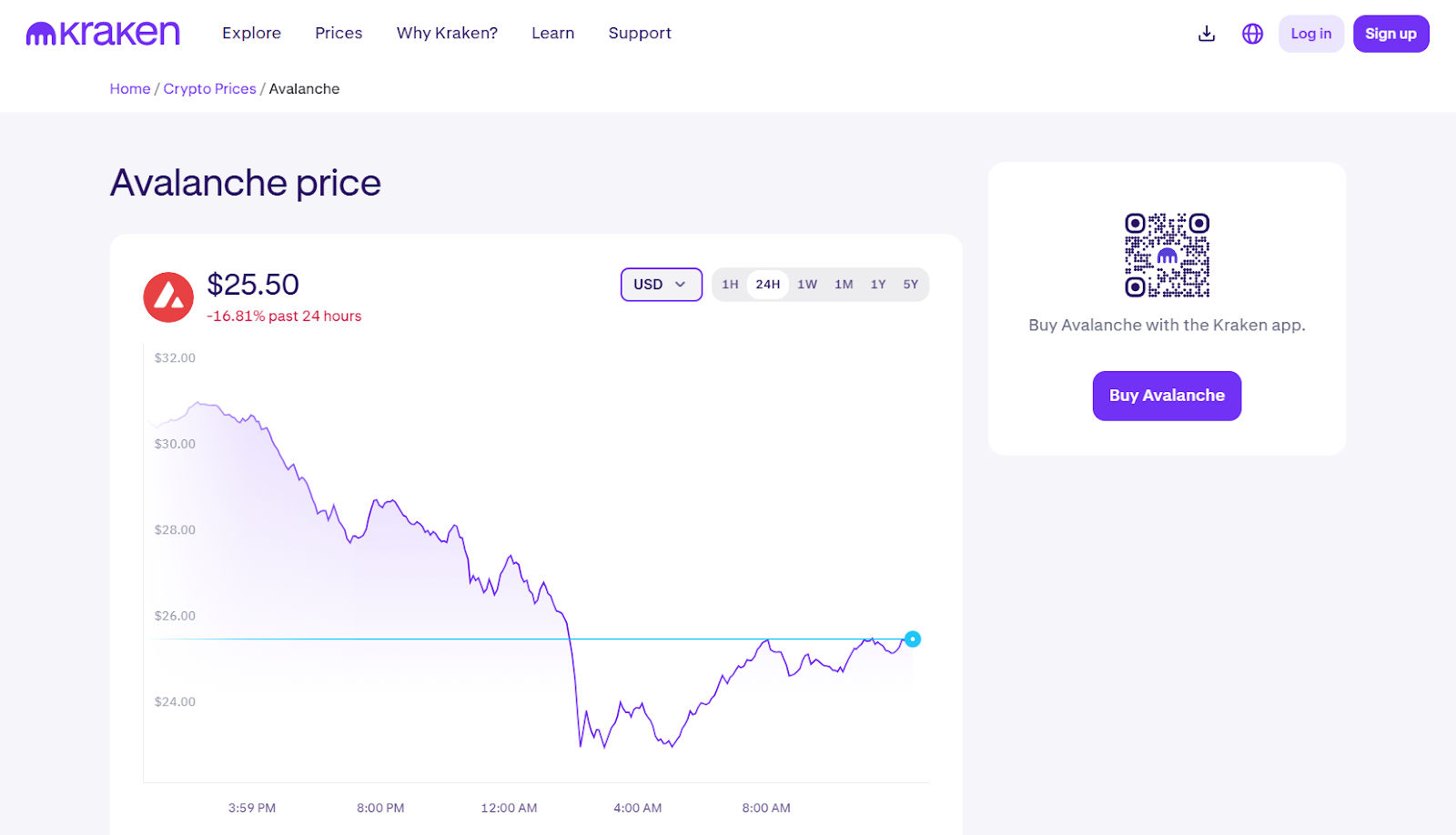

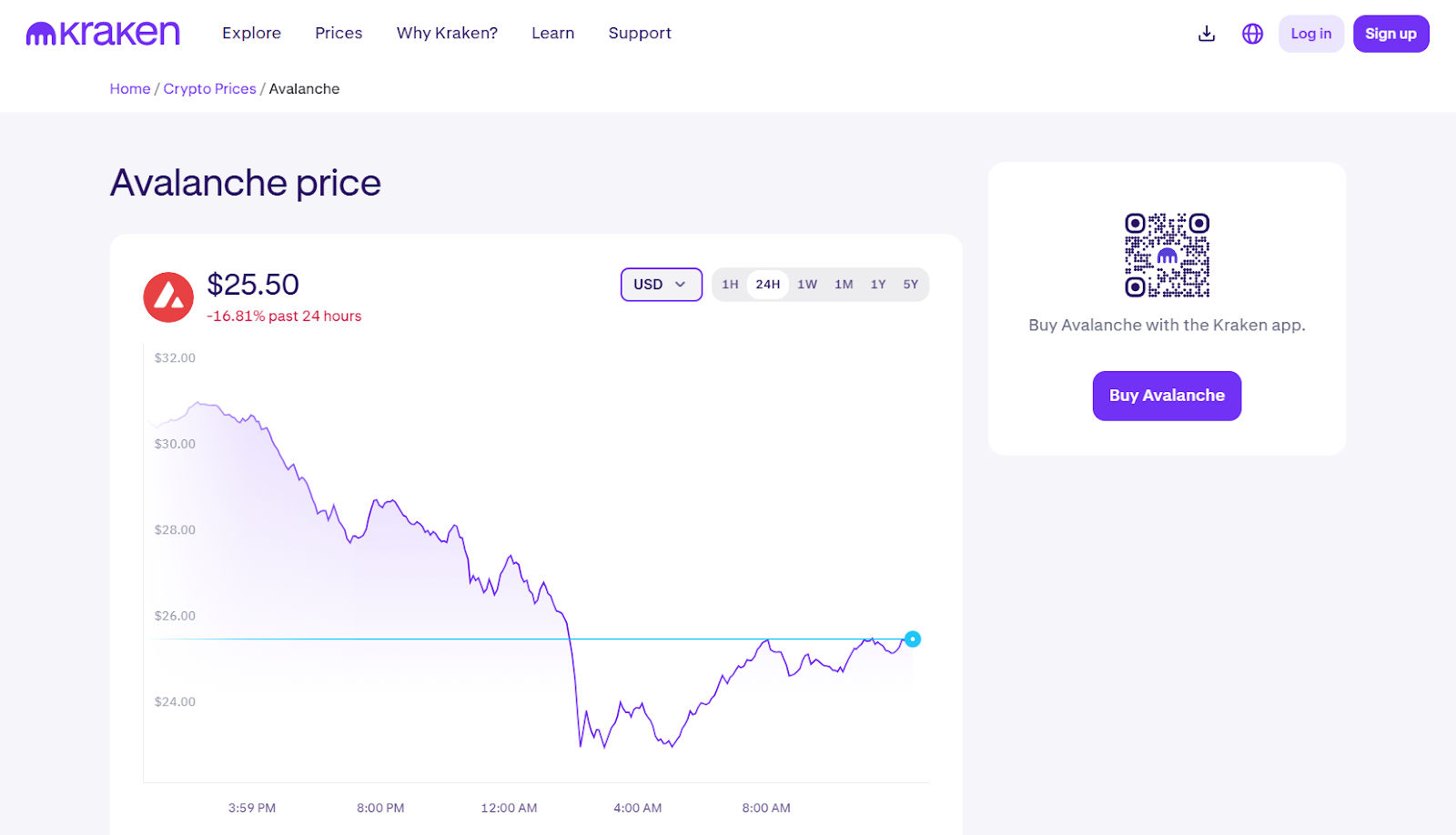

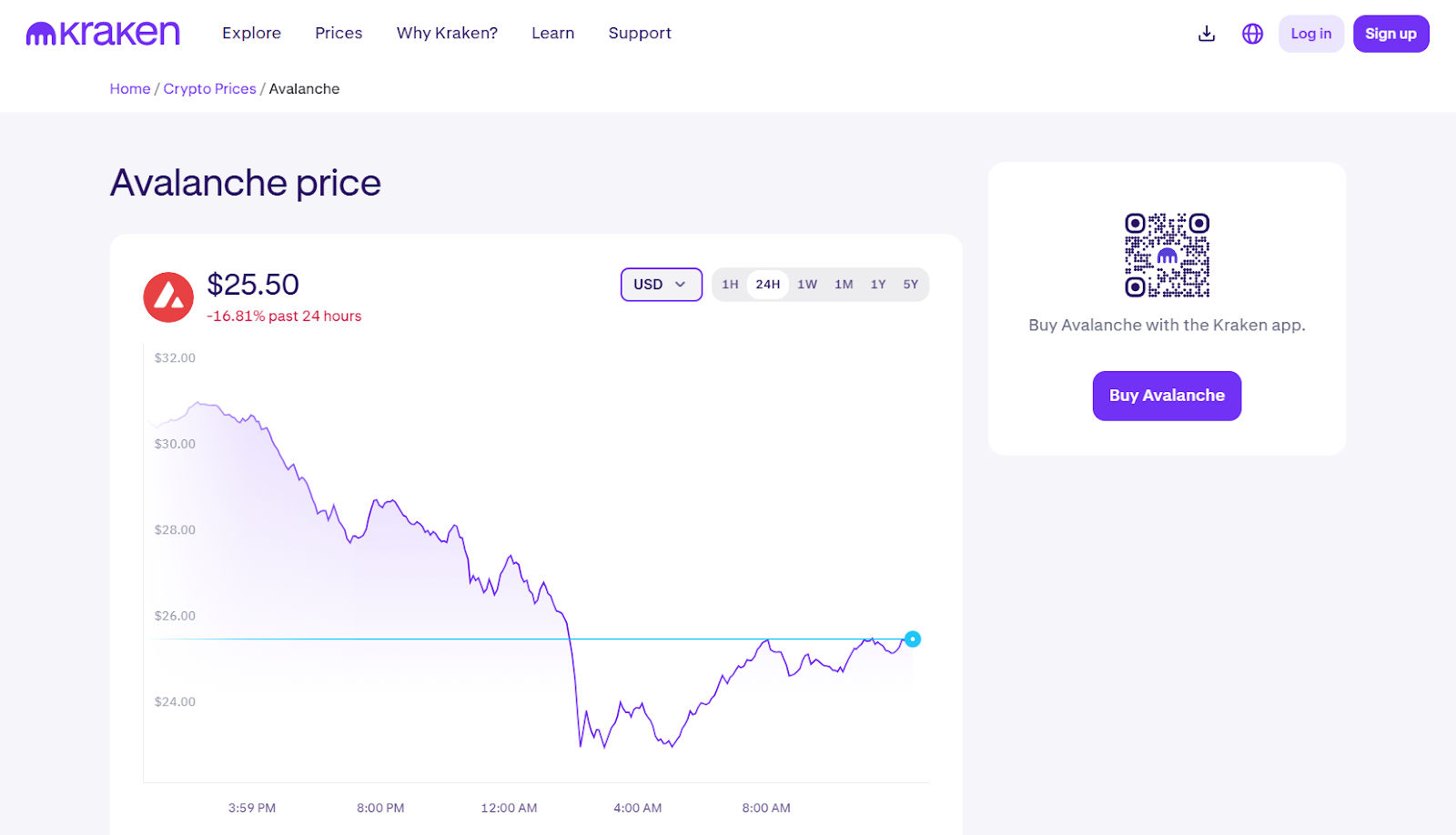

3. Kraken

Kraken is a fantastic option for anybody wondering how to buy Avalanche for the first time. It’s perfectly suited to beginners – perhaps even more so than Coinbase – and the exchange has really created a flawless user journey.

Still unsure about Avalanche and the crypto space? The Kraken Learn Center is one of the best places to educate yourself on blockchain technology and Web3. Here, you’ll find articles on all of the following, and more:

- Trading

- Decentralized Finance (DeFi)

- Non-Fungible Tokens (NFTs)

- Blockchain Technology

- Bitcoin

In terms of trading features, Kraken offers a good range that will suit both new and advanced traders, as well as an on-chain crypto wallet for storing your AVAX tokens. If you have limited capital, Kraken also allows you to open positions for as little as $10, making it a really affordable option.

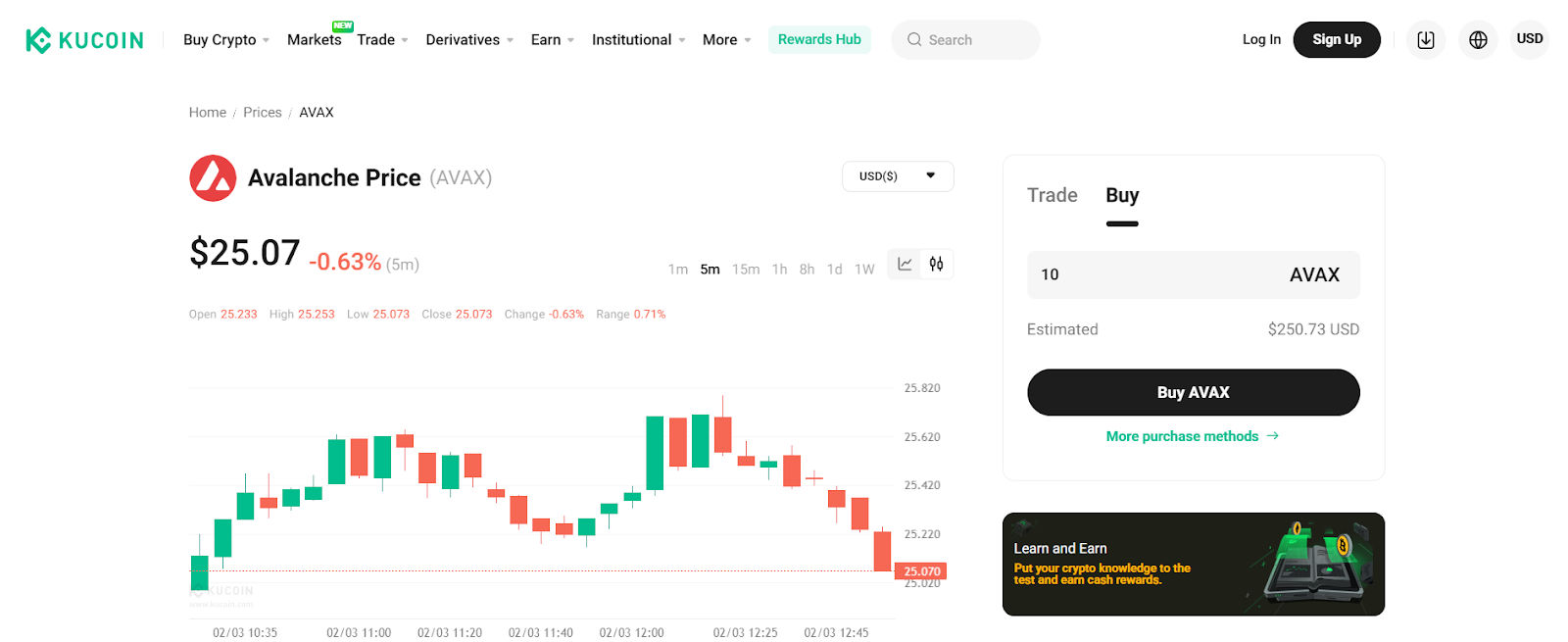

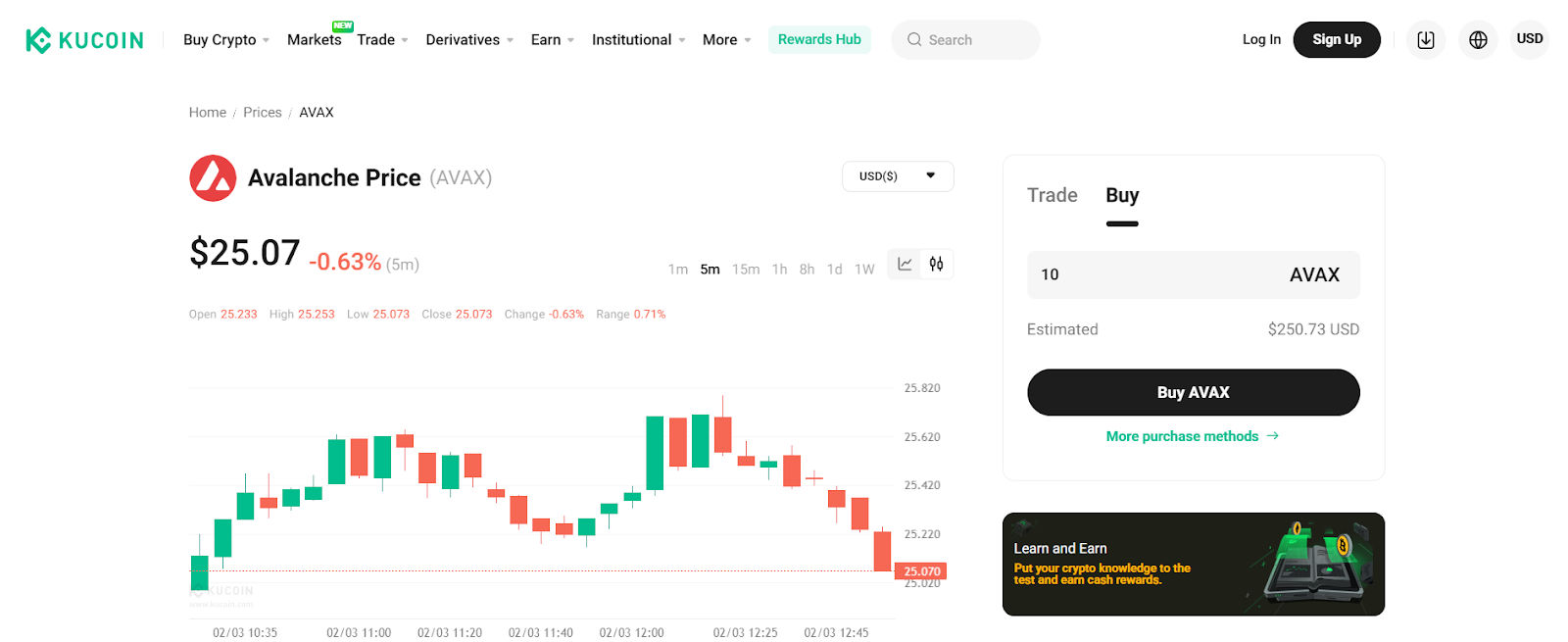

4. KuCoin

KuCoin is another of the world’s largest exchanges. In fact, according to KuCoin, a quarter of all crypto holders currently have an account on the platform. It’s hardly surprising, given the range of markets and tools that KuCoin offers.

For example, investors can open both spot, margin and futures positions in AVAX. Alternatively, you can buy Avalanche tokens using another cryptocurrency or with an array of payment methods, including Visa, Apple Pay, Skrill, or via a third-party provider such as Banxa.

The site is a little more complex than some of its competitors, but experienced traders could benefit from KuCoin’s impressive trading features. Explore KuCoin’s “Rewards Hub” and educational platform, or take a look at “KuCoin Earn” which allows you to earn up to 7% by staking AVAX.

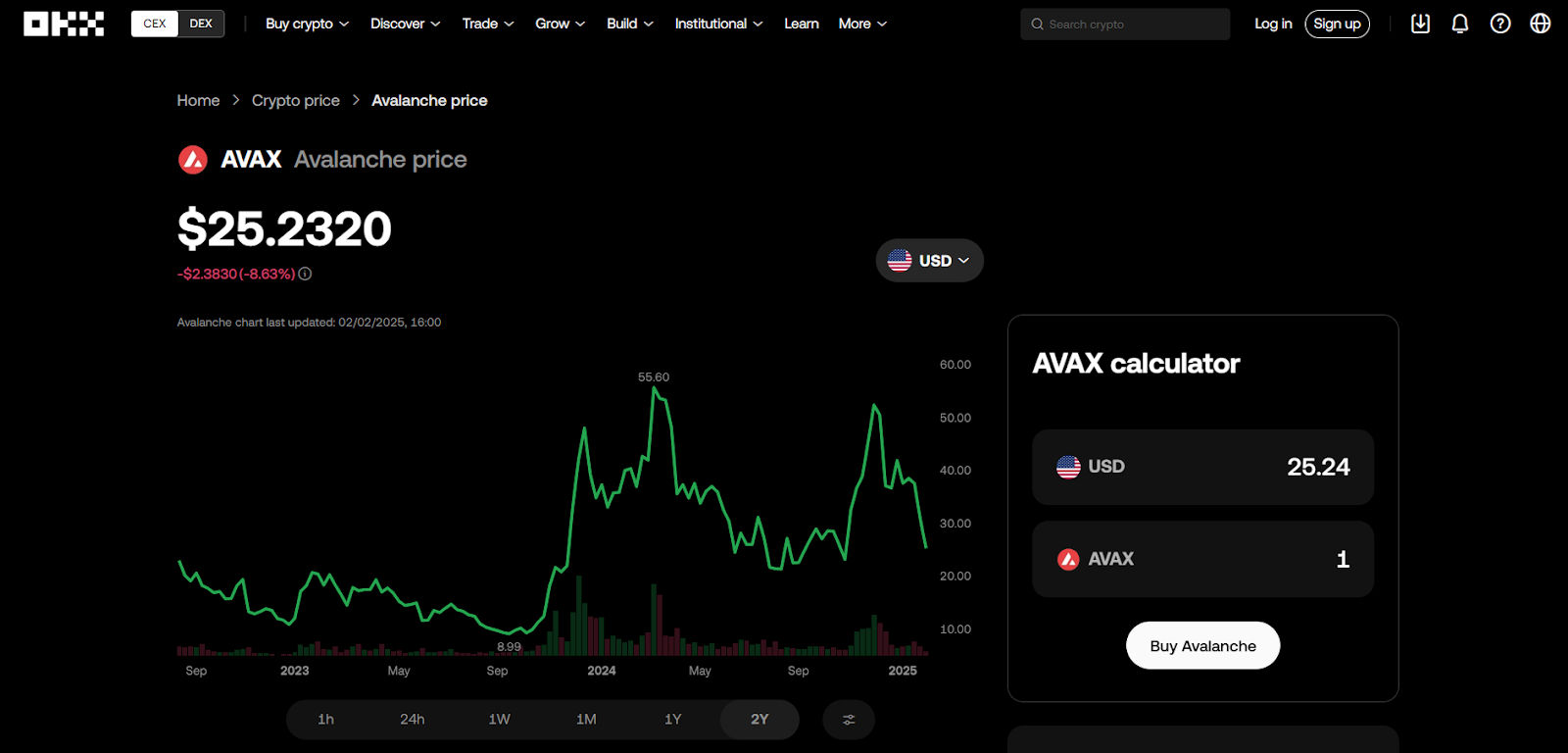

5. OKX

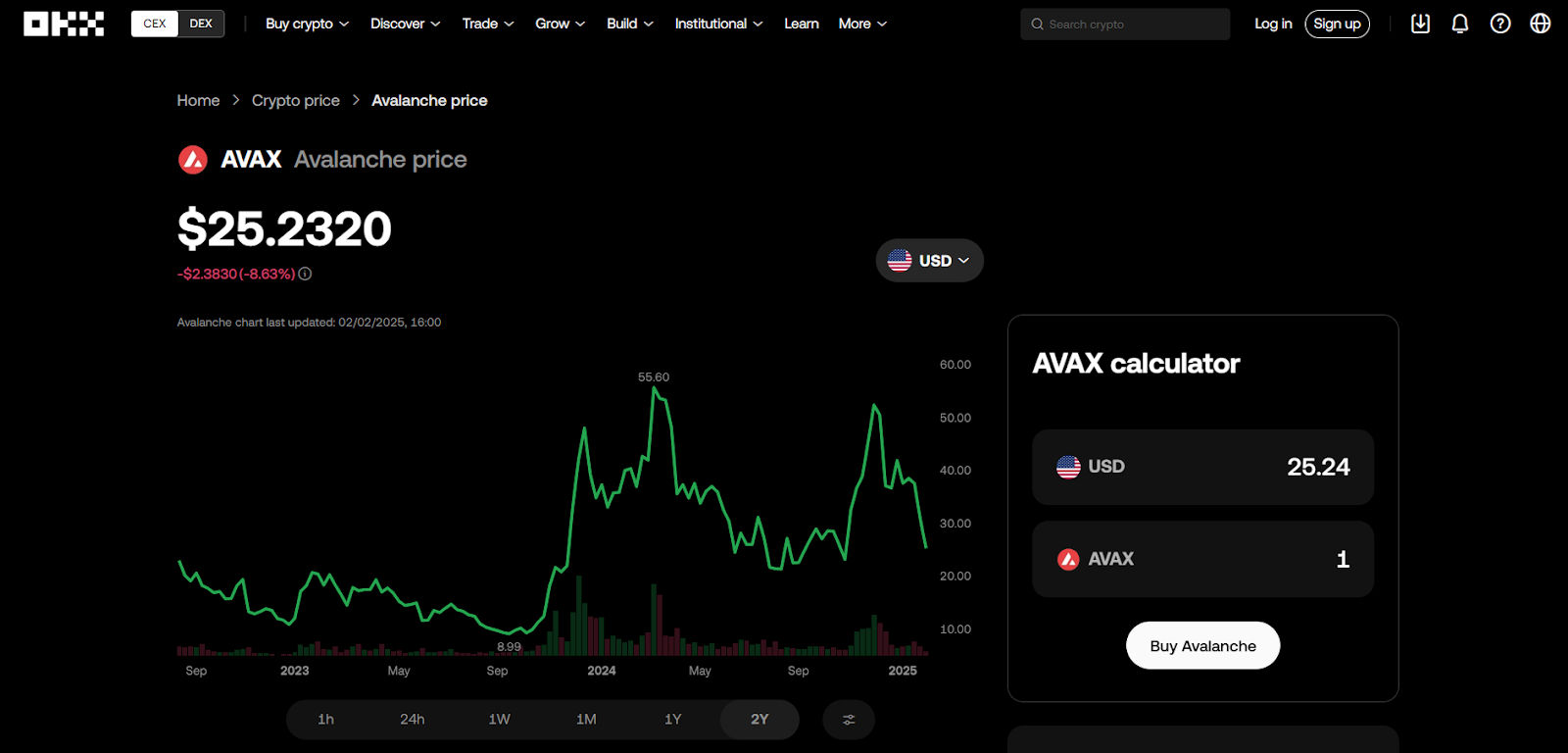

OKX is an established centralized exchange that encourages users to open positions for as little as $5. The user experience is intuitive, and investors can convert cryptocurrencies or open spot positions in AVAX.

There’s also a range of decentralized trading features, including a decentralized exchange that enables users to trade tokens – including AVAX – on a peer-to-peer basis.

OKX has lower fees than a lot of its competitors and transactions are incredibly fast and uncomplicated. Perhaps most impressive, however, is OKX’s “Earn” feature, which allows users to earn up to 46% APR using the platform’s “Simple Earn” function. If you want to buy AVAX and earn passive income on your holdings, OKX is one of the best places to do so.

How to Buy Avalanche on Coinbase

Step 1: Create an account

So, you’ve decided to use Coinbase and want to learn how to buy AVAX tokens? First, you’ll need to create a new account if you don’t already have one.

Click “Sign Up” and click “Individual”. Register using your personal email address, Google account or Apple account. You’ll be sent a six-digit code to your email, which you’ll need to input here. Create a new password and then add some more personal information. Once you’ve added your mobile number, you’ll need to verify it by adding in the SMS verification code.

Confirm that you’re happy with Coinbase’s T&Cs, select your citizenship and validate your Social Security number if you’re in the US. You’ll also need to verify your identity using some photo ID – this could include a passport or driving license.

Finally, Coinbase will also ask you a number of questions about your investment intentions and your knowledge of the cryptocurrency space to ensure you understand the risks of investing.

Step 2: Connect a payment method to your account

Connect a payment method to your account and deposit fiat in order to start buying AVAX. To do so, you’ll need to click “Deposit Cash” and select a payment method that best suits your needs.

Choose how much you’d like to deposit and select a local currency such as USD. You’ll need to fill in any details relating to your preferred payment method and will be redirected to this provider to confirm the payment.

Make sure you’ve looked at any fees that Coinbase charges for the deposit before you hit “Confirm”!

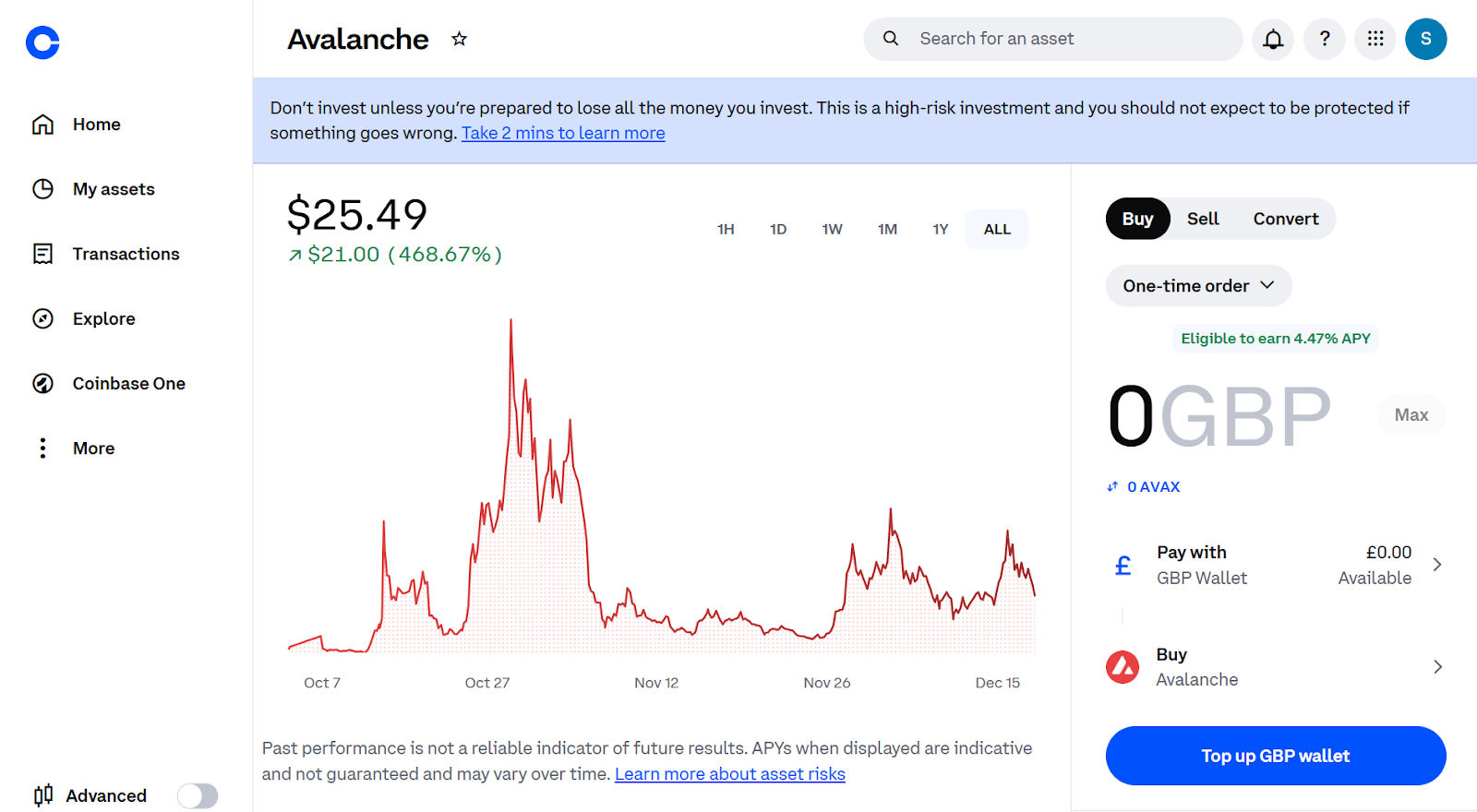

Step 3: Search for “AVAX” or “Avalanche”

Coinbase has a search function that will allow you to access the “Avalanche (AVAX)” market page. Because of Avalanche’s significant market capitalization, you can also find Avalanche through the “Explore” page.

Step 4: Buy Avalanche (AVAX)

Once you’re on the “Avalanche” page, click “Buy”. Choose between a “One-time order” or a “Recurring buy order”. If you’re simply looking to buy AVAX once at the current market price, a “One-time order” is your best bet.

Decide how much you want to spend or how many AVAX tokens you want to buy. If you deposited fiat into a fiat wallet earlier, you can select that now. Alternatively, choose a different payment method if you’d prefer – the available payment methods will depend on your country of residence.

Confirm that you’re happy with the transaction details, fees and exchange rate. Once you’ve done so, your AVAX tokens should appear in your Coinbase account. From here, you can either keep them stored on Coinbase or use the “Send” function to transfer them to a non-custodial wallet for safekeeping.

How to Buy Avalanche with a Credit Card

Buying Avalanche with a credit card is incredibly straightforward. Once you’ve found an exchange that accepts credit cards, you’ll be able to deposit funds using your credit card or simply buy AVAX directly.

To deposit funds using your credit card, visit the site’s “Deposit” page. Choose “Visa” or “Mastercard” from the list of options, or click “Credit Card” – the options available will depend on the exchange you’ve chosen. Decide how much of your chosen fiat currency you’d like to deposit and then input your card details. Confirm the transaction with your card provider and then use the deposited funds to buy AVAX from the “Avalanche (AVAX)” market page.

If you want to know how to buy Avalanche crypto tokens directly with your credit card, visit the “Avalanche” page and click “Buy” or “Trade”. Choose “Visa”, “Mastercard”, or something similar, and then decide how many AVAX tokens you want to buy. Add your card details, approve the transaction with your payment provider, and confirm the transaction.

How to Buy Avalanche Anonymously

If you want to know how to buy Avalanche anonymously, you should consider using a decentralized exchange (DEX). These platforms allow users to trade cryptocurrencies on a peer-to-peer basis, without needing to interact directly with the buyer or seller. DEXs use smart contracts which automate the process and ensure your funds are safe at all times.

Unsure how to buy AVAX using a decentralized exchange?

- Find an exchange – Only certain DEXs will accept AVAX, so make sure you find a compatible exchange

- Fund your crypto wallet – Add the cryptocurrency you want to swap to your wallet

- Connect your wallet – Connect your funded wallet to the exchange you’ve chosen

- Select the crypto to swap – Select whichever crypto token you want to exchange for AVAX

- Choose “AVAX” – Make sure you’ve selected “AVAX” as the token you want to swap for

- Decide an amount – Choose how many tokens you want to swap or receive

- Confirm – Confirm the transaction and wait for your AVAX to appear in your wallet

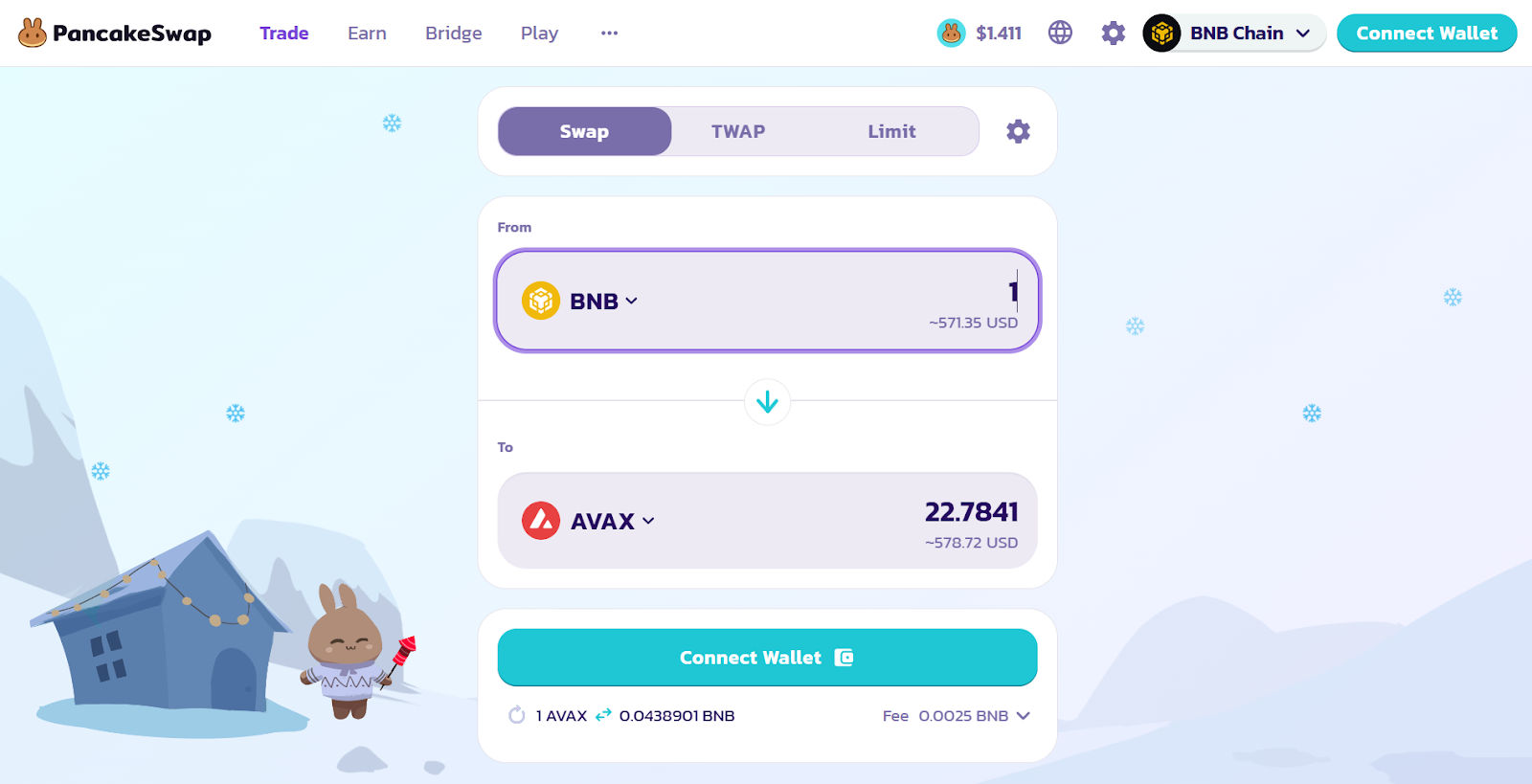

PancakeSwap

PancakeSwap is a decentralized exchange that allows you to trade thousands of different cryptocurrencies across various chains, including BNB Smart Chain (BSC) and Ethereum. For Avalanche (AVAX) trades, you’ll need to select “BNB Chain” and pick a BNB-compatible token to swap. This could include BNB, USDT or CAKE.

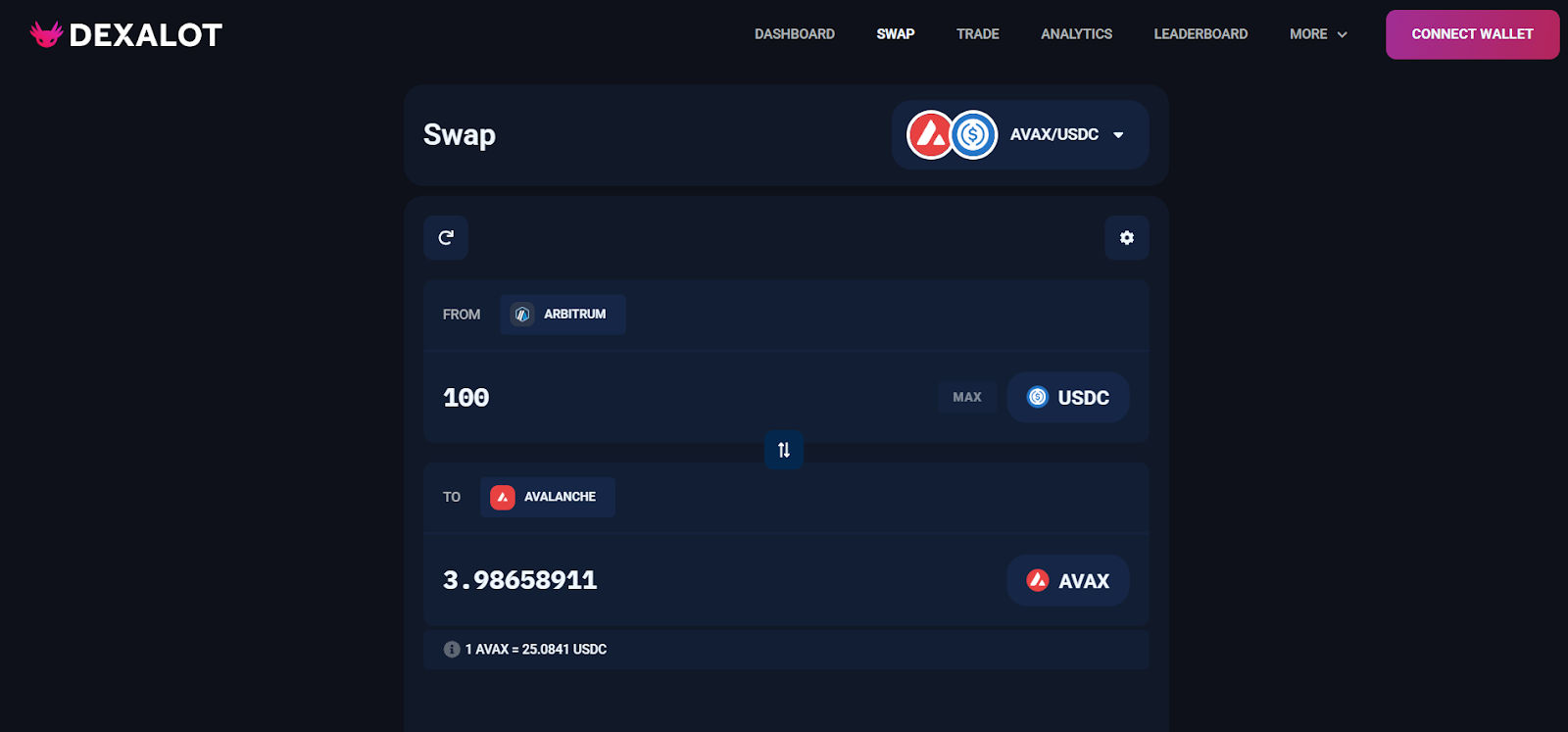

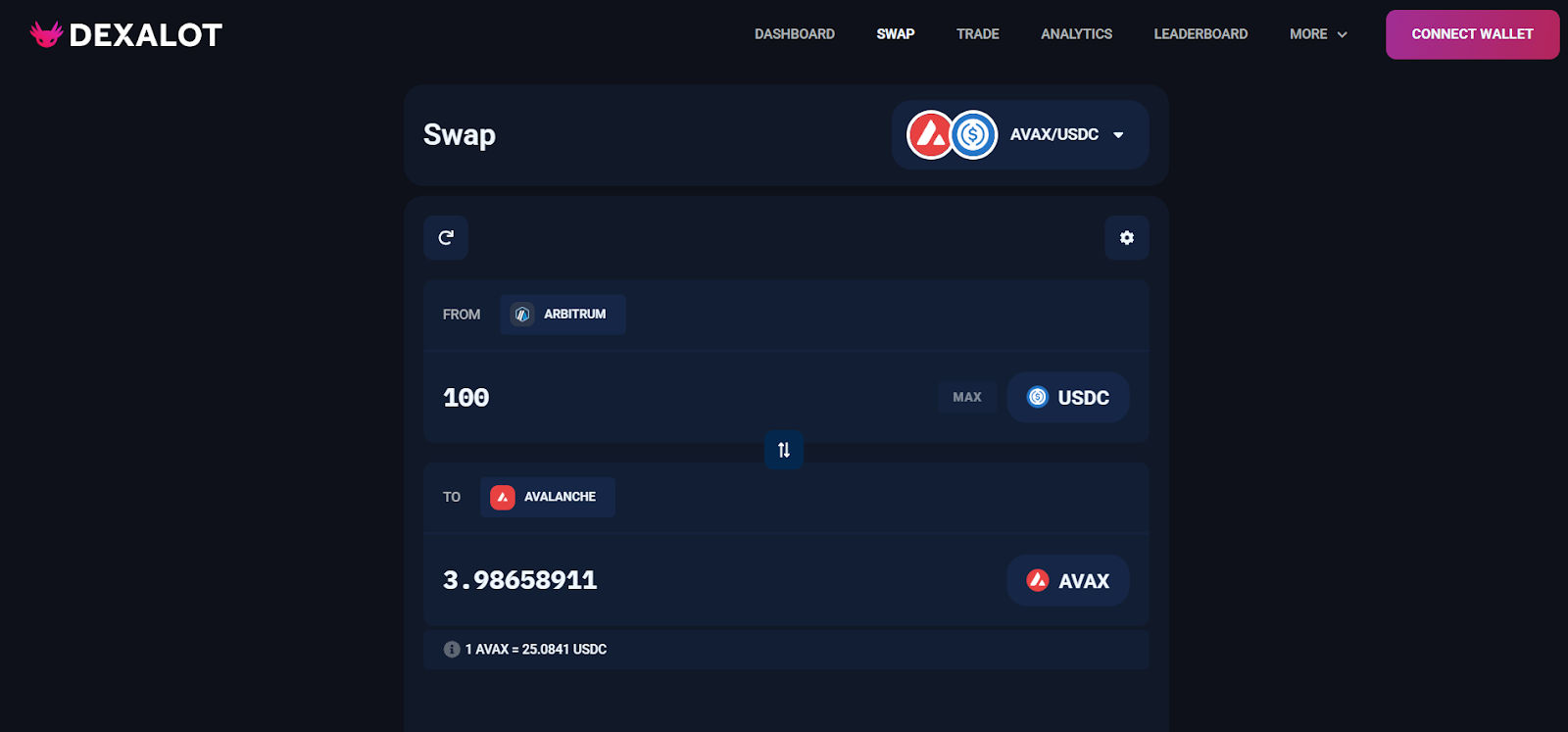

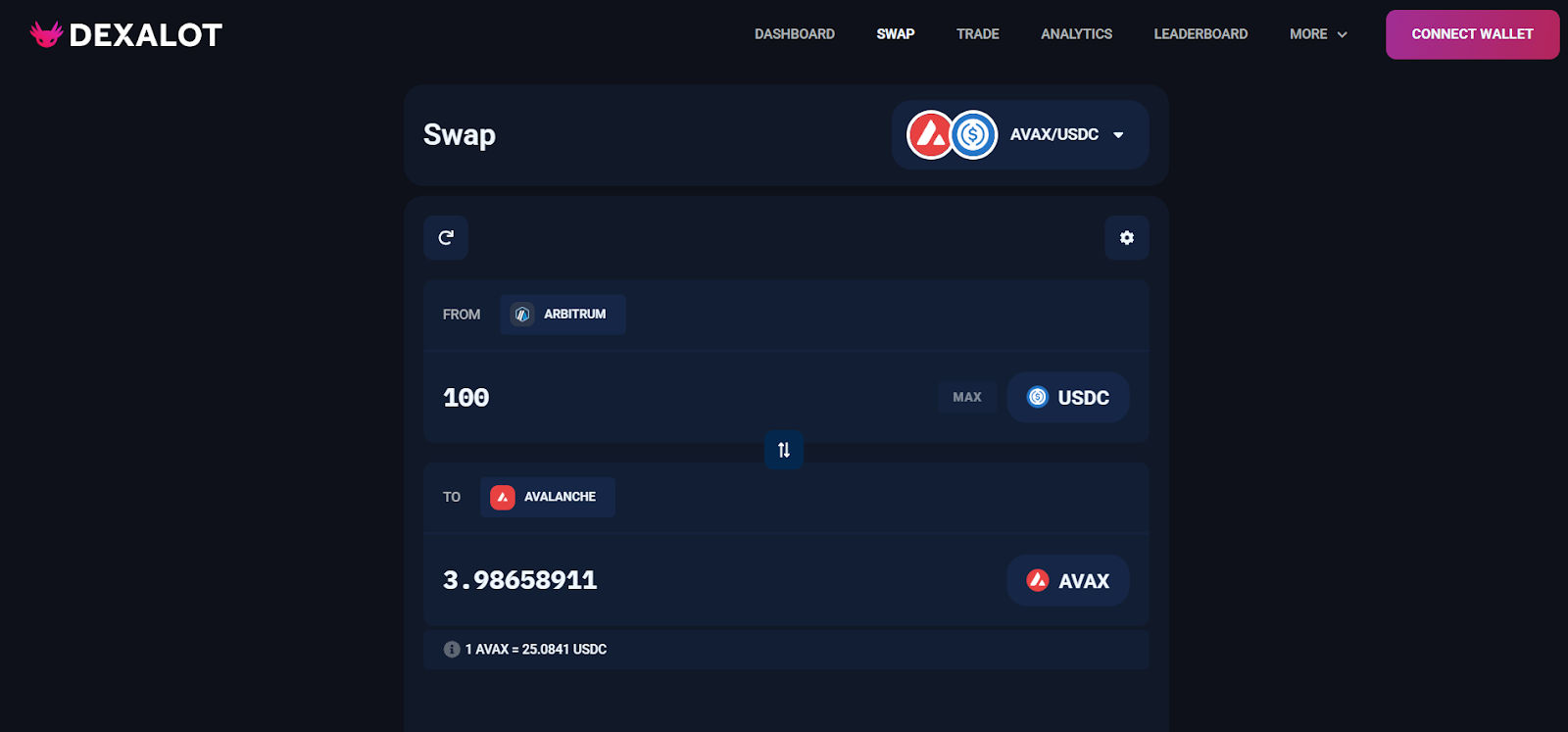

Dexalot

Dexalot is a fast, secure and decentralized crypto exchange that allows you to trade tokens on (and between) the Avalanche, Arbitrum and Base networks. Launch the application, decide which network you want to trade on and select a currency pair. With Dexalot, you can trade a range of different pairs including:

- WETH / AVAX

- AVAX / USDC

- AVAX / USDT

- ALOT / AVAX

- AVAX / USDC

How to Sell AVAX

Once you’ve learned how to buy Avalanche (AVAX), and if you’re lucky enough to experience a price increase, you’ll need to know how to sell your Avalanche tokens. Thankfully, once you’re comfortable with buying AVAX, the selling process is equally as simple.

Make sure your AVAX tokens are stored on a centralized exchange. If they’re in a non-custodial wallet, transfer them to your preferred exchange by using your wallet’s “Send” function and the wallet address provided by the CEX.

Once on the exchange, access your AVAX tokens and click “Sell” or “Trade”. You’ll probably need to exchange these tokens for fiat, which you can then withdraw. Decide how many tokens you want to sell and pick a local currency that you’d like to swap them for.

Confirm that you’re happy with the exchange rate and any fees, then complete the transaction. Once you’ve swapped your AVAX for fiat, visit the “Withdrawal” page, select a payment method (and input the details of that method) and decide how much you want to withdraw.

How to Know Which Purchasing Method is Right for You?

There are lots of options available to investors interested in buying Avalanche, but not all methods will suit every investor.

Centralized or decentralized?

Centralized exchanges are some of the best options available to both new and experienced investors. You’ll be able to buy Avalanche tokens using fiat currencies and the exchange will facilitate the transaction on your behalf. Alternatively, decentralized exchanges will allow you to swap one cryptocurrency for another and will use smart contracts to do so. A CEX may have higher fees but the process is more straightforward. A DEX removes third-party intermediaries from the process but there is a greater margin for error compared to a centralized alternative.

New or experienced investor?

If you’re new to crypto, you’ll need to find a method of buying AVAX that is uncomplicated. If you have more experience in the crypto space, you could explore options that require a little more knowledge. For example, experienced investors will likely already have a cryptocurrency wallet that they could use to buy AVAX, while new investors could benefit from the help provided by centralized exchanges.

Is Avalanche a Good Crypto to Buy?

Avalanche is one of the most exciting cryptocurrency projects available in 2025. Now, this doesn’t mean that an AVAX investment is always a good idea, but the project has strong fundamentals that could help it to do well in the long-run.

Avalanche is a Layer 1 blockchain that allows developers to create and deploy smart contracts, much like Ethereum does. However, Avalanche is much quicker and more affordable than Ethereum, which could encourage developers to prioritize the former. Avalanche is also EMV-compatible, which means that dApps can be easily ported between Ethereum and Avalanche.

Avalanche uses “subnets” which help to drastically increase transaction speeds, with the network able to handle 6,500 transactions per second (TPS).

AVAX is a crypto token that can be used for governance, transaction fees and for transaction validation. As the Avalanche network continues to grow, it’s likely that AVAX will grow alongside it.

Final Thoughts

Avalanche is a Web3 protocol with high potential. It utilizes the AVAX cryptocurrency, which is available to buy at all of the world’s largest exchanges. If AVAX continues to grow and see mainstream adoption, it’s important that you know how to buy Avalanche tokens in a safe, uncomplicated manner. Always conduct research before opening an AVAX position and make sure you diversify your portfolio – both between crypto and non-crypto assets – to minimize risk.

FAQs

How to buy Avalanche (AVAX)?

To buy Avalanche (AVAX), find an exchange that suits you. If you’re new to crypto, find a centralized exchange that allows you to buy AVAX – this is a more user-friendly option compared to decentralized exchanges.

Create and verify an account and then deposit funds using your preferred payment method. Visit the “Avalanche (AVAX)” market page, click “Buy” or “Trade” and decide how many tokens you want to buy using the funds you deposited previously. Confirm that you’re happy with the transactions and wait until the process is complete!

How to buy Avalanche coin in US?

For US-based investors, AVAX can be bought at a number of centralized exchanges. This includes Coinbase, Binance, OKX and Kraken. Alternatively, if you don’t want to use a CEX, consider using a decentralized exchange such as PancakeSwap or Dexalot.

What is the best exchange to buy AVAX on?

The “best” exchange will depend on your personal preferences. For example, Coinbase has relatively high fees but is incredibly easy to use. Binance is slightly more complicated but has lower fees and more advanced trading features. OKX offers an impressive annual percentage yield when staking AVAX and Kraken is beginner-friendly and has a fantastic educational offering.

Can I buy Avalanche on Coinbase?

Yes, you can buy AVAX and other cryptocurrencies on Coinbase. Create an account, deposit funds and then visit the “Avalanche (AVAX)” market page. Once here, decide whether you want to buy AVAX using a “One-time order” or a “Recurring-buy order”, choose how many tokens you want to purchase and confirm the transaction.

Can I buy Avalanche with PayPal?

Yes, you can buy Avalanche crypto tokens with PayPal, as long as your chosen exchange offers it as a payment method. To buy AVAX with PayPal, create an account with the exchange and visit the “Avalanche (AVAX)” market page. Click “Buy” and select “PayPal” as your payment method of choice, then decide how many AVAX tokens you want to buy. Visit the PayPal site to confirm that you’re happy to make the transaction, and then finalize the purchase.