Since launching 12 years ago, Bankless Times has brought unbiased news and leading comparison in the crypto & financial markets. Our articles and guides are based on high quality, fact checked research with our readers best interests at heart, and we seek to apply our vigorous journalistic standards to all of our efforts.

BanklessTimes.com is dedicated to helping customers learn more about trading, investing and the future of finance. We accept commission from some of the providers on our site, and this may affect where they are positioned on our lists. This affiliate advertising model allows us to continue providing content to our readers for free. Our reviews are not influenced by this and are impartial. You can find out more about our business model here.

Best Cryptos to Buy (Updated for 2025)

The cryptocurrency market is always changing, and it can feel impossible to know which crypto assets are the best option from an investment standpoint. New projects are always being launched, while existing projects continue to adapt and grow.

Below, I’ve broken down the best crypto to buy now, in 2025, and explained some of the key features of each to help you better understand how each of them works.

A List of The Best Cryptos to Buy This Year

Here is a list of the top cryptocurrency options for 2025:

- Bitcoin Pepe

- PepeX

- CartelFi

- Ethereum (ETH)

- Bitcoin (BTC)

- Dogecoin (DOGE)

- Solana (SOL)

- Ripple (XRP)

- Ton coin (TON)

- Cardano (ADA)

- Shiba Inu (SHIB)

- Tron (TRX)

- Binance Coin (BNB)

- A List of The Best Cryptos to Buy This Year

- What is The Best Crypto To Buy Now?

- Bitcoin Pepe (BPEP)

- CartelFi (CARTFI)

- PepeX (PEPX)

- Bitcoin (BTC)

- Ethereum (ETH)

- Dogecoin (DOGE)

- Solana (SOL)

- Ripple (XRP)

- Toncoin (TON)

- Cardano (ADA)

- Shiba Inu (SHIB)

- Tron (TRX)

- Binance Coin (BNB)

- How We Choose The Best Cryptos to Buy in 2025

- How to Know If a Crypto Has Potential

- Top Tips for Investing in Crypto Safely in 2025

- Final Thoughts

- FAQs

What is The Best Crypto To Buy Now?

Although it’s difficult to know definitively what the best crypto to buy is, I’ve detailed some potential options for investors to consider.

Nothing in this guide should be taken as financial advice. The crypto market is very volatile and the ‘best’ coins to buy depends on current market conditions as well as your own trading goals.

Bitcoin Pepe (BPEP)

The best cryptocurrencies to buy are those that combine strong community backing, innovative tokenomics, and long-term growth potential. Bitcoin Pepe (BPEP) is the latest meme coin making waves in the crypto space, offering a unique blend of Bitcoin’s influence and the internet’s most legendary meme—Pepe the Frog.

A Meme Coin with a Mission

At its core, Bitcoin Pepe is more than just another meme token. It aims to create a decentralized and community-driven cryptocurrency that thrives on internet culture while offering real utility.

BPEP’s vision includes integrations into NFTs, Web3 gaming, and staking mechanisms, giving investors multiple ways to engage with the ecosystem. With a growing community and increasing adoption, Bitcoin Pepe is quickly becoming one of the most exciting projects in the meme coin sector.

A Transparent and Fair Launch

Bitcoin Pepe follows a fair launch model, meaning no private sales, no insider allocations—just a fully decentralized token for the people.

- Total Supply: 420,690,000,000 BPEP

- No Team Allocation: 100% community-driven token distribution

- Liquidity: A large portion is locked to ensure price stability

- Future Plans: NFT utility, staking rewards, and gaming integrations

With a fair launch and strong community involvement, Bitcoin Pepe stands out as one of the most transparent and accessible meme coins to buy in 2025.

Get in Before the Hype Peaks

BPEP is currently available on its official website, where investors can swap popular cryptocurrencies like ETH or SOL to acquire tokens. As Bitcoin Pepe gains traction, major exchange listings are expected soon—giving early investors a unique opportunity to get in before the price surges.

With meme culture stronger than ever in the crypto space, Bitcoin Pepe (BPEP) is set to be one of the most exciting tokens of the year. Don’t miss your chance to be part of the next big meme revolution!

CartelFi (CARTFI)

CartelFi is a DeFi protocol that connects meme coins with yield-generating opportunities. Launching April 8, 2025, the project addresses the issue of idle meme coin holdings by allowing investors to earn yield without selling their assets.

Memes Meet DeFi

CartelFi creates specialized liquidity pools designed for popular meme coins like $PEPE and $SHIB. Users can stake their meme tokens in these pools to earn returns while maintaining full exposure to the underlying token’s price movements.

The protocol employs a “Burn & Earn” mechanism that uses platform fees to buy back and burn CARTFI tokens from the open market. This approach aims to reduce the total token supply over time, differing from platforms that rely on continuous token emissions.

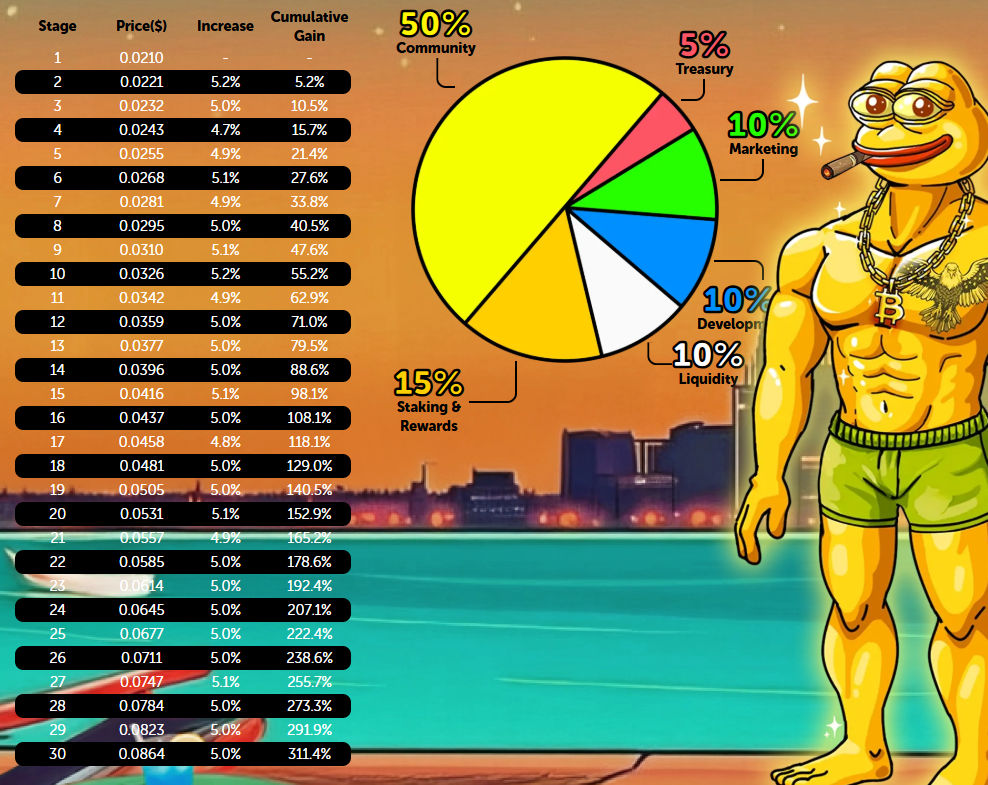

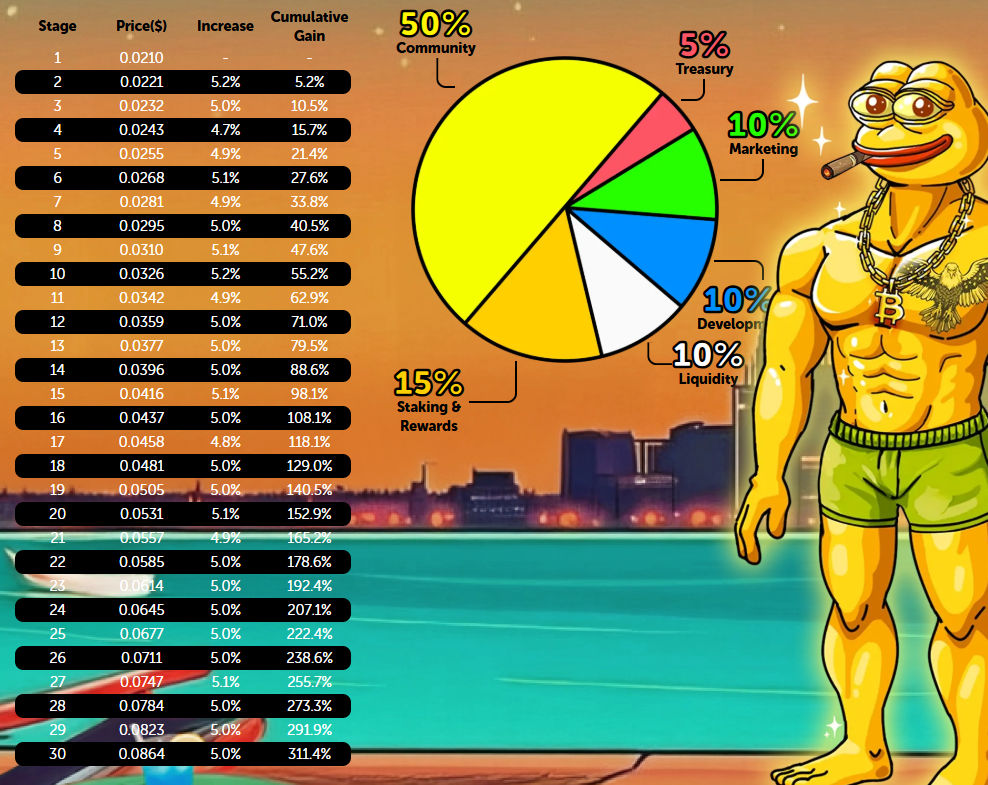

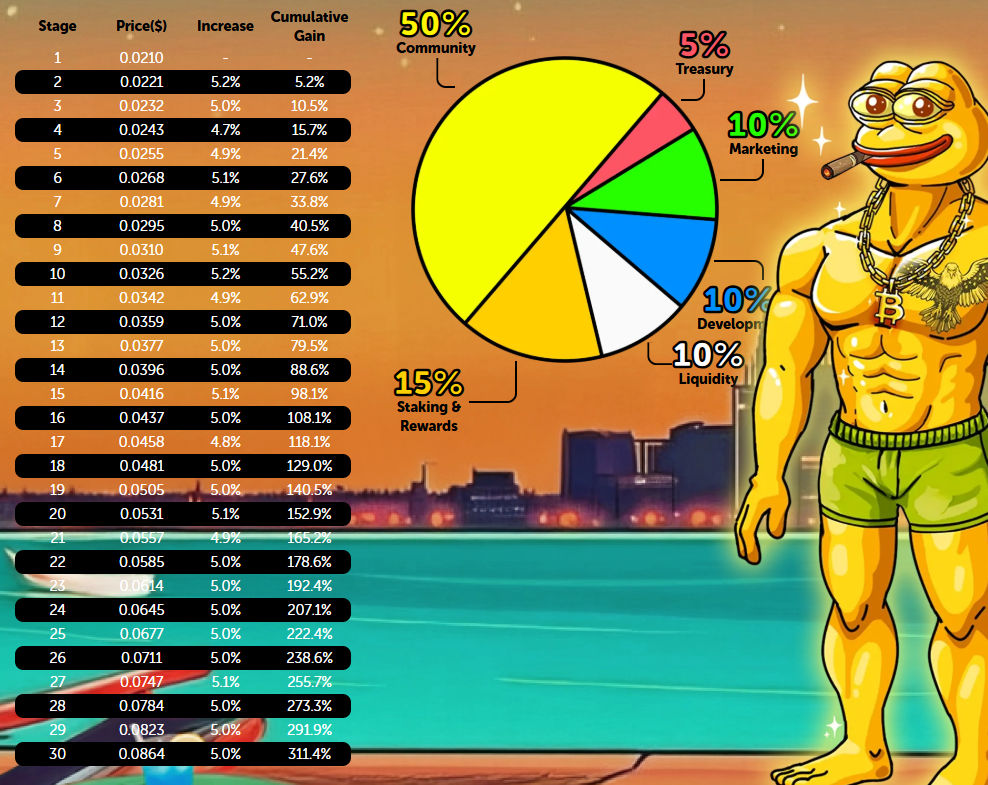

CartelFi Tokenomics

The total supply of CARTFI tokens is capped at 1 billion:

- Presale (25%) – 250 million tokens

- Staking & Rewards (10%) – 100 million tokens

- Liquidity (15%) – 150 million tokens

- Ecosystem Development (25%) – 250 million tokens

- Marketing & Community (10%) – 100 million tokens

- Treasury (5%) – 50 million tokens

Presale Structure

CartelFi’s presale consists of 30 stages, each lasting 72 hours, for a 90-day period beginning April 8, 2025. The Stage 1 price is set at $0.0251 per token, with each subsequent stage introducing a 5% price increase.

Investors can participate using multiple payment options:

- Ethereum Network: ETH, USDT, USDC

- Binance Smart Chain: BNB, USDT, USDC

- Solana: SOL

- Fiat purchases via credit/debit card

CartelFi aims to provide utility for the estimated $50 billion in meme coin capital currently held in wallets, offering an alternative to the traditional hold-or-sell approach to meme investing.

PepeX (PEPX)

The best crypto projects to watch in 2025 are the ones that blend cutting-edge technology, community empowerment, and meme culture—and PepeX (PEPX) checks every box. As the world’s first AI-powered meme coin launchpad, PepeX is transforming how meme coins are created, marketed, and launched on the blockchain.

A Meme Coin Platform Built by AI

PepeX isn’t just another token—it’s a full-scale ecosystem designed to help anyone create and launch their own meme coin in minutes. Using AI, users can generate token names, tickers, smart contracts, logos, memes, and even promotional content—without needing any technical experience.

From concept to launch, the process is automated by PepeX’s proprietary Moonshot Engine, giving everyday users the power to participate in one of crypto’s most viral sectors: meme coins.

But what really sets PepeX apart is its commitment to fairness and transparency.

Fair Launch, Real Utility

Every token created on PepeX adheres to a strict distribution model:

- 95% of tokens are available to the public

- Only 5% goes to the project creator

- No private allocations, no hidden wallets, and anti-sniping protection at launch

This model ensures that launches are transparent and accessible, putting the community first. In addition, token distribution is visualized in real time through AI-powered bubble maps, showing users exactly who owns what—eliminating the guesswork and shady practices common in many meme coin launches.

AI Agents for Viral Growth

Beyond token creation, PepeX also features AI-driven agents that promote projects across social media platforms like X and Telegram. These bots create memes, engage users, and build hype autonomously—handling the marketing so creators can focus on their community.

PepeX is also building out features like fee-sharing for PEPX holders, integrations with major DEXs, and advanced analytics tools for project tracking and performance insights.

Get in Early on the PEPX Presale

The PEPX token is currently in presale and available on the official website. Investors can participate using ETH, SOL, USDC, or USDT, making it easy to get in before the platform’s official launch.

With listings on major exchanges expected soon and a growing wave of interest in AI and meme culture, PepeX is quickly emerging as one of the most innovative and community-focused meme coin platforms of 2025.

Don’t miss your chance to be early on the next big crypto trend—PepeX is where memes meet machine.

Bitcoin (BTC)

Bitcoin (BTC) is easily the world’s best-known cryptocurrency. It is designed to act as digital money and a form of payment. It prioritizes decentralization – meaning that it is not controlled by a single person or entity – and the removal of third-party involvement from financial transactions.

In January 2024, the Securities and Exchange Commission (SEC) approved spot bitcoin ETFs, providing non-crypto investors with an easily accessible means of investing in the asset.

Bitcoin ETFs are beneficial in that they are convenient and regulated, which should see an increase in the adoption of Bitcoin. With Bitcoin being created as an alternative to traditional financial options, this approval helps to further legitimize the asset class.

Additionally, the Bitcoin halving (the point at which 210,000 blocks are successfully mined) took place on April 19th, 2024. Historically, the Bitcoin halving has led to a drastic increase in the price of Bitcoin.

Ethereum (ETH)

Created to fix some of Bitcoin’s shortcomings, Ethereum is a peer-to-peer network that allows developers to build and run smart contracts and decentralized applications (dApps). Smart contracts are agreements between two entities that are automatically executed when the conditions of the contract are met.

Ether (ETH) is a decentralized cryptocurrency that powers all Ethereum-based applications. On Ethereum, it is possible to create custom currencies and financial instruments, own assets, develop non-fungible tokens (NFTs) and create decentralized applications.

Ethereum has widely been tipped to overtake Bitcoin in the future, and the recent approval of spot Ethereum ETFs in July 2024 could increase ETH’s popularity with institutional investors.

Ethereum is also the most popular blockchain for creating dApps and implementing DeFi protocols.

Dogecoin (DOGE)

DOGE is the native cryptocurrency of the Dogecoin blockchain. DOGE is a memecoin, a cryptocurrency with little utility and limited potential use cases. That being said, DOGE is more widely accepted than most meme coins and can be spent at a range of merchants.

Dogecoin is working towards a detailed roadmap (known as the Dogecoin “trailmap“) which clearly lays out the project’s long-term goals and vision.

In August 2024, Dogecoin released a core network update, fixing bugs and improving transaction handling, which shows that the developers are constantly looking to make improvements to the network.

Solana (SOL)

Solana is a highly scalable cryptocurrency platform. It was created to be faster, cheaper and more scalable than Ethereum.

Solana uses a combination of algorithms to maintain consensus and validate transactions. These consensus mechanisms allow Solana to process thousands of transactions per second, while keeping fees and energy usage low.

Similar to Ethereum, Solana also allows developers to create decentralized applications, meaning it can be used within decentralized finance (DeFi), or to create NFTs, amongst other things.

SOL, Solana’s native cryptocurrency, could be a good investment because of its low fees and high throughput. Solana is also a popular blockchain; with a growing ecosystem of dApps, Solana is often favored by developers.

Ripple (XRP)

Ripple is a company focused on facilitating low-cost cross-border payments using blockchain technology and XRP, the project’s native cryptocurrency.

The XRP Ledger (XRPL) is a decentralized public blockchain that allows businesses and financial institutions to send money internationally, both quickly and affordably.

Using a unique consensus algorithm, known as the Ripple Protocol Consensus Algorithm (RPCA), Ripple uses a network of trusted validators to process and validate transactions. This makes the process energy efficient, while making sure that the blockchain is fast and scalable.

XRP is used as a bridge currency within the Ripple network.

Ripple is arguably the biggest crypto-focused company within the cross-border payments sector. Given the size of the payments sector, if Ripple can position itself as a really viable alternative to traditional companies such as SWIFT, there is potential for the value of XRP to increase.

Additionally, a long-standing court case against Ripple has just ended. This has provided some regulatory clarity for the company, as well as the wider crypto market. Many investors believe this to be a positive sign for Ripple and XRP.

Toncoin (TON)

TON is described as “The Open Network“. Designed to be used as a decentralized and open internet, TON was created using technologies designed by Telegram.

Toncoin (TON) is the network’s native cryptocurrency and can be used for transactions, games and network operations.

The TON network is built up of several components:

- TON Blockchain

- TON DNS

- TON Storage

- TON Sites

TON is designed to process millions of transactions per second, with the TON Blockchain being created as a distributed supercomputer. The TON Blockchain will provide a range of products and services that align with the project’s decentralised vision for the new internet.

TON has a rapidly growing, community-driven ecosystem, making it an interesting option for investors to consider. If the network can eventually handle “millions of transactions per second”, as suggested, there is potential for mainstream adoption which could help the price of Toncoin.

Cardano (ADA)

Cardano is a layer 1 blockchain launched in 2017. Designed to improve on the flaws of Bitcoin and Ethereum, Cardano has focused on scalability and interoperability, meaning that it can exchange data with other blockchains.

Cardano works using ADA, the network’s native cryptocurrency. ADA can be used as an exchange of value or investors can stake their ADA tokens by delegating them to a staking pool in order to secure the network and earn rewards.

Cardano has smart contract functionality, and there are a range of decentralized applications that investors can interact with using ADA.

The Cardano ecosystem continues to grow, as does the number of daily ADA transactions. Many investors believe that, in the long-run, ADA’s price could bounce back to its all-time high of $3.10, which it reached in 2021. If this is the case, it could be possible to see 5x-10x gains.

Shiba Inu (SHIB)

Shiba Inu (SHIB) is a popular meme coin, built on top of the Ethereum blockchain as an ERC20 token. Being Ethereum-based means that the Shiba Inu network has access to a range of dApps.

The Shiba Inu ecosystem is made up of several tokens, including SHIB, LEASH and BONE.

There are also a number of cryptocurrency-projects that make up Shiba Inu, including Shibaswap – a decentralized exchange – and Shibarium – an Ethereum layer 2 scaling solution.

Shiba Inu is a very community-driven crypto project, and the community behind it are incredibly loyal. This, combined with Elon Musk’s interest in the project, could see the price of SHIB grow in 2025.

Tron (TRX)

TRONPROTOCOL is a decentralized blockchain protocol that claims to have incredibly high throughput, scalability and availability.

Operating using TRX, the network’s native cryptocurrency, TRONPROTOCOL is smart contract-enabled, which means that decentralized applications can be built on the network.

The Tron network has shifted focus several times, with project leaders adapting as the market shifts. This adaptability could potentially see the TRONPROTOCOL succeed in the long-run, especially as the network is currently focused on providing a viable alternative to Ethereum and Bitcoin.

Binance Coin (BNB)

BNB Chain is a blockchain platform that allows developers to create and launch decentralized applications. Having evolved from Binance Chain and Binance Smart Chain, BNB Chain is a community-driven, open-source blockchain.

BNB Chain is also compatible with the Ethereum Virtual Machine (EVM), and offers high performance and low fees.

BNB Chain has a large ecosystem and a heavy focus on decentralized finance. It is also backed by Binance, one of the world’s largest centralized exchanges.

BNB, the project’s native cryptocurrency, can be used to pay transaction fees or as a form of payment. It can also be used as a governance token to help make decisions about the future of BNB Chain.

BNB’s link to Binance is probably the cryptocurrencies strongest attribute. If Binance continues to grow (and can stay out of regulatory trouble), there’s a good chance that the value of BNB will grow with it.

How We Choose The Best Cryptos to Buy in 2025

To be considered the “best cryptocurrency”, an asset has to really stand out. I’ve broken down some of the key elements we look for when rating and ranking cryptocurrencies.

Market cap

Within crypto, market capitalisation, or market cap, is calculated by multiplying a cryptocurrency’s circulating supply by the price of a single coin or token. This can be used to work out the overall value of an asset.

For example, if the price of a single bitcoin is $50,000, and there are 19,700,000 BTC in circulation, bitcoin’s total market capitalisation would be $985 trillion.

Market capitalisation can be used to understand the stability of a crypto asset. Often, although not always, the larger a cryptocurrency’s market cap, the more stable its price action will be.

Some investors prefer to invest in smaller-cap cryptocurrencies as they believe them to have a better chance of seeing higher potential returns. However, it’s important to note that smaller cap currencies can also be incredibly volatile.

Although people have differing opinions, I like to break down cryptocurrencies into the following sections:

| Large Cap | More than $10 billion |

| Mid Cap | $1 billion – $10 billion |

| Small Cap | $300 million – $1 billion |

| Micro Cap | Less than $300 million |

Token utility

It’s important to look at a cryptocurrency’s utility when deciding whether or not to invest. Although lots of cryptocurrencies are released with limited (or no) utility, most crypto assets are designed to serve a purpose.

There are a range of potential use cases within crypto, but cryptocurrencies will typically fall into one of the following categories:

- Utility tokens: Designed with a specific use case within a blockchain network or project

- Security tokens: Representative of ownership or participation in real-world assets

- Stablecoins: Designed to maintain a stable value that tracks the price of a specific fiat currency

- Governance tokens: Allow holders to engage in network decision-making, usually through a vote

- Meme coins: Named after viral moments or trends, usually with limited utility

When looking for the best crypto to buy, you’ll typically want to look for one that has potential real-world utility. This is usually a good indication of whether or not a cryptocurrency has any chance of long-term success.

Community and social presence

A project’s community can be a really good indication of how strong a cryptocurrency is. A good social presence and a large following suggests that people are interested in, and talking about a project.

Community is especially important when looking at meme coins. Based on viral memes or trends, meme coins typically thrive when people are talking about them.

For other cryptocurrencies, a strong community might be less important. However, if nobody is talking about the crypto asset, it’s unlikely to see mainstream adoption, especially from retail investors.

Future developments

When investing in crypto, it’s essential that you consider the project’s future trajectory. A well-defined roadmap and a detailed whitepaper can offer valuable insights into a team’s vision and commitment to long-term growth.

A roadmap usually functions as a medium- to long-term plan for future developments, outlining planned updates, changes and additions to a project. Although roadmaps can change, when looking for cryptocurrencies to buy, it’s worth looking into a project’s potential longevity and making sure the developers are looking to grow the project.

If there isn’t a roadmap or clear plan for the future, it’s worth asking yourself why. Will the cryptocurrency succeed if there isn’t a plan for future developments?

Growth potential

When choosing the best cryptocurrencies to buy, we look at their growth potential, both as a project and in terms of monetary value.

Will the cryptocurrency – and the project it’s connected to – have any real-world impact? Was the cryptocurrency created as a profit-making exercise? It’s important to understand whether or not the project might positively disrupt an industry. If so, it’s more likely that the cryptocurrency will see long-term growth.

We also look at the value and tokenomics of a cryptocurrency. If a cryptocurrency already has a considerable market cap, it’s less likely to see a 500% growth in value. On the other hand, if a cryptocurrency has a very small market cap, it might not gain enough traction to be considered a worthwhile investment.

How to Know If a Crypto Has Potential

It’s impossible to know whether a cryptocurrency will be successful, but there are some key things to look out for:

- Market capitalization and trading volume: A cryptocurrency with a large market cap and a high trading volume often indicates a greater stability and liquidity. However, smaller market cap coins typically offer higher potential returns, albeit with greater risk.

- Team and community: A strong team, with a proven track record in the industry, can be an indication for a project’s potential for success. Also, an engaged community can contribute to the project’s growth and development.

- Use cases: Cryptocurrencies with real-world applications are more likely to experience mainstream adoption, which can be crucial for the project’s success.

- Partnerships: Look at any partnerships that a project has entered into. If experienced, well-known companies are partnering with a cryptocurrency/crypto project, this could suggest that they see long-term potential in it.

Top Tips for Investing in Crypto Safely in 2025

When buying crypto in 2025, it’s important to stay safe. I’ve highlighted some of the key things to keep in mind when investing in crypto.

1. Diversify

Always diversify your portfolio. Crypto is a very volatile asset class, so consider investing in non-cryptocurrency products at the same time. Hedging your investments can minimize risk and provide some additional security, should the crypto market crash.

It’s also important to diversify your cryptocurrency holdings. Experienced investors will often try to buy a mixture of small, medium and large-cap cryptocurrencies.

You could also explore a range of industries within crypto. For example, investing in AI, Gaming and DeFi could lead to positive returns if one of those industries becomes particularly successful.

2. Don’t try to time the market

Some investors will try to time the market, but this rarely works. Although technical and fundamental analysis can provide you with some insight into potential price moves, crypto is too volatile to try and predict accurately.

Instead, consider investing small amounts, little and often. Dollar-cost averaging into positions can avoid you making large investments before a crash and it’s usually a more affordable option for retail investors.

3. Avoid FOMO investing

FOMO (Fear Of Missing Out) investing involves jumping into positions because people around you are. Often, inexperienced investors will see positive price movements and invest without conducting research or understanding the market.

Only invest after conducting significant research, and never invest because other people are.

Final Thoughts

The best cryptocurrency will have real-world utility, good growth potential and a positive, dedicated community around it. It’s impossible to guarantee that a crypto asset will increase in price after you buy it, but there are usually some good indications that investors will look for before committing money to a trade.

FAQs

What is the best crypto to invest in right now?

The best cryptocurrency to invest in right now will depend on your investment goals. Meme coins or small cap cryptocurrencies could be the best option for investors hoping to make significant, short-term gains. However, investors looking for less risky investments might want to consider investing in medium-large cap cryptocurrencies and holding them for a longer period of time.

Which crypto has 1000x potential?

The cryptocurrency with 1000x potential will have a very small market cap. For example, if a cryptocurrency has a market cap of $1 million, a 1000x will see it reach a $1 billion market cap.

What is the most profitable cryptocurrency to buy now?

The most profitable cryptocurrency to buy right now is arguably one that has not seen significant price appreciation or is down significantly from its all-time high. Look for small cap cryptocurrencies in an industry that has good growth potential.

Is CartelFi a good investment in 2025?

CartelFi is attracting attention in 2025 as a DeFi protocol that connects meme coins with yield-generating opportunities. For investors holding meme coins like PEPE or SHIB, CartelFi offers a way to earn passive income without selling their assets. With its ‘Burn & Earn’ mechanism and structured presale approach, CartelFi shows promise, but as with all crypto investments, you should conduct thorough research and only invest what you can afford to lose.

How do I know which crypto to invest in?

To determine which cryptocurrency to invest in, consider factors like: market capitalization, trading volume, real-world utility, development team credibility, community engagement, roadmap clarity, and tokenomics. Also evaluate the problem the cryptocurrency aims to solve and whether its solution offers a competitive advantage. Finally, diversify your portfolio across different types of cryptocurrencies to manage risk.

What is the safest cryptocurrency to buy in 2025?

While no cryptocurrency is entirely safe due to market volatility, established cryptocurrencies like Bitcoin and Ethereum are generally considered less risky investments in 2025. They have larger market caps, higher liquidity, wider adoption, and more developed ecosystems. However, even these relatively stable cryptocurrencies can experience significant price fluctuations, so invest only what you can afford to lose.

Are meme coins worth investing in 2025?

Meme coins can offer substantial short-term returns but come with higher risk. In 2025, some meme coins like DOGE and SHIB have established longer track records, while new projects like CartelFi aim to add utility to the meme coin space. Consider allocating only a small portion of your portfolio to meme coins, and look for those with active communities, transparent developers, and some form of utility beyond just speculation.

What’s the difference between DeFi and traditional crypto investments?

DeFi (Decentralized Finance) platforms like CartelFi offer financial services without intermediaries, allowing users to earn yield on their crypto assets through staking, lending, or liquidity provision. Traditional crypto investments typically involve buying and holding coins with the expectation of price appreciation. DeFi adds an additional layer of utility and potential passive income to crypto holdings, but often comes with smart contract risks and higher complexity.