Since launching 12 years ago, Bankless Times has brought unbiased news and leading comparison in the crypto & financial markets. Our articles and guides are based on high quality, fact checked research with our readers best interests at heart, and we seek to apply our vigorous journalistic standards to all of our efforts.

BanklessTimes.com is dedicated to helping customers learn more about trading, investing and the future of finance. We accept commission from some of the providers on our site, and this may affect where they are positioned on our lists. This affiliate advertising model allows us to continue providing content to our readers for free. Our reviews are not influenced by this and are impartial. You can find out more about our business model here.

How To Buy Polkadot (DOT) in 2025

Polkadot is one of the world’s most innovative cryptocurrency projects. It is an open-source multichain protocol that connects a network of blockchains together, allowing users to transfer data and cryptocurrencies cross-chain. Polkadot is one of the most influential protocols when it comes to facilitating interoperability, so it’s hardly surprising that so many investors are interested in learning how to buy Polkadot (DOT).

Below, I’ve created a detailed, step-by-step guide to buying DOT in 2025. I’ll talk you through some of the best centralized and decentralized options for buying Polkadot and help you to get a better grasp of the process.

An Overview of How to Buy Polkadot in 5 Steps

Here’s a brief overview of how to buy Polkadot crypto tokens in 2025:

- Do your research – Always conduct research before committing capital to any trade

- Create an account – Find a centralized exchange and create (and verify) your account

- Deposit funds – Use the “Deposit” page to add fiat currency to your account

- Find the Polkadot page – Use the search bar to find the “Polkadot (DOT)” market page

- Buy DOT – Click “Buy” or “Trade”, decide how many DOT tokens you want, and confirm the transaction

Where to Buy Polkadot Crypto in 2025

The first step towards buying DOT is finding an exchange that suits you. Centralized exchanges are platforms that allow users to buy, sell and trade cryptocurrencies. The exchange itself is controlled by the company in question, who help to facilitate transactions between buyers and sellers, holding user funds in custody. They’re the best option for beginner investors because they take a lot of the pressure out of the process.

1. Coinbase

If you want to know how to buy Polkadot (DOT) in a user-friendly manner, Coinbase is one of the best options on offer. Available in over 100 countries and with more than $180 billion in quarterly trading volume, Coinbase has become synonymous with the cryptocurrency space.

With Coinbase, users can buy, sell and trade cryptocurrencies through their desktop or via the Android or iOS mobile app. For more experienced investors, Coinbase Advanced is an advanced trading platform that offers enhanced tools such as interactive charts, advanced order types, staking, and more.

Alternatively, you could consider using Coinbase One, a monthly subscription service that allows you to trade with zero fees. Considering the typically high fees that are associated with the Coinbase platform, Coinbase One could be a good option for those looking to buy Polkadot tokens on a regular basis.

2. Binance

Binance is a global exchange with more than 250 million registered users. Allowing you to buy, sell and trade hundreds of different cryptocurrencies, Binance is one of the best places to buy DOT. There’s an Android and an iOS app, or users can buy Polkadot from the desktop version of the site.

Binance prioritizes user-experience, allowing you to make a crypto purchase within several easy steps. Accounts are free to create – although users will need to complete Know Your Customer (KYC) checks – and it’s possible to start trading in a few simple clicks.

If you’re worried about security, Binance maintains a 1:1 reserve for all customer assets, which should provide you with some peace of mind. You can trade one cryptocurrency for another and earn rewards (up to 24% APY) for staking your crypto assets. This includes an annual yield of 8.6% for US users that stake their DOT tokens with Binance!

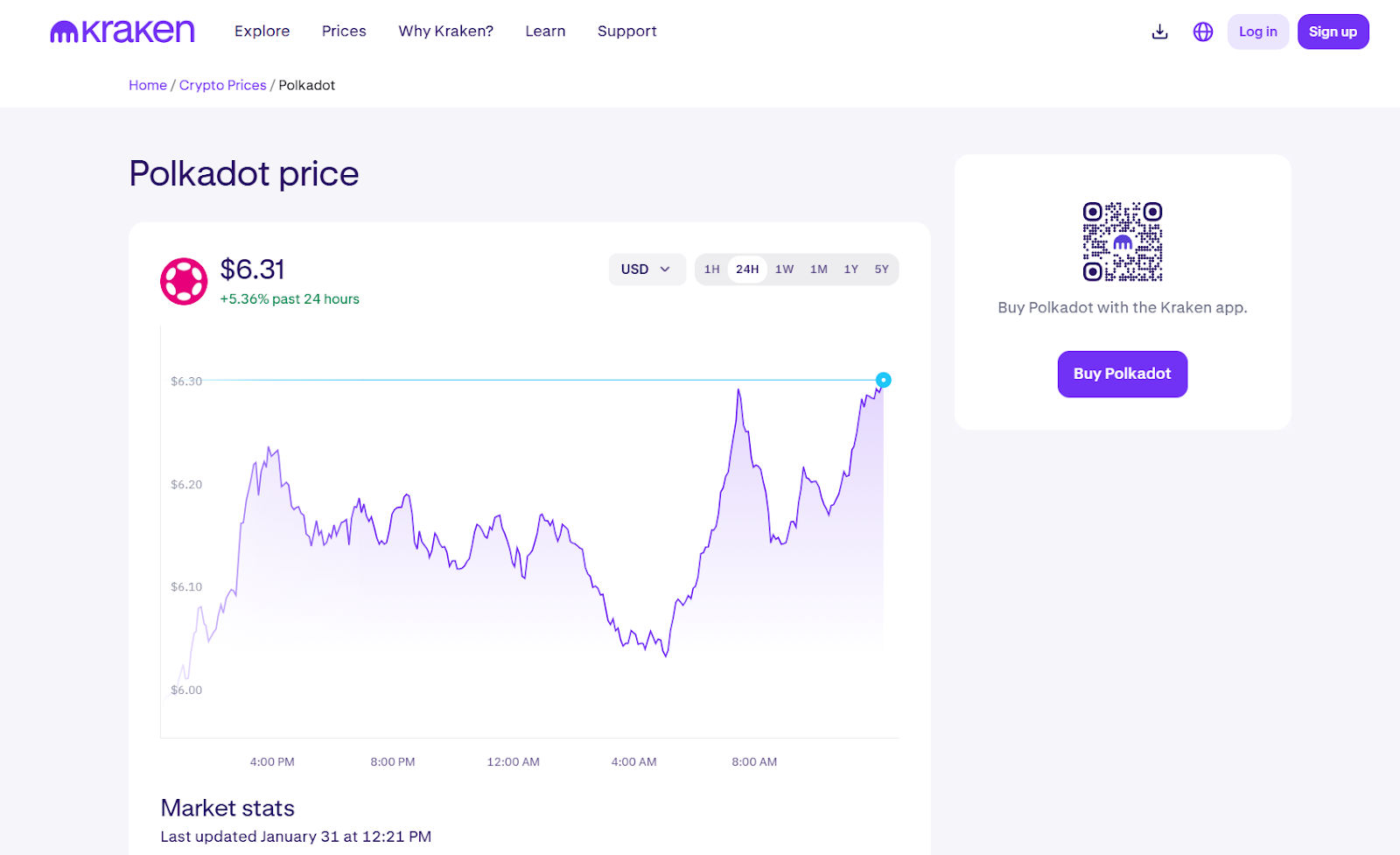

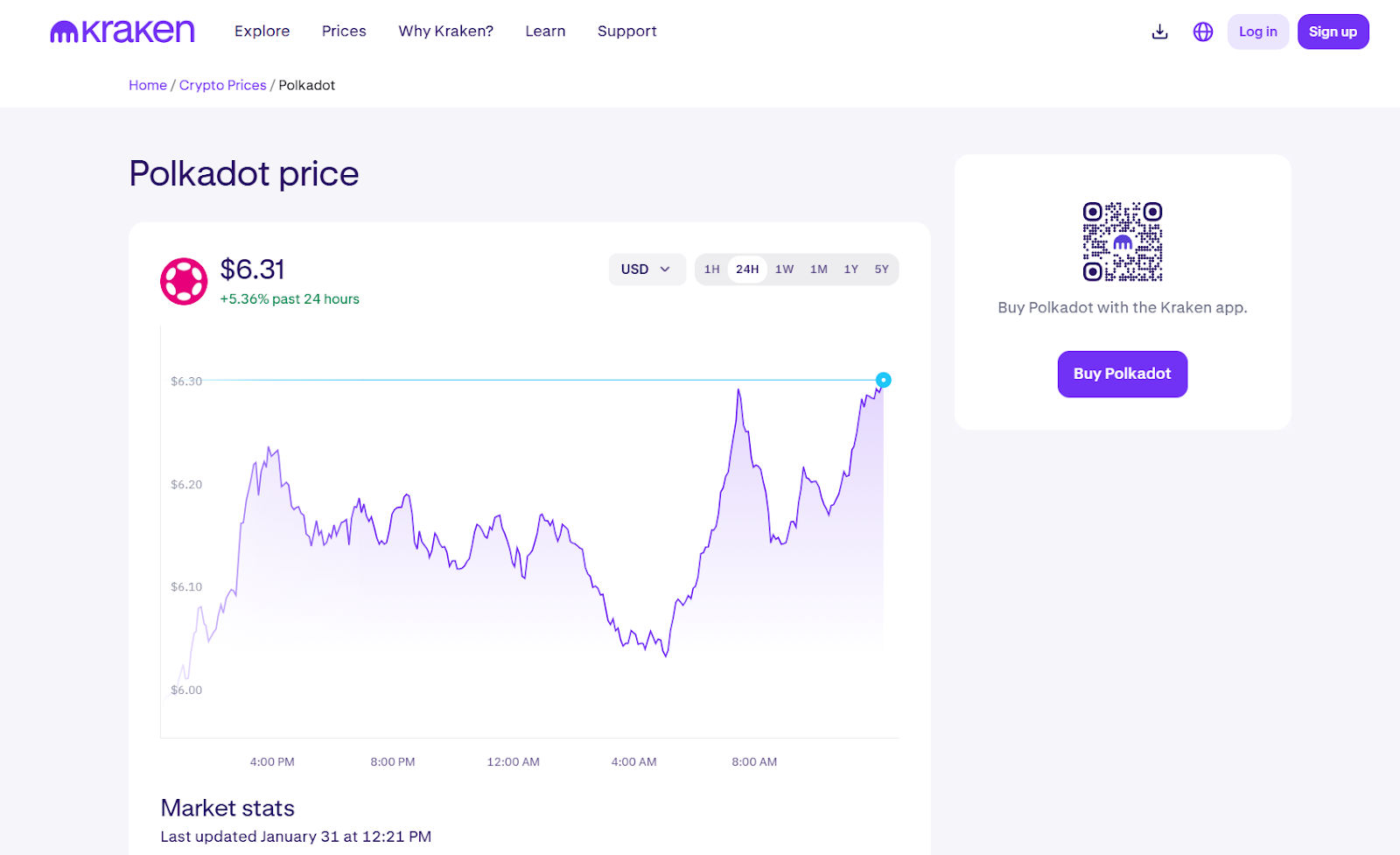

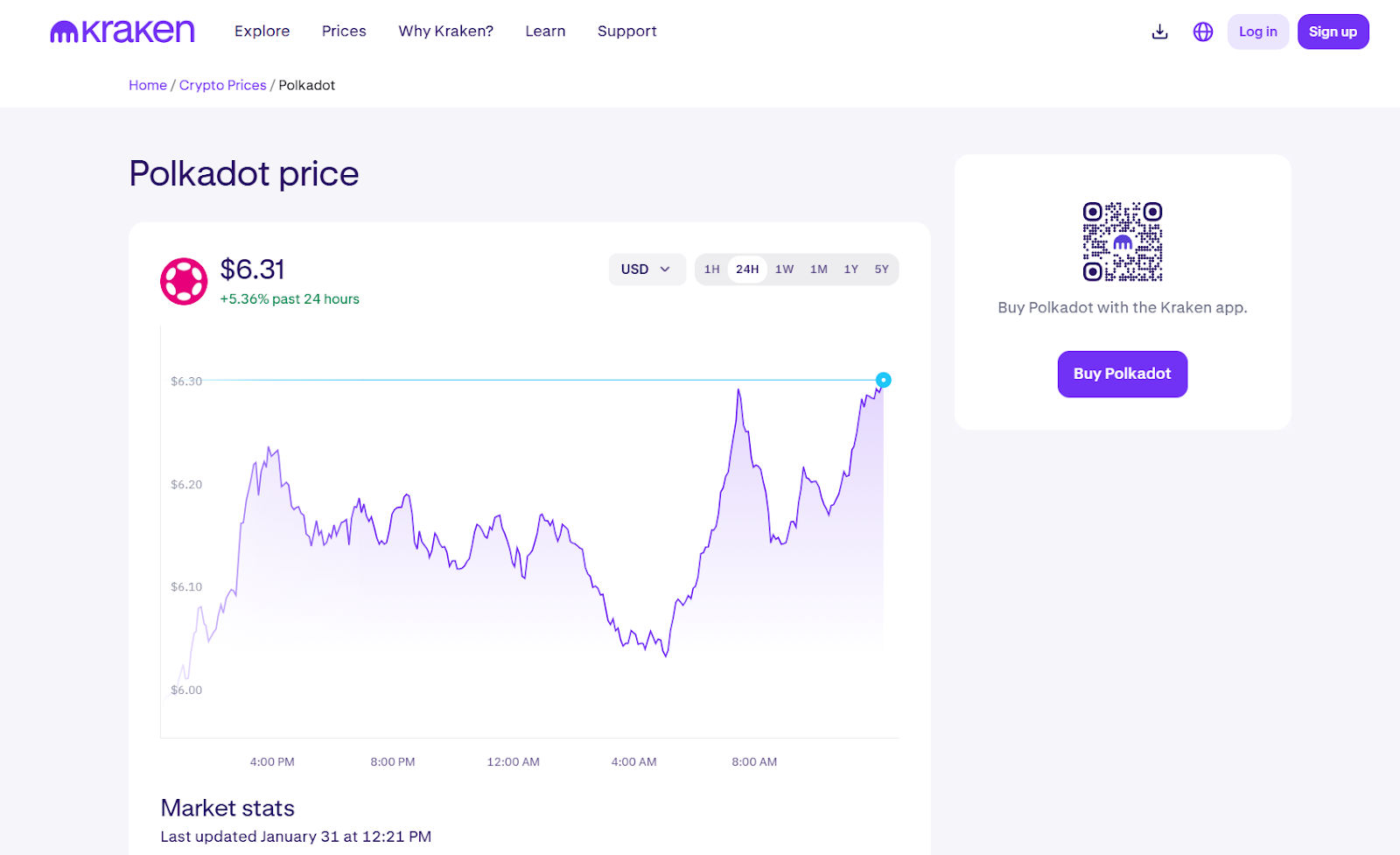

3. Kraken

New and inexperienced investors could benefit from using Kraken to buy DOT. It has an intuitive interface, a smooth mobile app and an impressive Learn Center that helps to educate users on the intricacies of blockchain technology and cryptocurrencies.

Kraken has a range of tools and trading features:

- Kraken Pro – For more experienced and advanced traders

- Kraken Wallet – An onchain crypto wallet for storing DOT and other tokens

- Derivatives Trading – More than 300 multi-collateral contracts

- Earn – Staking for up to 10% APR

Investors can get started on Kraken for as little as $10, making it one of the most affordable centralized exchanges available. Traders can convert one cryptocurrency to another, meaning that it’s possible to swap tokens for DOT, if that’s your preference. For more confident (and experienced) investors, Kraken also allows you to engage in leverage trading of up to 5x.

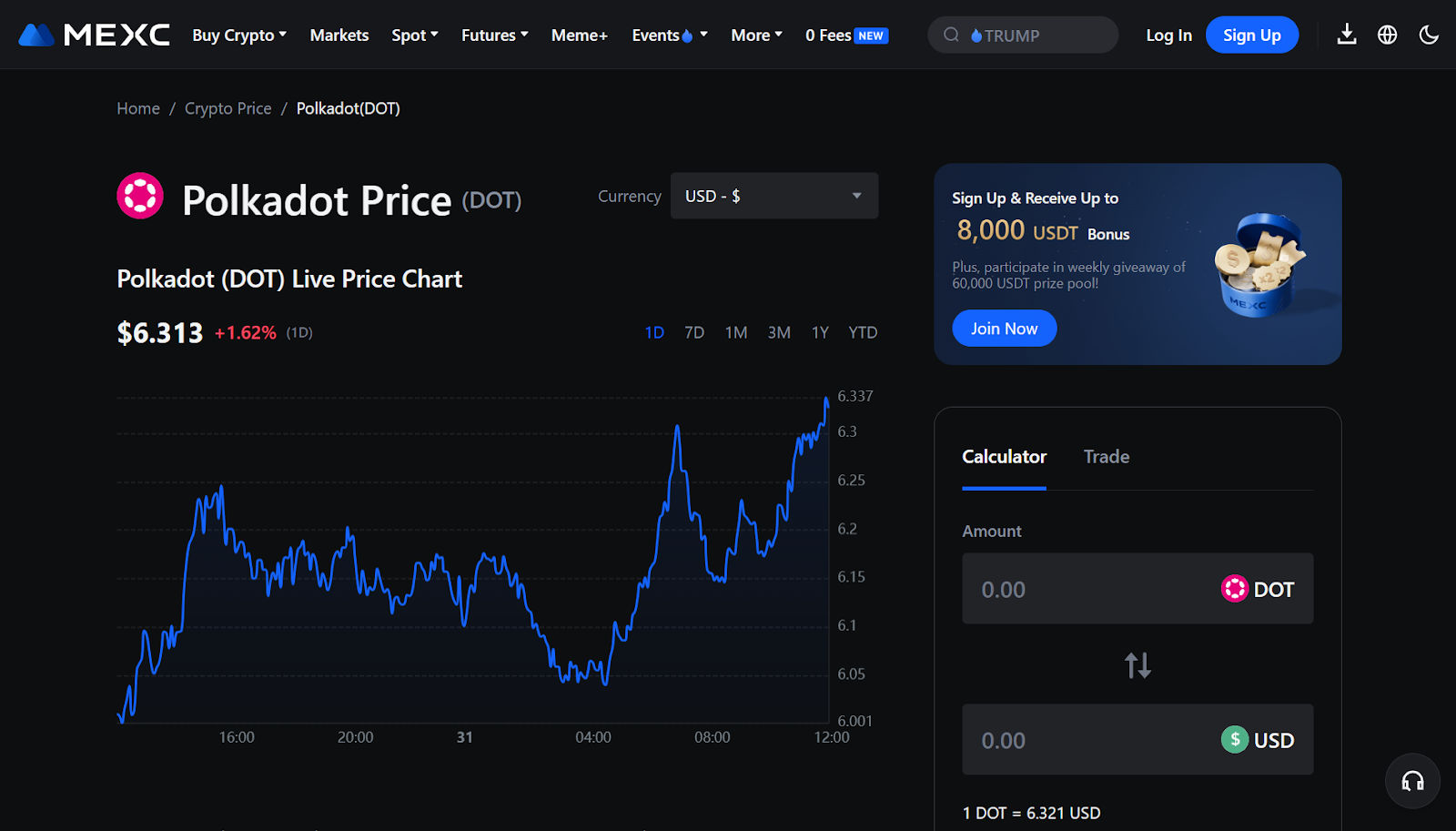

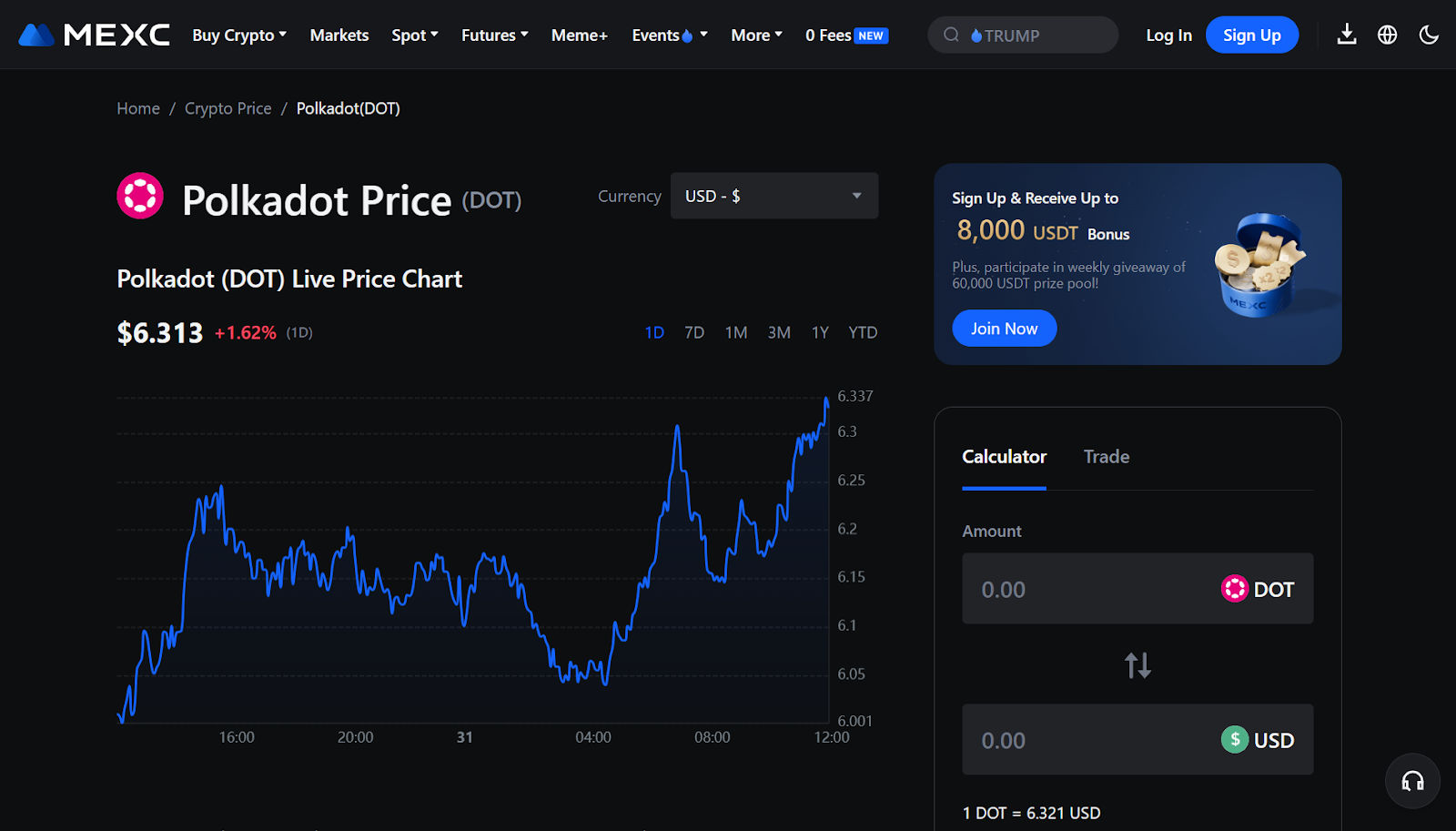

4. MEXC

MEXC is a cryptocurrency exchange that allows you to receive up to 8,000 USDT in bonuses once you’ve signed up for an account. You can also trade a number of different crypto tokens with zero fees, which is rare to find.

MEXC is known for listing new tokens early, although the platform is still home to all of the world’s largest tokens by market capitalization. The platform has impressive levels of liquidity, meaning that it’s possible to open and close positions quickly.

With MEXC, users can open spot positions and futures positions, and MEXC also offers a unique “Meme+” feature which provides users with the opportunity to become early investors in new meme coins.

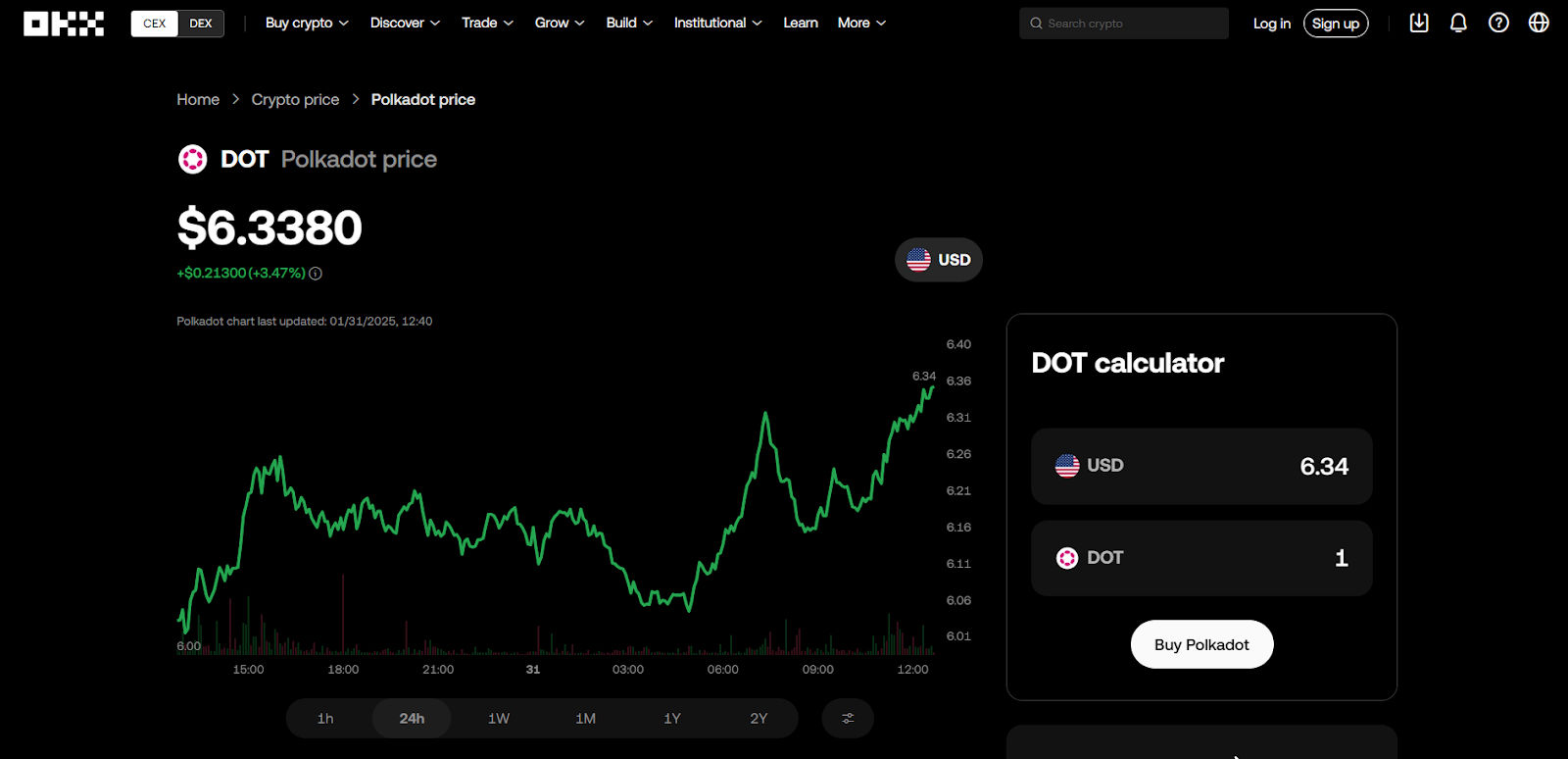

5. OKX

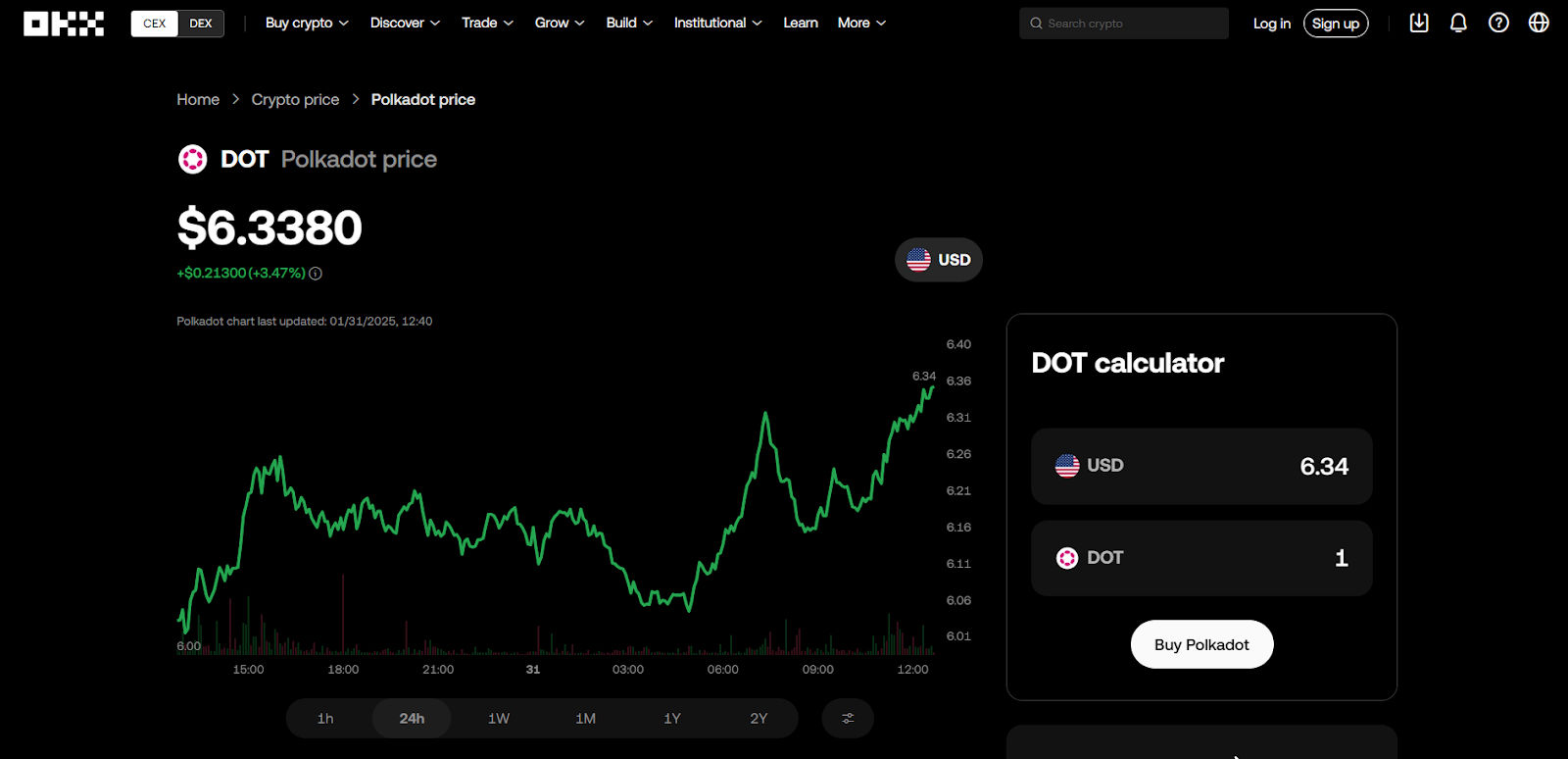

OKX is a well-known centralized cryptocurrency exchange that encourages users to “trade like a pro”. With low fees, fast transactions and powerful APIs, OKX is an excellent option for anybody interested in buying Polkadot (DOT).

You can buy cryptocurrencies for as little as $5 with OKX, and the exchange has created a seamless user journey for new investors. With OKX, users can convert one cryptocurrency into another, open spot positions in DOT, trade futures contracts, and more. OKX also operates a decentralized exchange that allows users to trade tokens on a peer-to-peer basis.

Finally, OKX’s “Earn” feature provides one of the best opportunities for yield farming at any centralized exchange. This includes a 1% APR for DOT when using OKX’s “Simple Earn” function or up to 10% APR with the OKX “On-chain Earn” feature.

How to Buy Polkadot on Coinbase

If you’ve decided to use Coinbase to start investing, you should know exactly how to buy Polkadot crypto tokens. Thankfully, Coinbase has created a smooth, user-focused experience that makes it suitable for new investors.

Step 1: Create an account

Before you can buy DOT, you’ll need to create an account. Because Coinbase is a centralized exchange, you’ll need to verify your identity when doing so – it’s a legal requirement and helps to ensure that only “real” people are registering for accounts.

To get started, click “Sign Up” and state whether you’re creating an account for an “Individual” or a “Business”. Register using your email address, Google account or Apple account. Enter the six-digit code sent to your email and then create a strong, memorable password.

After inputting some more personal information (including your name and mobile number), you’ll need to verify your phone number by adding in an SMS verification code. Confirm that you’ve read the T&Cs and that you’re legally old enough to create an account, then click “Continue”.

If you’re in the US, select your citizenship and validate your Social Security number. Use a piece of government-issued photo ID to verify your identity and then complete Coinbase’s simple questionnaire – this is designed to make sure that you understand the risks associated with investing in cryptocurrencies.

Step 2: Connect a payment method to your account

For ease, it’s often best to connect a payment method to your account and deposit funds in the form of a fiat currency. It is possible to buy DOT directly, but adding funds to your account can allow you to split your capital between multiple tokens, which can help to minimize risk.

To make your deposit, click “Deposit Cash” and select a payment method. The list of available options will vary depending on where you live, but you can typically make a bank transfer or use your debit card to make a deposit.

Choose how much you’d like to deposit and fill in the necessary details associated with your payment method. Coinbase usually charges fees for deposits, so make sure you’re aware of these before completing the transaction. You’ll be redirected to your payment provider to confirm the payment, and once this is done, you’ll be able to access your funds via whichever local currency wallet you deposited them into.

Step 3: Search for DOT

Use Coinbase’s search function to look for the “Polkadot (DOT)” market page. Alternatively, because DOT is one of the world’s largest cryptocurrencies by market capitalization, you’ll be able to find it on the “Explore” page.

Step 4: Buy Polkadot

Click “Buy” to start the process of buying DOT. Choose between a “One-time order” – which involves purchasing DOT once at the current market price – and a “Recurring buy order” – an instruction to purchase DOT consistently at set time intervals.

You can choose to input a fiat amount, depending on what you want to spend, or an amount of DOT tokens that you want to buy. Choose your payment method, which will either involve selecting the fiat wallet that you deposited into earlier or choosing another payment method such as PayPal or bank transfer.

Confirm that you’re happy with all the details of the transaction and click “Confirm”. You may need to wait a short period of time, but your DOT tokens will soon appear in your Coinbase account. You can choose to leave them in Coinbase’s custodial wallet or transfer them to a secure non-custodial wallet.

How to Buy Polkadot with a Credit Card

If you don’t know how to buy Polkadot coin with a credit card, you might be surprised at how easy the process is. First, you’ll need to find an exchange that accepts credit card payments. Then, you have two options:

- Deposit funds – Deposit fiat currencies using your credit card and the exchange’s “Deposit” function. To do this, click “Deposit” or “Add Funds” (or something similar) and choose “Credit Card” from the list of available options. Choose how much you’d like to add to your account, input your card details and approve the transaction with your payment provider. Once the funds are added to your account, you can visit the “Polkadot (DOT)” market page and buy DOT tokens with your deposited fiat.

- Buy DOT directly – Visit the “Polkadot (DOT)” market page and click “Buy” or “Trade”, depending on the exchange in question. Select “Credit Card” from the list of available payment options, choose how many DOT tokens you want to purchase and add your card details. Again, you’ll need to approve the transaction with your card provider, but once you’ve done so your Polkadot tokens will be added to your account.

How to Buy Polkadot Anonymously

The blockchain is one of the most transparent financial technologies ever created, but it is still possible to buy Polkadot anonymously if you want to. Unfortunately, it’s not feasible using centralized exchanges, which are legally required to verify your identity.

However, decentralized exchanges do not require you to create an account, and instead enable you to trade one cryptocurrency for another on a peer-to-peer basis. These trades happen automatically using a system of smart contracts, which means you don’t need to know or trust the person you’re swapping with.

So, if you want to know how to buy Polkadot (DOT) anonymously:

- Find a DEX – Find a decentralized exchange that accepts DOT

- Fund your wallet – Fund a non-custodial crypto wallet with the crypto you want to swap for DOT

- Connect a wallet – Connect your wallet to the exchange in question

- Select your crypto – Choose which cryptocurrencies you want to swap

- Add the amount – Decide how many tokens you want to trade

- Confirm – Confirm the transaction once you’re happy with the details and potential fees

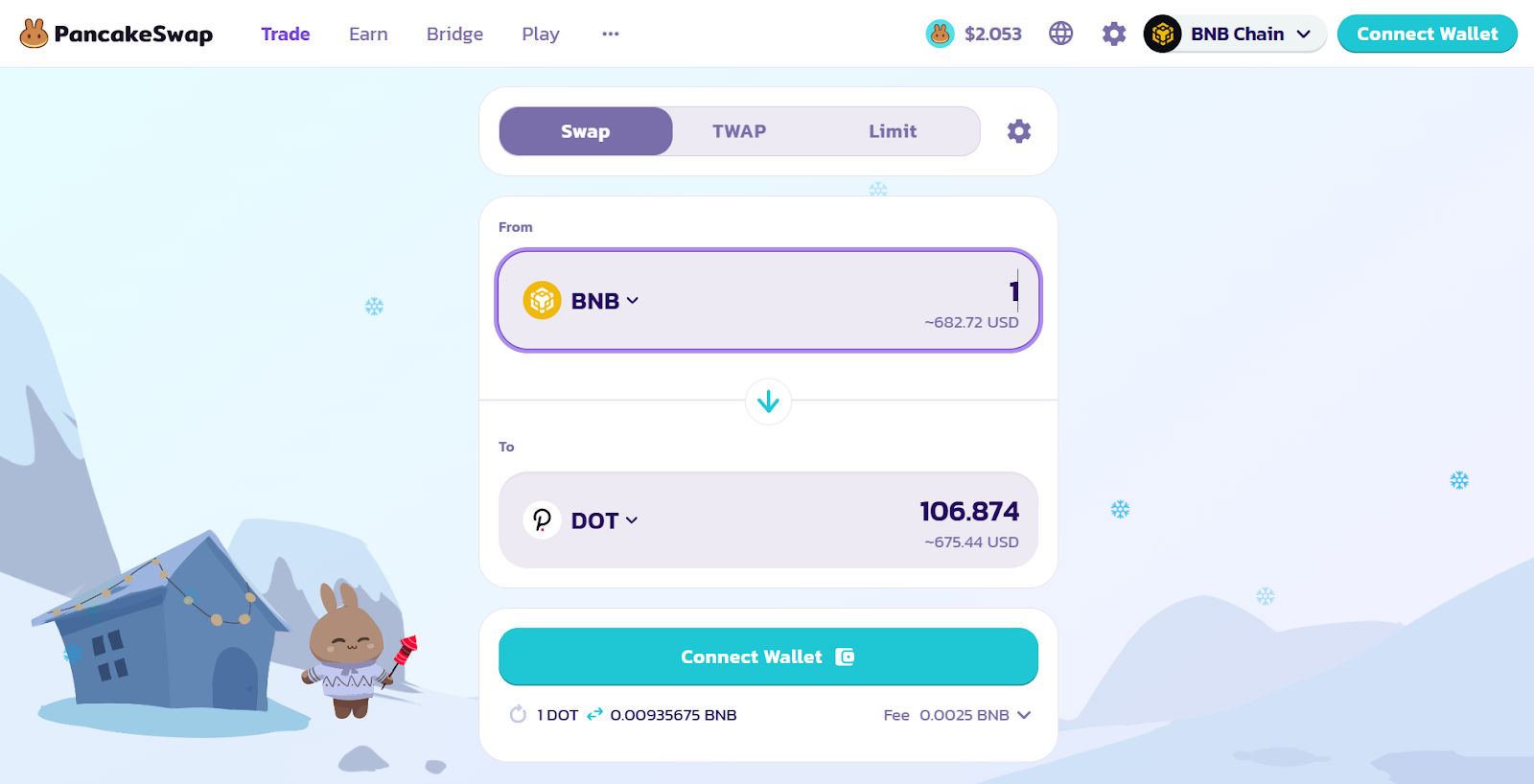

PancakeSwap

PancakeSwap is one of the world’s largest decentralized exchanges. Originally created for the BNB Smart Chain (BSC), PancakeSwap has since become a multi-chain DEX that allows users to trade tokens across BSC, Ethereum, Base, and more.

It’s only possible to purchase DOT via BSC, but this does mean that you can buy Polkadot tokens anonymously using any BSC-compatible token accepted on PancakeSwap – this includes BNB, AAVE and USDT.

How to Buy Polkadot with PayPal

PayPal is one of the largest payment providers in the world, so it makes sense that you might want to learn how to buy Polkadot crypto tokens with PayPal. Although PayPal does allow you to buy crypto directly through their website, they don’t currently offer Polkadot.

However, you can still purchase DOT with PayPal if you can find an exchange that offers it as a payment method. For example, Coinbase allows you to make deposits and purchases with PayPal, so this could be worth considering.

To buy DOT with PayPal, you can either deposit funds by selecting “PayPal” as your preferred payment method or you can buy DOT directly with PayPal by clicking “Buy” or “Trade” on the “Polkadot” page.

You’ll be directed to the PayPal website to confirm the transaction, and you can either use funds stored in your PayPal account or link to your bank account through PayPal. Either way, once you’ve approved the transaction, you’ll be able to complete the purchase and access your new DOT tokens.

How to Sell Dot

As with any crypto investment, there will likely come a time that you want to sell your DOT tokens. But how do you do it? Selling DOT tokens essentially involves completing the buying process but in reverse.

First, you’ll want to make sure that your DOT tokens are being held on an exchange. If you’re currently storing them in a non-custodial wallet, send them to your chosen CEX by using the wallet address provided.

Once your DOT tokens are on the exchange, access them via the “Portfolio” or “Assets” button. Click “Sell” or “Trade” and input the number of tokens that you want to sell. Alternatively, you can click “Max” or “All” if you’d prefer to sell every token you own.

Normally, with centralized exchanges, you’ll need to convert your cryptocurrencies back into fiat before you can withdraw them. So, select a local currency that you want to swap your DOT for and check that you’re happy with all of the transaction details. Keep an eye out for any fees that your chosen exchange might charge when you sell tokens.

Once you’ve swapped your DOT into a local currency, visit the platform’s “Withdrawal” page and pick a payment method that you’re interested in using. Decide how much you want to withdraw and then follow the necessary steps to complete the process.

How to Know Which Purchasing Method is Right for You?

So, you’ve learnt how to buy DOT, but how do you know which method is the best one for you?

What is your experience?

How experienced are you as an investor? Some platforms are more user-friendly than others, so if you’re new to investing then you’ll want to pick one that is suitable for beginners. Centralized exchanges are probably best, although not every CEX is perfectly intuitive. Alternatively, a decentralized exchange could be a good option, but it requires you to create a wallet and have a slightly better understanding of the crypto space.

Regardless of what you choose, make sure you’re comfortable with the process before you start committing capital to any trades.

What are your goals?

What are you hoping to achieve by buying DOT? Are you trying to invest for the long-term or are you aiming to actively trade your DOT tokens by opening and closing positions quickly? Centralized exchanges are not necessarily suitable for experienced, short-term traders – the fees alone can make it an impractical solution. Find an exchange or platform that suits your investment needs. This involves looking at the fee structure and the available liquidity, amongst other things.

Would you like to buy DOT with fiat or crypto?

Buying DOT with fiat is best done at centralized exchanges, while trading one cryptocurrency for another is probably easier done using a decentralized exchange. That being said, there are some DEXs that allow you to connect a fiat payment method, and vice versa.

Is Polkadot a Good Crypto to Buy?

Polkadot is a cryptocurrency project with really strong fundamentals. It was designed to address scalability and interoperability issues, which could help it to achieve long-term adoption. The Polkadot ecosystem is constantly growing, with the development team aiming to create a connected blockchain future.

It’s also possible to stake Polkadot (DOT) on a number of different platforms, including Binance and Kraken. This means that buying Polkadot can allow users to earn passive income by locking their tokens into yield farming mechanisms.

Final Thoughts

Polkadot is one of the most promising Web3 projects on offer in 2025. It’s available at all of the world’s largest centralized exchanges and could experience long-term, widespread adoption by connecting the world’s largest blockchain networks together.

Now you know how to buy Polkadot, make sure you’re doing so sensibly: conduct thorough research, diversify your portfolio and never invest more than you can afford to lose.

FAQs

How to buy Polkadot (DOT)?

To buy Polkadot (DOT), you’ll need to find a reputable exchange such as Coinbase or Binance. Then, deposit funds to your account and use these by visiting the “Polkadot (DOT)” market page, clicking “Buy” or “Trade”, and deciding how many DOT tokens you want to purchase.

How to buy Polkadot coin in US?

If you’re based in the US, you can buy Polkadot (DOT) using any of the largest centralized exchanges. For example, US users can buy DOT on Binance, Coinbase and Kraken. However, investors living in the US may not be able to use OKX or MEXC to buy DOT.

Is Polkadot worth buying now?

Polkadot could be worth buying in 2025. Not only does the project have good long-term potential, if the crypto market remains bullish and we see positive price movements from Bitcoin (BTC) and Ethereum (ETH) there is a good chance that DOT and other altcoins also see an increase in price.

Can I buy Polkadot on Coinbase?

Yes, you can buy Polkadot (DOT) on Coinbase. To do so, you’ll need to create and verify your account, link your preferred payment method and buy Polkadot. You can set up a recurring buy order or choose to buy DOT once at the current price.