You can excuse Marc Menowitz if he scoffs at any suggestion that we’re living in a digital age.

You can excuse Marc Menowitz if he scoffs at any suggestion that we’re living in a digital age.

And paperless? Please.

The Los Angeles-based real estate broker and investor applied for a mortgage nine months ago because he wanted to buy a new $4.5-million home.

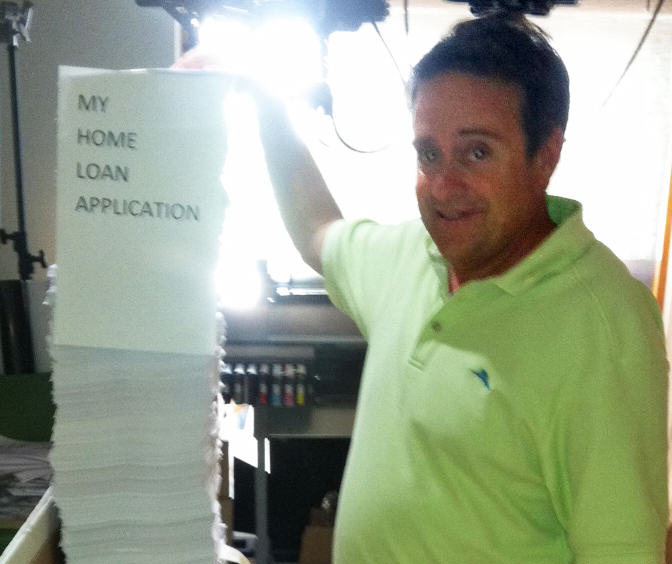

Even though he was prepared to put down 50 per cent of the value, the sheer volume of forms, approvals and double-checks in his application required 26,000 printed pages.

Curious to see what that might look like, he piled them all on top of each other and created a seven-foot stack.

“J.P. Morgan kept on asking me for documents on a onesie-twosie kind of basis. I decided to print off everything and see how much it is. It took me three days to put all the paperwork together,” he says.

“The stack is taller than me.”

Oh, just one more little detail – the entire process from start to finish took nine months.

Because he has 135 different real estate partnerships, the bank had to go through every single one of them as well as two years of tax returns before the loan could be approved.

Some of the banks – he applied at 10 – wouldn’t accept paperwork electronically so he had to rent a van and ship “wheelbarrows” of documents to them.

“One guy from the bank came over to pick up the loan (forms). He ended up renting an SUV to pick up all the paperwork,” he says.

“And sometimes they would get the documents electronically but they’d want to print them off to go through them. That would take them two or three days. They had to key all the (information) into spreadsheets. I offered to do the spreadsheets for them but they said no.”

It’s not as if Menowitz is working out of a cardboard box office in a backlane and sleeping under a bridge. His portfolio includes approximately 15,000 apartments and more than 4,350,000 square feet of commercial space located in 22 states.

If that wasn’t enough, halfway through the process, the bank decided to change the way it processed loans so Menowitz had to start all over again from the beginning.

“It was so complicated I would call up and some of the questions they’d ask, I didn’t know the answers to. A lot of the assumptions they’d make were incorrect based on the things they would read in 26,000 pages of documents,” he says.

“The biggest problem with the banks is, even with all the paperwork, 99 per cent of (employees) didn’t know how to read it.”

If nothing else, this unexpected reliance on hard copies by the banks and other lenders should propel America’s pulp and paper industry to new heights.

So, why does an established businessman have to jump through so many hoops just to do what hundreds of thousands of Americans do every year?

Menowitz chalks up the miles of red tape to the banking industry’s overreaction to the U.S. housing bubble of 2008 that saw billions of dollars in defaulted mortgages, a nearly $1-trillion government bailout, plummeting real estate values and an economy teetering on the brink of disaster.

“None of the lenders want to get stuck with bad mortgages anymore. The market has overcorrected,” he says.

“It’s a pretty painful process.”

While it’s been frustrating sitting and waiting and waiting – and printing off pages – for the amount of time it takes for the human reproductive system to bring a baby into the world, Menowitz is taking it in stride. He also knows he’s far from alone.

“I’ve heard of situations where a guy is making lots of money, works for a company and has a credit score of 825, which is one of the highest you can get, and (the banks) turned him down twice,” he says.

“(The lending process) doesn’t take into account that everybody has a unique circumstance. The banks treat everybody the same but unfortunately for them, everybody is different.”