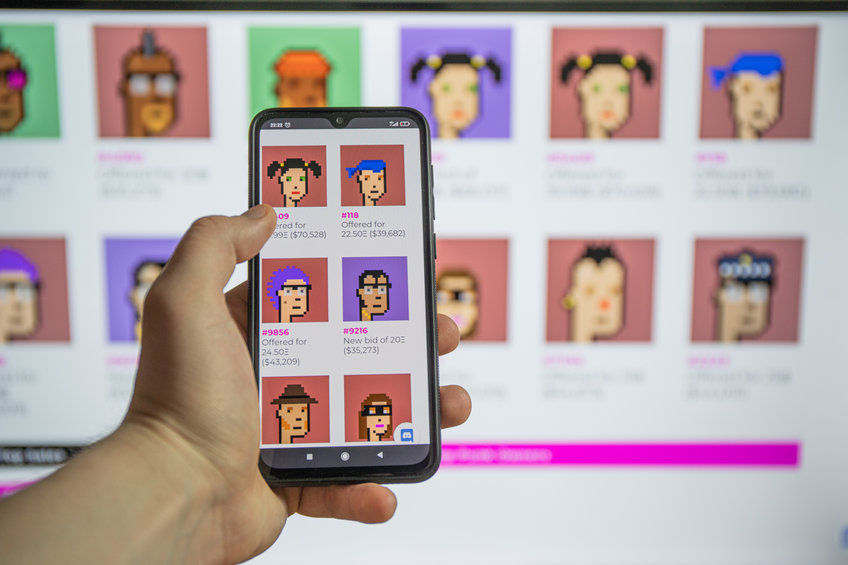

The red-hot NFT sector had a wild development earlier today after CryptoPunk #9998 sold for $532 million, or so it would appear. A report unveiled this news, detailing that someone using an Ethereum transferred the NFT to another Ethereum address. However, data from Larva Labs, the creator of CryptoPunks, shows the money from the NFT trade ended up in the original address.

According to the report, the address that transferred the NFT started 0xef76, while the address that received it started with 0x8e39. Approximately 30 minutes after the trade, the receiving address sold the NFT to another Ethereum address starting with 0x9b5a for 124,457 ETH ($532 million).

This trade attracted a lot of attention, with some members of the NFT community on Twitter suspecting wash trading to hide illicit crypto gains.

The buyer borrowed the funds from DeFi protocols

However, Larva Labs solved this mystery, noting saying,

“PSA: This transaction (and a number of others) are not a bug or an exploit, they are being done with “Flash Loans” (https://ethereumprice.org/guides/article/flash-loans-what-are-they-and-how-do-they-work/). In a nutshell, someone bought this punk from themself with borrowed money and repaid the loan in the same transaction.”

Larva Labs added that this is not an uncommon occurrence, seeing as some recent large bids used this approach. The organization further noted that such transactions involve someone offering ETH and removing it in a single transaction. As such, the trade becomes temporarily valid but cannot be accepted.

Larva Labs added that it would add a filter that will prevent the generation of notifications for such transactions in the future.

Notably, the person behind the trade borrowed the funds from three decentralized finance (DeFi) protocols, with the main contributor being Compound.

Toying around with crypto

Giving a more detailed explanation of what transpired, Robert Miller, a Steward at research organization Flashbots, tweeted that the first contract put up CryptoPunk #9998 for sale.

The second contract then took a massive flash loan and bought the NFT. The first contract then returned the funds to the second contract immediately, which used the tokens to repay the flash loan.

Afterward, the NFT’s avatar was returned to the original address (0xef76), which offered it for over 250,000 ETH (over $1 billion).

According to Miller, the person behind the trade only sought to set tongues wagging in the NFT space. However, such a move in regulated securities markets would be considered wash trading. The law bans this practice because trading with yourself is a tactic that can artificially inflate the price of a specific item.

That said, Beeple’s Everydays: the First 5000 Days remains the most-expensive NFT to date after fetching $69.3 million in a Christie’s auction earlier this year.