- Arweave price soared to the highest point in two months on Wednesday.

- On-chain metrics are showing weak activity in the ecosystem.

Arweave price continued its bullish trend on Wednesday even as the number of transactions in the network jumped. AR token rose to a high of $12.13, the highest level since November 9. The token has jumped by over 105% from the lowest level in 2022.

Transactions are dipping

Arweave is one of the leading blockchain projects that is in the storage subsection. The company pioneered a technology known as the permaweb, which helps to ensure that content is stored permanently in the internet.

Arweave has many uses. For example, non-fungible token (NFT) creators can use its technology to safely store their creations in the internet. Similarly, website developers, podcasters, and other creatives can use the technology to store their products.

However, as I wrote on Filecoin a few weeks ago, there were serious concerns about the need of these decentralized storage solutions. Besides, centralized platforms like those offered by players like Google and Microsoft work just fine.

A closer look at Arweave’s on-chain data shows that the number of transactions jumped sharply in January. They peaked at a high of 2.9 million on Saturday, which was the highest point since May last year. Recently, however, these transactions have crashed to about 1.57 million.

Read more: A comparison of blockchain storage providers.

Additional data shows that the amount of data uploaded in Arweave has been in a downward trend. It peaked at 2 trillion GB in October 2022 and has now crashed to less than 100 GB.

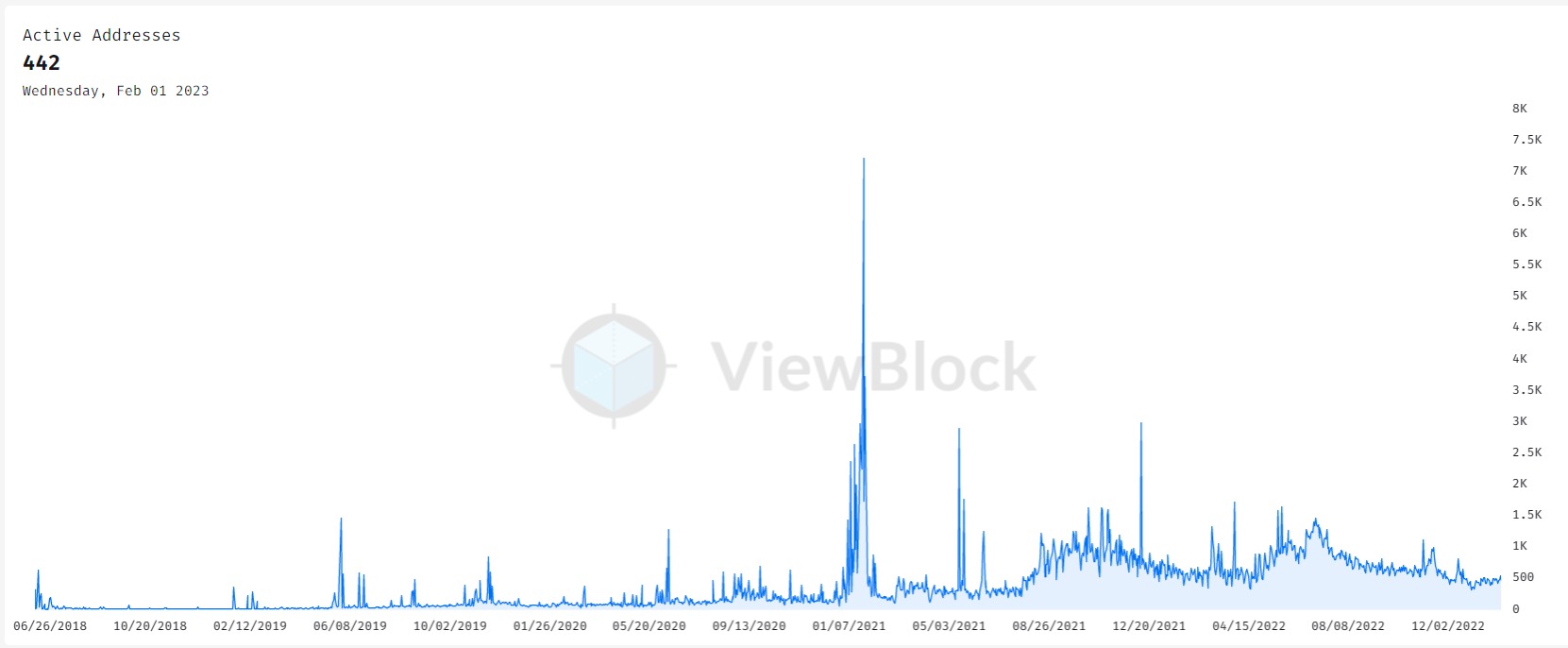

Another important on-chain thing to look is the number of active addresses. According to Arweave’s explorer, the number of active addresses dropped to about 221, which is close to the lowest it has been in more than a year. Other metrics are also not encouraging. For example, the number of address growth has dropped while the number of active contract addresses has fallen to 6.

Therefore, the recent Arweave price rally is mostly because of its correlation with other cryptocurrencies like Bitcoin and Ethereum.

Arweave price prediction

The 4H chart shows that the AR price has been in a strong bullish trend in the past few days. It has formed an ascending channel shown in red. The token also moved above the upper side of the ascending channel shown in red. It has also risen above the 25-day and 50-day moving averages.

At the same time, the Relative Strength Index (RSI) has formed a bearish divergence pattern. Therefore, there is a likelihood that the coin will resume the bearish trend as sellers target the psychological level at $10.