- Gold ETFs like GLD and GDX have done well in 2023 as gold hit its record high.

- BITO ETF is also seeing inflows as Bitcoin rose to over $40,000.

- We explain why BITO is still a better ETF than GLD and GDX.

The SPDR Gold Trust (GLD) and VanEck Gold Miners ETFs (GDX) have had a strong year, helped by the strong gold performance. GLD surged to a high of $192 on Friday, near its all-time high of $194.18. It has jumped by over 27% from the lowest point in 2023.

Similarly, the GDX ETF has risen in the past three straight months and moved to $32. On the other hand, the ProShares Bitcoin Strategy ETF (BITO) has been on a strong rally and was trading at $19.27, its highest level since May 2022. It has surged by 141% from its lowest point in 2023.

These ETFs have done well because of their underlying assets. Bitcoin price surged to over $40,000 for the first time since May 2022, making it one of the best-performing major assets this year. Similarly, gold price rose to an all-time high of $2,146 as investors predicted that the Federal Reserve will cut rates in 2024.

On Friday, Jerome Powell, the head of the Federal Reserve warned that investors were getting a bit complacent on their interest rate cut bets. He argued that inflation remained higher than its 2% target and that officials want more evidence that it is falling. One of these evidences is the sharp decline of goods inflation, which have declined in the past six months.

The key argument between BITO, GLD and GDX is on the best assets between gold and Bitcoin. Some analysts, like Peter Schiff, believe that gold is a better asset since it has a tangible role in the global economy. Besides, it is held by many central banks and investors.

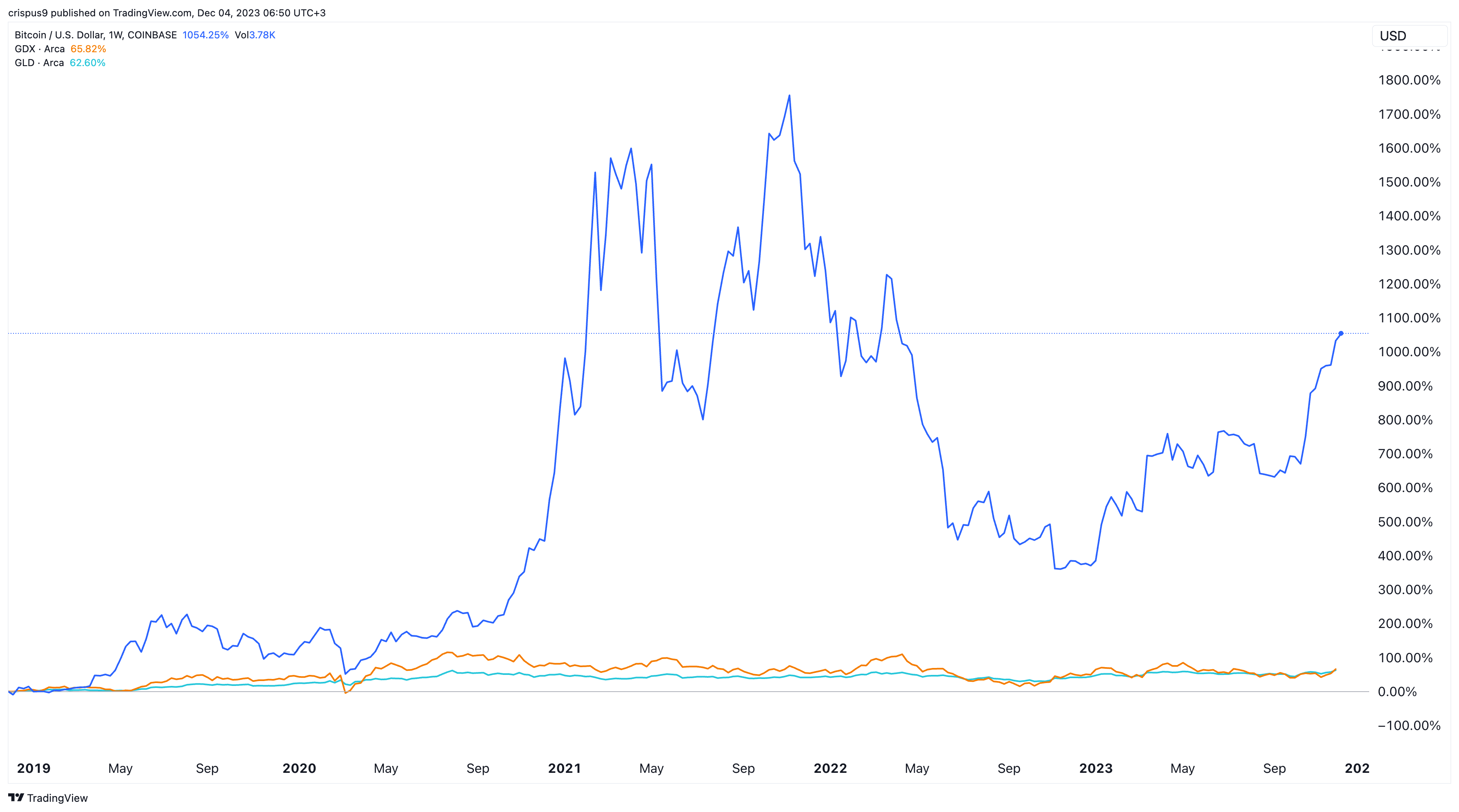

Others, on the other hand, believe that Bitcoin is a better investment, which makes BITO the best of the three. First, as shown above, Bitcoin has a better track record than gold-backed ETFs. it has jumped from less than $1 in 2019 to over $40,000 today.

Second, bitcoin has proven that it is a real asset in the past decade. It has survived several fatal events in the past like the collapse of Mt.Gox, FTX, Terra, Celsius, and Three Arrows Capital.

Most importantly, Bitcoin has also done well in the high-interest rate environment. This means that it can thrive in both a high or low interest rate environment. Rates have jumped from zero in 2022 to 5.5% today.

Finally, Bitcoin has catalysts ahead that could push its price much higher. There’s hope that the Securities and Exchange Commission (SEC) will approve the spot Bitcoin ETF by companies like Blackrock and Invesco.

Further, Bitcoin will go through its halving event, which will slash its block rewards. Also, while gold has soared to its all-time high, Bitcoin has room to retest its record high of $67,000.

Therefore, there is a likelihood that the BITO ETF will outperform GDX and GLD in the coming months as Bitcoin rally gains steam.