Crypto investors are getting greedy, helped by numerous catalysts in the industry. The closely-watched fear and greed index has jumped to over 85, its highest level in months.

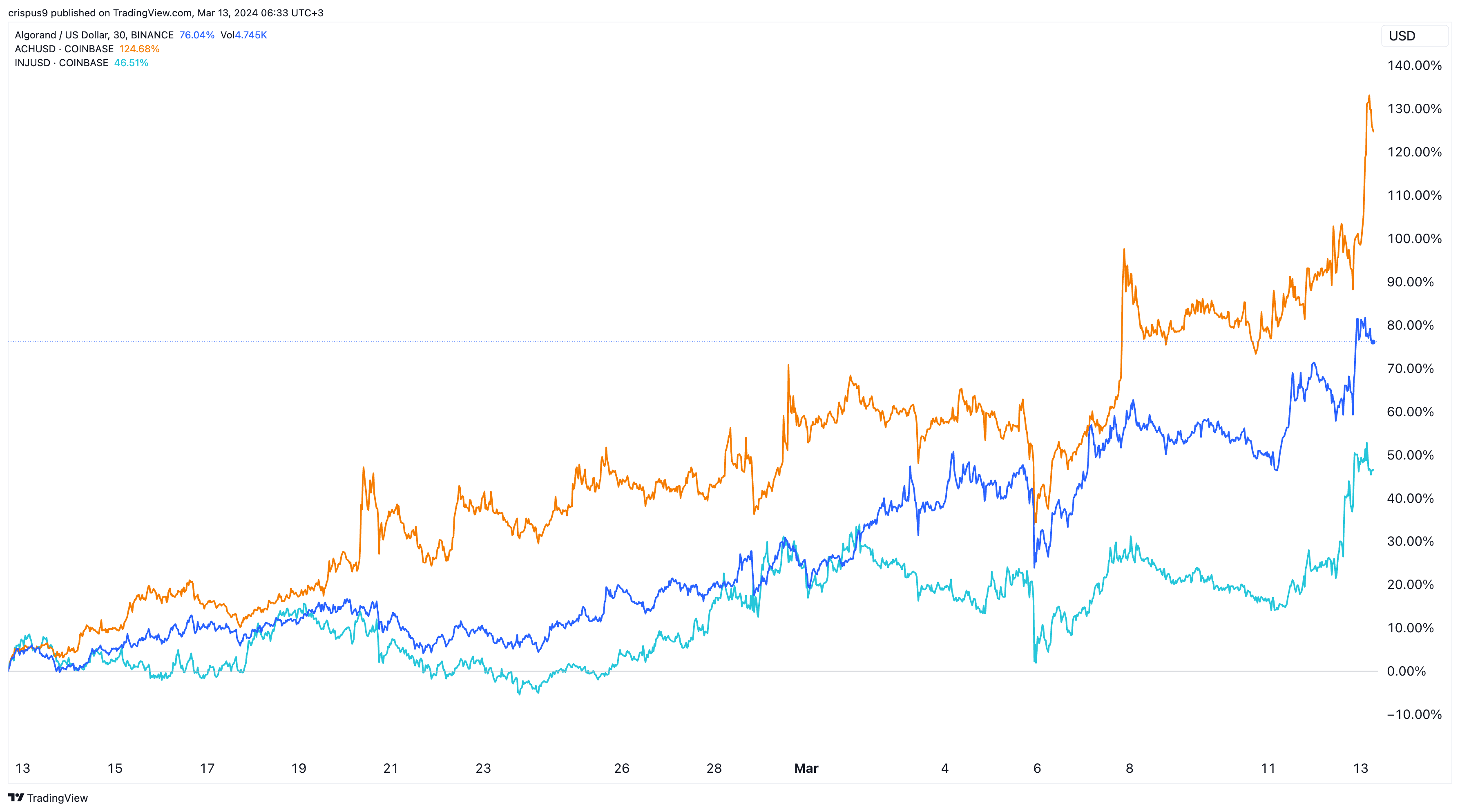

As a result, some of the top tokens like Alchemy Pay (ACH), Injective (INJ), and Algorand (ALGO) were the top-performing cryptocurrencies in the industry.

Alchemy Pay and Injective bull run

Alchemy Pay has risen in the past six consecutive weeks and is sitting at its highest point since April last year. It has soared by more than 450% from its lowest point in 2023.

Alchemy is one of the most important payment platforms in the industry. It is a gateway that makes it possible for companies to accept crypto payments. Using its technology, companies can easily offer crypto cards. It is used by the likes of Binance and OKX.

Injective price has also made a strong bullish breakout, pushing it to a record high of over $50. Its bull run has been more interesting than other cryptocurrencies since it was trading for less than $1 in 2022.

This means that people who invested $100 in the INJ token back then now have over $8,000. One of these people is Mark Cuban, a billionaire and one of the richest people in the US. Injective has done well as demand for the token has jumped.

Data shows that the Total Value Locked (TVL) in the Injective network has soared to over $176 million. This growth has been led by the likes of Hydro Protocol, DojoSwap, and Helix. Helix, the biggest DEX in its platform, has gained substantial market share in the industry.

Algorand price is surging

Algorand price has also done well recently. It has soared in the past six straight weeks and moved to its highest level since February 6th of last year. ALGO has jumped despite some lingering woes in its ecosystem.

Despite being one of the oldest blockchains in the industry, Algorand has not gained a major market share in the DeFi and NFT industries. Its DeFi ecosystem has a TVL of $286 million, which is smaller than newer protocols like Base, Blast, and Sui.

Read more: How to buy Algorand.

The performance of ACH, INJ, and ALGO is mostly because investors are now comfortable investing in cryptocurrencies. Besides, Bitcoin has soared from less than $16,000 to over $70,000 today and analysts believe that it has more room to run.

This trend has attracted more investors, which explains why the fear and greed index has turned green. As a result, most cryptocurrencies have jumped sharply this year.

The sense of greed is also happening in the stock market where the three main US indices have soared to their all-time high. The Dow Jones, Nasdaq 100, and S&P 500 indices have risen by more than 5% this year.

The crypto bull run will likely continue at least until the Bitcoin halving event happens in April. Halving will reduce the number of daily Bitcoin rewards to about 450 at a time when ETF demand is surging.