Bitcoin vs Tesla is an apples-to-orange comparison. On the one hand, Tesla is a major automaker that leads the world in the electric vehicle industry. Bitcoin, on the other hand, is a revolutionary cryptocurrency that is used for payments and investment purposes.

Still, the two are highly popular assets with a cult-like following. They are also huge revenue generators. Tesla’s revenue rose to over $96 billion in 2023 from 81.4 million in the previous year. This happened as the company increased the number of vehicle deliveries to over 1.8 million.

Bitcoin, on the other hand, leads the world of cryptocurrencies with its total market cap being at $1.3 trillion. This makes it more than twice the valuation of Tesla, which stands at $550 billion.

Bitcoin vs Tesla: performance

The first thing to look between the two is their performance over time. In this case, both assets have done well since going public but Bitcoin’s performance has been more spectacular.

Bitcoin jumped from below $1 in 2009 to over $70,000 today. Tesla, on the other hand, moved from below $5 in 2010 to over $175 today.

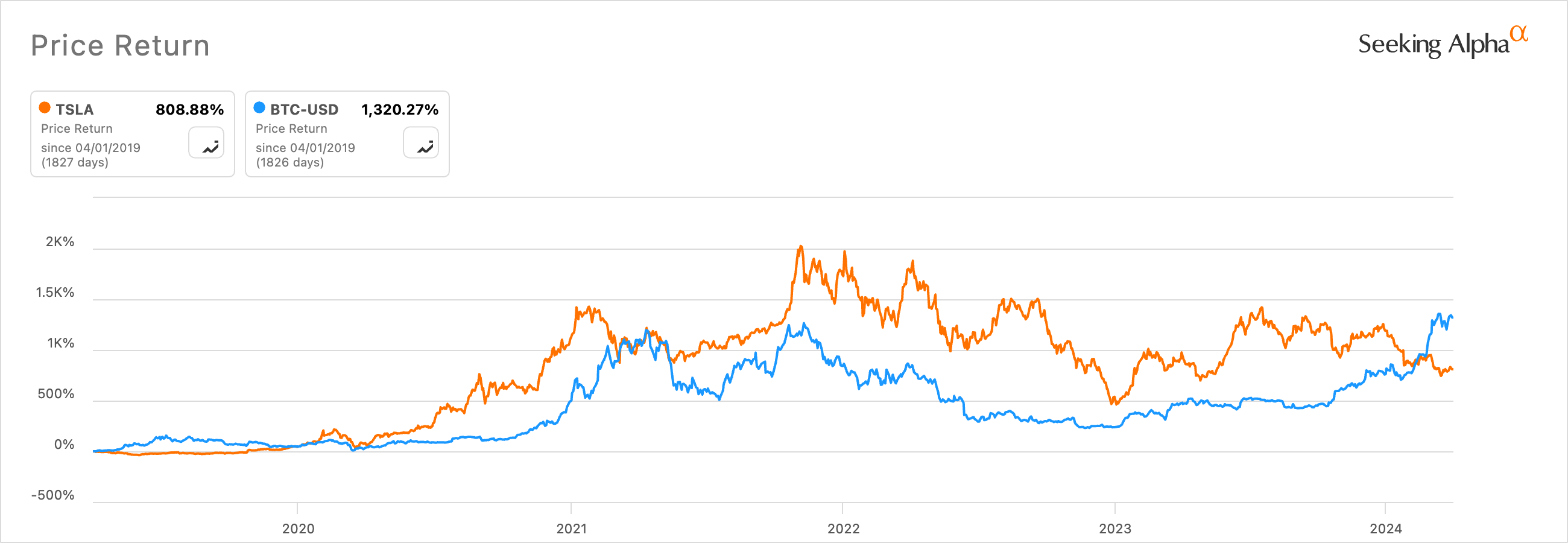

Bitcoin price has soared by 1,320% in the past five years compared to Tesla’s 808%. Similarly, the BTC is up by 17% in the past three years while Tesla is down by 20.57% in the same period. This trend is happening this year as Bitcoin soared by 51.4% compared to Tesla’s crash of 30%.

Therefore, Bitcoin wins in terms of performance by far. This means that people who bought Bitcoin and held it have done much better than Tesla investors.

Bitcoin vs Tesla 5-year performance

BTC vs TSLA fundamentals

Bitcoin and Tesla have strong fundamentals. BTC dominates in the crypto space, where it dominates by 53.91%. This is a strong performance considering that there are more than 2.4 million crypto tokens in the industry.

Tesla still has a strong market share in the EV industry. The company’s challenge is that it is losing its dominant position in the sector. It has already lost its battle in China, where BYD has become the biggest EV seller in the country.

The challenge is that the number of EV companies are still growing. Xiaomi, the giant smartphone company, has entered the industry with its SU7 launch. Other leading players in the sector are firms like Li Auto, XPeng, Lucid, and Rivian.

Therefore, there is a risk that China will flood the EV market as it did with the solar energy and steel. Today, China dominates these industries and it has become difficult for Western companies to compete.

The implication for Tesla is that it will continue cutting prices as this competition rises. That will lead to lower growth and profit margins.

Bitcoin, on the other hand, has better fundamentals. For one, its software has a halving feature that reduces the number of coins that are produced every four years. The next halving wll happen this month.

At the same time, Bitcoin supply in exchanges has dived sharply while mining difficulty is continuing its uptrend. Also, demand is rising from institutional investors. The iShares Bitcoin Trust has over $17 billion in assets while all ETFs have over $60 billion.

Therefore, with Bitcoin, we have an asset that is in demand and one whose supply growth is being constrained. This means that it has more room to grow.

Bitcoin has also erased one of its most important risks in terms of regulations. By accepting spot Bitcoin ETFs, the Securities and Exchange Commission (SEC) validated Bitcoin as a digital commodity.