Gold and Bitcoin prices jumped sharply on Wednesday after major economies published a slew of high inflation data. Bitcoin price jumped to more than $69,000 while gold approached the key resistance at $1,900. Today, the two are trading at $64,975 and $1,865, respectively.

Inflation hedge?

The global economy is facing significant inflationary pressures. On Wednesday, data by China showed that the country’s headline consumer price index (CPI) doubled to 1.5% in October. This was higher than the previous month’s 0.7%.

Additional data revealed that China’s producer price index (PPI) rose to 13.5% in October. This means that the world economy will see higher inflation since China is the biggest manufacturer. As such, it will have to pass these prices to customers.

Meanwhile, the same trend continued in Germany. Data by Destatis showed that inflation jumped by 4.5% in October. This was significantly higher than the previous month’s 4.1%. As such, there is a high likelihood that the European economy will see inflation that is higher than 4%.

In the United States, data by the Bureau of Labor Statistics (BLS) showed that the headline consumer price index rose to 6.2% in October. This was the highest number in more than 30 years.

And on Thursday, data by Japan’s statistics bureau showed that the country’s producer price index (PPI) rose to a multi-year high of 8.0%. Therefore, there is no doubt that the world is seeing an unprecedented level of inflation.

In theory, rising inflation should be negative for Bitcoin prices. That’s because higher inflation usually leads to higher interest rates and tight monetary policy.

On the other hand, higher inflation leads to more demand for inflation hedges. The price action this week shows that more investors believe that Bitcoin and gold are hedges of inflation.

Bitcoin vs gold

So, which is a better hedge against inflation between gold and Bitcoin? In my view, I believe that Bitcoin is a better hedge for several reasons.

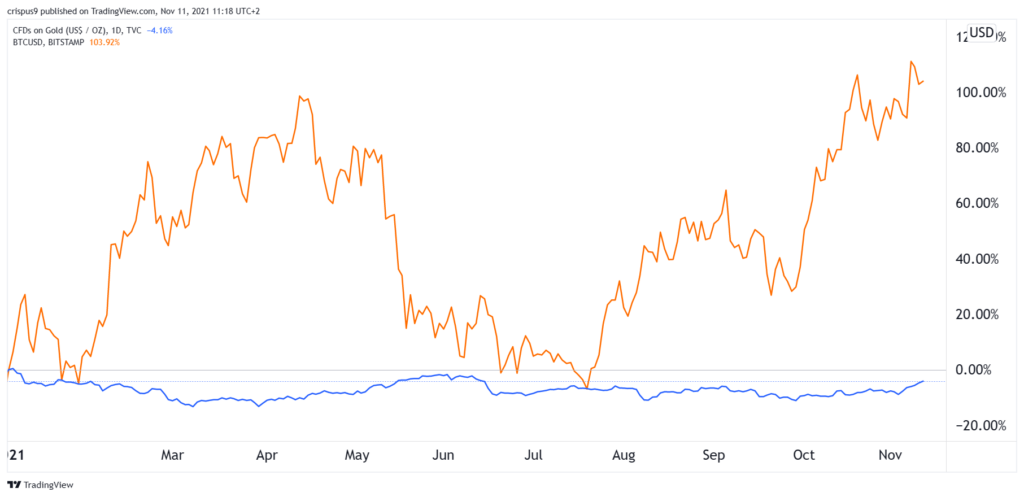

First, while past performance is not an indication of future price of action, it can tell give you signs about what will happen. Indeed, in the past decade, Bitcoin has been a better performer than gold. This year alone, Bitcoin has jumped by more than 120% while gold has fallen by more than 4%. Therefore, based on past experience, BTC is a better inflation hedge.

Of course, the future price of gold might change, which is why many versed investors are in favor of diversifying your investments. By monitoring price fluctuations, you can pick a good moment to invest in both gold and cryptocurrency. That can allow you to allocate your available funds in the most prudent way and ensure a strong hedge for the future

Second, Bitcoin has a longer runway for growth. For one, most investors who buy gold as in inflation hedge have already done so. Therefore, there is a likelihood that demand for Bitcoin will be higher as more institutions allocate capital to the ecosystem.

Third, Bitcoin seems to be having momentum right now. Historically, momentum plays tend to outperform value plays.Still, while Bitcoin is a better inflation hedge than gold, there are other better assets to invest in. Because of cryptocurrency correlations, it is often better to invest in altcoins like Ethereum and Solana.