Since launching 12 years ago, Bankless Times has brought unbiased news and leading comparison in the crypto & financial markets. Our articles and guides are based on high quality, fact checked research with our readers best interests at heart, and we seek to apply our vigorous journalistic standards to all of our efforts.

BanklessTimes.com is dedicated to helping customers learn more about trading, investing and the future of finance. We accept commission from some of the providers on our site, and this may affect where they are positioned on our lists. This affiliate advertising model allows us to continue providing content to our readers for free. Our reviews are not influenced by this and are impartial. You can find out more about our business model here.

Pepperstone Review 2025

Pepperstone is a popular CFD trading platform that is a reputable option for trading crypto in 2024. In our Pepperstone review, we reveal the ins and outs of the brokerage, how to use it and our take on whether it is a good option to consider for your trading.

- An Introduction to Pepperstone

- Pepperstone Trading Platform Overview

- Pros and Cons of Using Pepperstone

- Pepperstone Key Features Reviewed

- Pepperstone Cryptocurrencies and Trading Options

- Fees, Limits, and Payment Options on Pepperstone

- Can I Use Pepperstone in Any Country?

- Security and Regulation

- Extra Information

- How to Open an Account With Pepperstone

- Final Thoughts

- FAQs

Pepperstone is not available to US residents.

An Introduction to Pepperstone

Pepperstone is based in Melbourne, Australia and was founded in 2010 by Owen Kerr and Joe Davenport. Notably, both founders received the 2014 EY Australia Entrepreneurs of the Year Awards.

Pepperstone is primarily a CFD broker that is suitable for active trading strategies such as spread betting, day trading and margin trading. Like most Bitcoin CFD brokers, Pepperstone provides users with a selection of charting tools, indicators, and market insight that can be used to meticulously analyse the markets and make informed decisions.

Pepperstone stands out from other cryptocurrency brokers that we have reviewed because it has won multiple awards including Best MetaTrader 4 Broker, Best Retail CFD Broker, and Best Platform Features.

However, it is important to note that the cryptocurrency products available at Pepperstone are limited compared to many of the best crypto exchanges. This is because Pepperstone is a multi-asset broker, which means that it provides access to a range of different markets – not just crypto.

Overall, we think that Pepperstone is a good option if you want to trade cryptocurrency CFDs and are happy with a limited number of coins to choose from. The platform is known for tight spreads and fast execution speeds.

However, if you are a long-term investor who wants to grow your wealth by building a diverse portfolio of different cryptocurrencies, Pepperstone may not be the most suitable platform to use. Alternative exchanges to consider include Coinbase and eToro.

Pepperstone Trading Platform Overview

| 💼 Provider Type: | Broker |

| 💸 Minimum Deposit: | $0 |

| 💰 Trading Fees: | Varied |

| 💰 Deposit Fees: | None |

| 💰 Withdrawal Fees: | Varied |

| 💰 Management Fees: | None |

| 🔀 Minimum trade order | 0.01 lots |

| ⌛ Withdrawal Timeframe: | 1-5 business days |

| #️⃣ Number of Cryptocurrencies Supported: | 20 |

| #️⃣ Number of Crypto Pairs Supported: | 0 |

| 💱 Top supported Cryptocurrencies: | BTC, LINK, XRP, DOGE, ETH |

| 📊 Leverage: | 2:1 |

| 📱 Native Mobile App: | Yes |

| 🖥️ Free Demo Account: | Yes |

| 🎧 Customer Support: | Customer support chat |

| ✅ Verification required: | KYC |

| 📈 CFD Available | Yes |

| 📊 Software: | MT4, MT5, CTrader, Mobile app |

| ⚽ Social Trading: | Yes |

| ✂️ Copy Trading: | Yes |

| 👮♂️ Regulators | The FCA in the UK, ASIC in Australia, CySEC in Cyprus, DFSA in Dubai, CMA in Kenya, BaFin in Germany, SCB in Bahamas |

Pros and Cons of Using Pepperstone

- A huge library of tutorials, webinars, and guides for beginners set on trading forex and CFDs

- Three platform types for different kinds of traders, including MT4, MT5 and cTrader, where all their instruments are available

- Social trading functionality that allows users to copy trade similar to eToro or NAGA

- A large suite of technical tools for advanced traders. These are not proprietary but primarily white-label integrations of the best tools available in online trading

- You can trade cryptocurrency CFDs with leverage

- The number of cryptocurrencies available is limited compared to other platforms

- CFD cryptocurrency trading is not available in the US

- As a CFD trading platform, some features that are offered by Pepperstone may be too complex for beginner cryptocurrency traders to understand

Pepperstone Key Features Reviewed

Now that you understand what the Pepperstone trading platform is, let’s dive into our Pepperstone review and look at the key features that the platform has to offer.

CFD trading platform

The main product offered by Pepperstone is the CFD trading platform which provides you with a selection of tools and resources to implement complex trading strategies.

You can use all of Pepperstone’s apps on any device, desktop, mobile, or tablet. They do not have their own apps, but rather white-label other applications for trading functionality. The options are:

MT4 – simplest functionality without many of the tools in MT5 and cTrader

MT5 – similar to MT4 but with more complex tools and indicators

cTrader – all of the tools of MT5 with a more modern-looking layout

Their platform integrates seamlessly, and anybody familiar with these apps will find switching to Pepperstone easy.

You have to manage your profile, payment methods, and platforms in the secure client area of their website. The bonus features like their library of educational tools and the social trading platform are only available on the desktop version of the platform.

Social trader function

There is a simple social platform built into the website. You can find traders and mirror their trading strategies. But this function isn’t as developed as on eToro or Naga, and the social platform doesn’t allow traders to market themselves effectively with posts or interaction.

Although Pepperstone offers social trading, it is not the main product that is offered by the brokerage.

Tutorial library

We were impressed by the selection of educational materials that are available at Pepperstone. The library of video webinars, guides, and tutorials helps less advanced traders get started and understand the ins and outs of CFD and forex trading.

As well as a library of tutorials, Pepperstone offers expert insight, helpful articles, an economic calendar and a huge selection of tools for in-depth analysis.

The platform seems to prioritize informed trading and ensures that all users are able to implement effective research strategies.

With that being said, the guides and analysis tools are certainly most suitable for knowledgeable crypto traders who understand market terminology.

Customer support

The most impressive feature of the Pepperstone website is the chat support. After answering a few questions, the chatbot reliably puts you in contact with a support agent within seconds, which was very helpful in writing this article.

You can also contact the customer support team via email and phone call. However, the response times when using these methods may be a bit longer.

Trading APIs

For pro traders, the Peperstone API allows you to use the trading platform’s liquidity alongside your own customized trading tool.

The API integration is free to use and you can access it by emailing the Pepperstone support team.

Automated trading

Pepperstone users can access automated trading with the cTrader API. This function lets you build your own custom Bitcoin robots using C# language and implement these bots into your trading strategy.

Pepperstone also offers an Autochartist feature which allows you to filter out market noise and focus on events that are relevant to your individual trading strategy.

Pepperstone Cryptocurrencies and Trading Options

You cannot buy cryptocurrency directly on Pepperstone. Instead, you can buy cryptocurrency CFDs which involve buying into a contract that tracks the price of the underlying crypto. The reason that Pepperstone does not offer direct cryptocurrency purchases is that the platform is a broker and not an exchange.

You can buy CFDs based on 20 cryptocurrencies offered on the platform such as:

Different trading options offered by Pepperstone

Pepperstone is primarily a CFD trading platform that also offers spread betting to users in some jurisdictions.

When you purchase a CFD, you don’t own the underlying asset or have the option to buy it at a future date; instead, you just have a contract with the broker for the difference in price from when you purchased it.

If you take a buy position, it means you believe the price will go up. If you take a sell position, you expect the price to go down. You either get the difference in the price minus the fees if the price moves in your favour, or you have to pay the difference in price plus the fees if the price moves against your favour.

Besides cryptocurrency CFDs, on Pepperstone, you can also trade:

More than 90 forex pairs

3 currency index CFDs

More than 800 stock share CFDs

More than 20 index CFDs

More than 12 commodity CFDs

Forex pairs are similar to CFDs in that you don’t take ownership of the currencies, just bet on the change in the price of one currency versus the other.

Can I trade with leverage on Pepperstone?

One of the main advantages (or disadvantages, depending on your skill level) of CFDs to traders is the ability to take leverage against them.

Different regulators set different limits on margins. For example, in the EU, you have to hold a 3% margin, meaning you can only take 30:1 leverage. Retail investors in countries without broker regulation (like in much of Africa) may be able to take up to 400:1 leverage on some instruments, according to the Pepperstone site.

However, SCB-licensed investors can take up to 200:1 retail and 500:1 Pro leverage, meaning they only have to hold a 0.2% margin.

Leverage also depends on the instrument. Generally, instruments based on less volatile assets allow you to take more leverage.

According to Pepperstone support, for European customers, they offer:

30:1 for major currency pairs

20:1 for minor currency pairs, gold and major indices

10:1 for commodities other than gold and minor indices

5:1 for individual equities

2:1 for cryptocurrencies

Leverage increases the risk of the trades that you place. For example, if you take 5:1 leverage, your gains or losses will be multiplied by five. Also, consider that CFDs carry more risk than the assets they represent, and more than 70% of investors lose money after fees.

Pepperstone spreads

On CFD broker platforms, spreads are the difference between the market price of an asset and the buy or sell price of its corresponding CFD. These are measured in pips.

The average spread on Pepperstone is 0.69 pips, but some CFDs offer 0 spreads. While many reviews say Pepperstone consistently ranks among top brokers for tight spreads, we found them to be roughly average. Razor account users can access tighter spreads.

Spreads vary from instrument to instrument, especially among cryptocurrencies. For example, Bitcoin has a spread of 30 pips and Ripple has a spread of 0.0081 pips. Conversely, forex typically has tighter spreads, less than one pip, because of the small day-to-day changes in prices.

Because of the high volatility of crypto, crypto CFD spreads are more variable than other kinds of instruments. There is very little info on the Pepperstone website about crypto CFD spreads for this reason.

When evaluating these spreads, you should also consider other fees on the platform — like commissions (more on this later).

Fees, Limits, and Payment Options on Pepperstone

Spreads are not the only fee that you may come across when using Pepperstone, here as an overview of other platform fees and well as Pepperstone payment options.

What Are the Deposit and Withdrawal Fees, Limits, and Speeds?

It is hard to say how many payment methods Pepperstone offers because there is no information on their site about payment methods until you create an account, and then you can view which payment methods are supported locally.

However, they do support major payment methods for most countries. These include:

Debit and credit card

SWIFT Bank Transfer (both local in Australia and international)

Neteller and Skrill

PayPal

And depending on the jurisdiction, they also offer:

POLi

M-PESA

BPAY

UnionPay

It is free to deposit with any payment method.

Pepperstone doesn’t limit deposits, except for Paypal, Neteller, and Skrill which have a max deposit limit of 50,000 of your base currency (USD, GBP, EUR). We could not find any minimum deposit requirements so it is fair to assume that the minimum deposit is $0.

Your bank may take additional fees or set its own limits.

All payment methods are almost instantaneous, except for wire transfer, which usually takes up to three business days for local transfers and up to five days for international transfers.

You have to KYC verify with the standard broker procedures before you can make your first trade. These include proof of residence, proof of identity, and filling out a questionnaire.

Withdrawal Methods

All of the same terms apply to withdrawals as deposits, and you can use the same methods to withdraw as to deposit.

The only difference is Neteller, Skrill, and Paypal incur a $1 withdrawal fee. These payment methods also have a 50,000 base currency withdrawal limit. International wire transfer withdrawals will also incur a $20 fee. Credit, debit, and local wire transfers are free, and there are no limits.

It can take a few days longer to withdraw money than to make a deposit.

You can only withdraw up to 90% of your free margin.

How Much Are Pepperstone’s Fees and Commissions?

Most of the fees in Pepperstone trading are daily rollover swaps. If you hold your position overnight, they lend you the money to maintain your position and take a fee for making the market. You get charged these every night you hold the position.

Most brokers take a percentage or a fixed price for daily rollover swaps. Pepperstone uses complicated equations like:

Daily swap charge / credit = (One point / exchange rate) x (Trade size [or notional amount] x tom next)

There are different equations for different instruments, making it even more complicated.

Islamic persons who cannot take loans can get a swap-free account.

The commissions also depend on the account type. You can either choose a Razor account with lower spreads but commissions or a standard account with higher spreads but no commissions. They charge $3.5 per trade ($7 in and out) for Razor accounts.

When you add up the typical spreads, daily rollover swaps, and these commissions, the total fees are higher than many other platforms, but only by a margin. However, if you hold the position long enough, the daily rollover fees can eat considerably into your profits.

Pepperstone Trade Sizes and Limits

The minimum order is 0.01 lots, and the maximum order is 100 lots. However, these vary from instrument to instrument. With crypto, the minimum lot size is .01, and the maximum lot size is 50.

Can I Use Pepperstone in Any Country?

Pepperstone has clients in over 160 countries. However, you can’t use Pepperstone if you are a resident of Afghanistan, American Samoa, Antarctica, Argentina, Armenia, Azerbaijan, Belarus, Belgium, Belize, Bhutan, Bosnia and Herzegovina, Burundi, Cameroon, Canada, Central African Republic, Chad, Congo, Democratic Republic of the, Côte d’Ivoire, Eritrea, French Guiana, French Polynesia, Guadeloupe, Guam, Guinea, Guinea-Bissau, Guyana, Haiti, Holy See, Iran, Iraq, Japan, Kazakhstan, Lebanon, Liberia, Libya, Mali, Martinique, Mayotte, Mozambique, Myanmar (Burma), New Zealand, Nicaragua, North Korea, Palestine, Puerto Rico, Réunion, Saint Kitts and Nevis, Saint Lucia, Saint Vincent and the Grenadines, Samoa, Somalia, South Georgia and the South Sandwich Islands, South Korea, South Sudan, Sudan (North), Suriname, Syrian Arab Republic, Tajikistan, Tunisia, Turkmenistan, Turks and Caicos Islands, United States of America, Uruguay, Vanuatu, Venezuela (Bolivarian Republic of), Virgin Islands (U.S.), Western Sahara, Yemen, Zimbabwe because these countries outlaw either CFDs or forex brokerage.

Their major markets are in Australia, Thailand, Vietnam, and the UK.

You should check your local regulations about CFDs, forex, and cryptocurrency before you try to sign up.

Is Pepperstone Available in My Language?

Currently, the platform supports 12 languages including English, Chinese, Arabic, French, German, Italian, Polish, Portuguese, Russian, Spanish, Vietnamese, and Thai.

How Easy Is It to Use Pepperstone?

For experienced traders, Pepperstone is relatively easy to navigate. The platform offers a user-friendly dashboard, live customer support and a good range of tutorials to help you get started. However, newer traders may find the features offered by Pepperstone to be too complex.

Spread betting, margin trading and automated trading tools require in-depth knowledge of the crypto market and technical analysis best practices.

Security and Regulation

Before providing any personal information to a crypto broker, it is important to check that the platform is safe to use. the best cryptocurrency apps and brokers should follow strict security processes and adhere to local regulatory guidelines.

Is Pepperstone Safe?

Pepperstone white labels other apps, which means that they are only as safe as the applications that they use.

In the past, there was a data breach of these third-party apps and user information was stolen, but not user funds.

During our Pepperstone review, we found that the trading platform uses basic security protocols such as 2FA. However, we could not find much information about the exact processes that are followed by each application.

Am I and My Funds Protected?

Pepperstone has indemnity insurance and is regulated, but there is limited protection for users. UK residents are protected up to £85,000 under the FSCS Protection.

However, unlike many other broker companies, they do not guarantee stop loss or stop-outs. Their terms admit that losses may exceed your deposit amount. Only UK and EU clients are guaranteed negative balance protection.

Is Pepperstone Regulated?

Pepperstone is regulated by many different regulatory authorities, including:

The FCA in the UK

ASIC in Australia

CySEC in Cyprus

DFSA in Dubai

CMA in Kenya

BaFin in Germany

SCB in the Bahamas

Do I Have to Verify My Account With Pepperstone?

You have to go through the standard verification procedures regulated CFD brokers must comply with for KYC and anti-money laundering purposes.

You must provide one of each of the following: Primary ID such as passport, driver’s license, or government-issued ID; secondary ID such as utility bill, bank statement, government-issued tax document, birth certificate, or citizen certificate.

These documents can be in most European languages, Arabic, Chinese, Japanese, Malay, Russian or Thai.

Extra Information

Educational Resources

You can ask the chat any question, and they usually respond within a minute.

The website lacks basic maintenance, and many of the links are broken. Much of the information there is incomplete or incorrect, and you won’t find out until you create an account.

Many customers are impressed by the tutorials, videos, and guides. These are both beginner and intermediate trader-friendly.

Tools and Charting

Because you trade in MT4, MT5, or cTrader, you have access to all the standard tools, indices, and charts provided by those platforms.

Customer Support

From experience, the chat customer support is very helpful. They are available 24 hours a day, Monday through Friday.

How to Open an Account With Pepperstone

Setting up an account with Pepperstone is slightly more complicated than with other brokers. Follow the process below to get started.

Step 1 – Visit Pepperstone’s official site & Sign up

Visit the official Pepperstone website and click “Join Now”. You can use email, Facebook or Google SOS. You can create an standard, razor, or swap free account. If you don’t see your country of residence on the list, Pepperstone isn’t available in your country. When you create your account, you will be taken directly to the secure client area.

Step 2 – Verify your identity

You will be asked to upload a copy of photo ID to prove your identity. Follow the instructions that appear on your screen to do this.

Step 3 – Create an account with a trading platform

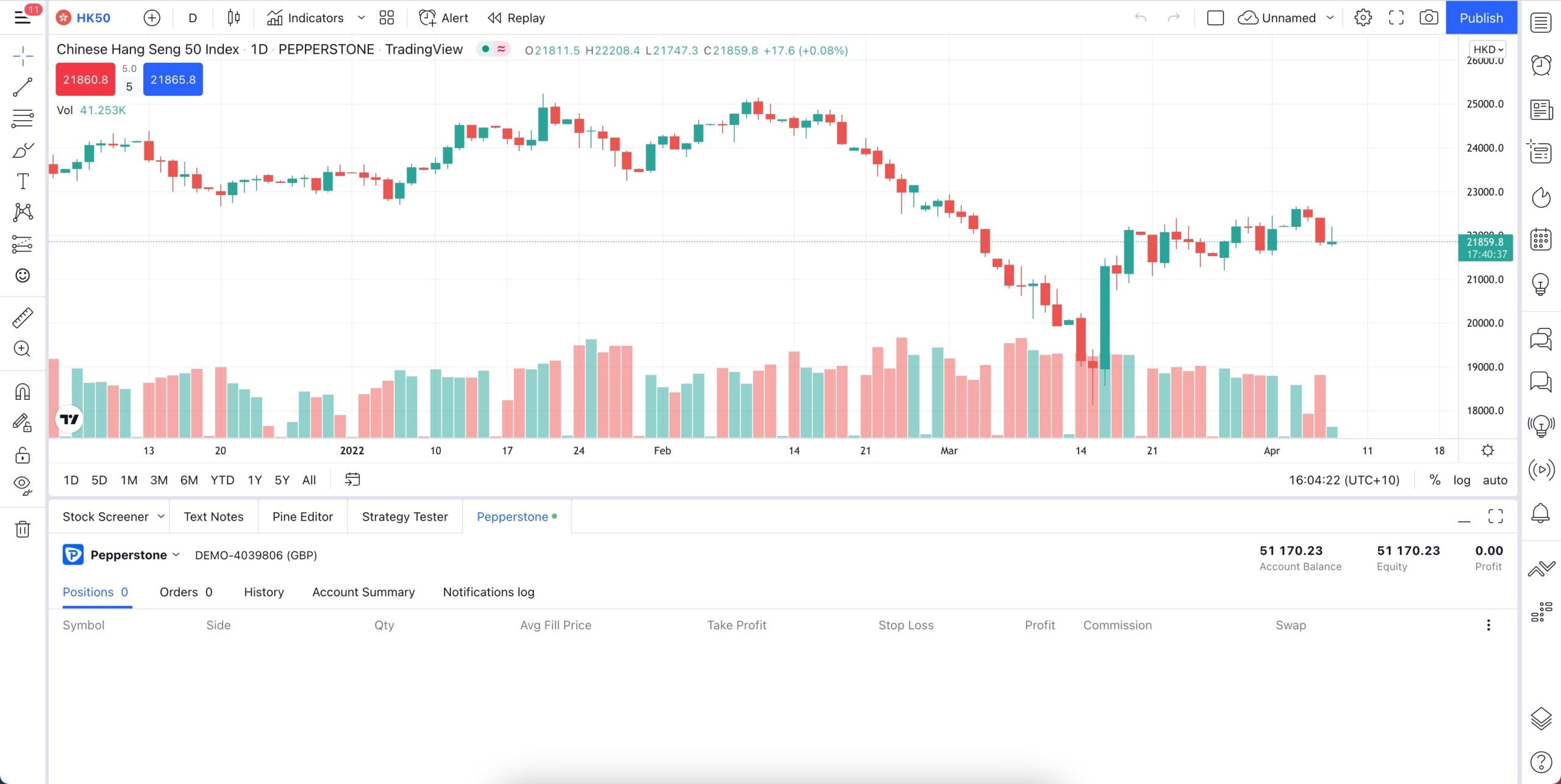

After signing up to Pepperstone, you will need to sign up to a third-party charting tool. You can choose between MT4, MT5, TradingView and cTrader. The process of signing up to these platforms is very similar to joining Pepperstone itself.

Once you have created an account, you will be able to connect your Pepperstone brokerage account to your trading platform account and use your funds to execute trades.

Step 4 – Set preferences

Once you are in the trading dashboard, you will be able to set your preferences. This includes setting up indicators and alters, adjusting leverage and implementing APIs.

Step 5- Fund your account

Use your chosen payment method to fund your Pepperstone account with enough funds to cover the cost of the first trade that you would like to make.

Step 6 – Start trading

Once you have funded your account and set your parameters, you will be able to start placing trades.

Always take time to conduct thorough research before making any trading decisions.

Final Thoughts

Even though Pepperstone is known for low fees and no holding fee, it is suggested that for retail investors, there are better platforms to use than Pepperstone. Look for a lower commission, spreads, and uncomplicated rollovers swaps. Also, look for a platform that offers more instruments and features. Those taking their first steps into forex or CFD trading should look for more user-friendly interfaces.

For the average retail investor, eToro is a better choice across the board. That’s why they have 17+ million users, compared with Pepperstone’s 1 million.

Nevertheless, Pepperstone stands out as a good option for experienced traders who are looking to implement active trading strategies. The broker supports leading charting tools such as MetaTrader, cTrader and TradingView, which are not available on other crypto exchanges.

FAQs

Is Pepperstone good for beginners?

Yes and no. On one hand, Pepperstone offers low spreads and a good selection of education resources that could be helpful to beginners. However, many of the features that are available on the platform require previous trading experience.

What is the minimum deposit for Pepperstone?

Pepperstone does not have a minimum deposit. However, the minimum trade size is 0.01 lots.

Is Pepperstone available in the US?

No, Pepperstone is not available to US residents and is not regulated by any US financial authority.

Contributors