- Despite retraction across markets, investments in crypto startups at all-time high

- Deal sizes in crypto and blockchain continue to dramatically outpace the broader VC landscape

- Web3, NFTs, DAOs, Metaverse, and Gaming deals had the largest share of capital invested and deal count

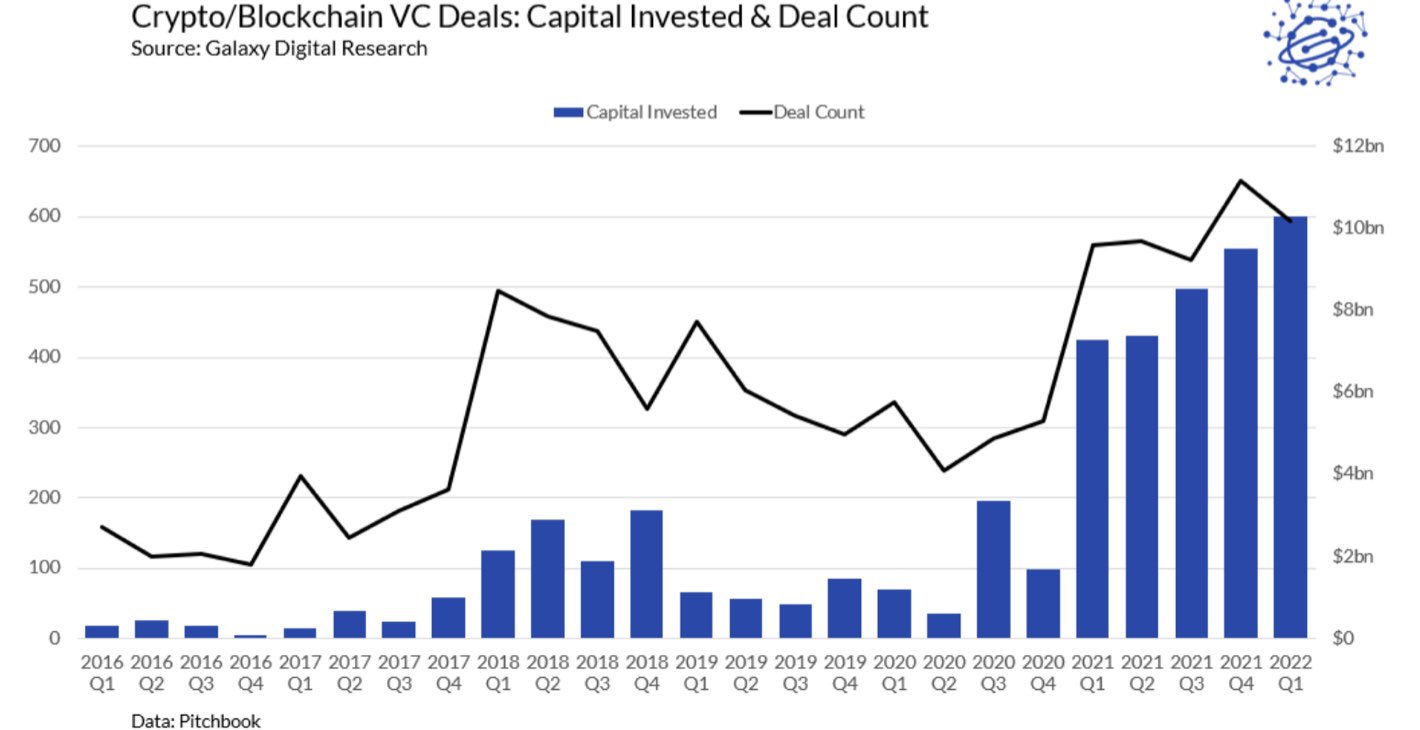

Despite significant drawdowns across traditional and crypto-asset markets, the amount of money invested in crypto and blockchain startups by venture capitalists (VCs) has reached a new all-time high with over $10 billion being invested in crypto startups in the first quarter of this year.

According to a report compiled by financial services and investment management firm Galaxy Digital, after a reversion in Q4 2021 where more capital went to earlier stage deals, later-stage deals accounted for most investment dollars, returning to a trend that held for most of 2020 and 2021.

Healthy demand from investors

Demand from investors for inclusion in crypto and blockchain deals remains healthy while the number of Pre- seed deals continues to remain depressed. Competition for access to deals increases, with founders raising more on a median basis while selling less equity, leading to higher valuations, the report states.

Prior to 2020, venture investment in the crypto and blockchain ecosystem tended to follow digital asset prices closely, albeit on a slightly delayed basis. This dynamic is evident when reviewing the money invested against the price of Bitcoin in 2017 and 2019.

However, while investments grew with the Bitcoin price in 2020 and 2021, they continued to grow during major bitcoin price drawdowns in Summer 2021 and in Q1 2022. This decoupling is demonstrative of investors’ disbelief that a prolonged bear market in digital assets is forthcoming as well as the significant amount of dry powder held by funds seeking to allocate to the sector.

The report further states that the money invested by venture capitalists continues to grow to new highs, even while the total number of venture deals in crypto and blockchain companies is down slightly from the last quarter.

VCs focus on later-stage companies

In terms of money invested by stage, vast amounts of capital continue to go to later-stage companies, with more capital going to later-stage companies (series B+) than earlier stage companies (pre-seed, seed, and Series A) in Q1 2022.

The total deal count in Q1 2022 was slightly below the all-time high in Q4 2021 and nearly half of all deals went to Pre-seed, Seed, or Series A stage companies, reversing a trend seen in 2021 where later-stage deals accounted for the largest share.

“The recent rise in earlier stage deals is demonstrative of increased interest in the crypto and blockchain sector by entrepreneurs in the face of unprecedented market growth over the last 18 months. However, most of that rise was accounted for by Seed and Series A stage companies—these companies were previously Pre-Seed companies that launched in prior quarters. Indeed, Q1 2021 had the largest count of Pre-Seed deals of any quarter since Q1 2020, but that count continues to decline,” the report states.

Web3, NFT, Metaverse and Gaming companies rule the roost

Examining the breakdown in capital allocated by subsector shows the continued rise of Web3, NFT, Metaverse, and Gaming companies in the crypto and blockchain ecosystem, which have taken the largest share of raised funds for the first time, accounting for more than 40% of all deals done in Q1 2022.