Since launching 12 years ago, Bankless Times has brought unbiased news and leading comparison in the crypto & financial markets. Our articles and guides are based on high quality, fact checked research with our readers best interests at heart, and we seek to apply our vigorous journalistic standards to all of our efforts.

BanklessTimes.com is dedicated to helping customers learn more about trading, investing and the future of finance. We accept commission from some of the providers on our site, and this may affect where they are positioned on our lists. This affiliate advertising model allows us to continue providing content to our readers for free. Our reviews are not influenced by this and are impartial. You can find out more about our business model here.

Best Crypto Savings Accounts

Crypto savings accounts are a new concept in the cryptocurrency landscape. They work just like traditional savings accounts but instead of earning interest on regular money, you earn interest on your cryptocurrency holdings. It’s a great way to make your crypto work for you!

One of the biggest advantages of crypto savings accounts is the higher interest rates they offer compared to traditional savings accounts. However, like with any investment, there are risks involved with crypto savings accounts, such as hacks or security breaches, market volatility, and regulatory changes. That’s why it’s important to choose a reputable platform with strong security measures in place to minimize these risks.

Now, let’s talk about some of the best crypto savings accounts available. To find the right one for you, it’s important to consider factors such as interest rates, security measures, supported cryptocurrencies, and overall reputation. We’ve researched all these factors and more, so let’s take a look at the top platforms.

- Top Crypto Savings Accounts

- Best Crypto Savings Accounts Reviewed

- Comparison of the Best Crypto Savings Accounts

- What is a Crypto Savings Account?

- How Do Crypto Savings Accounts Work?

- Are Crypto Savings Accounts Safe?

- How Do I Choose a Crypto Savings Account?

- Pros and Cons of Crypto Savings Accounts

- Final Thoughts

- FAQs

Top Crypto Savings Accounts

Best Crypto Savings Accounts Reviewed

1. Nexo – Best for Overall Crypto Savings

| Coins Available for Savings Accounts | 35+ |

| Stablecoin Interest | Up to 16% |

| Crypto Interest | Up to 15% |

| Payout Frequency | Daily |

| Term Length | Flexible / Fixed-Term (1, 3, & 12 Months) |

Nexo offers a variety of services including savings accounts, loans, and credit cards. One of the unique selling points of Nexo is that they offer up to 16% interest on your cryptocurrency holdings, which is higher than many other platforms.

Nexo is an excellent platform for those who are new to cryptocurrency savings accounts as they offer high-yield interest rates and a simple mobile and web interface. Nexo offers flexible and fixed-term deposits that allow you to earn interest on your cryptocurrency holdings. They support a wide variety of cryptocurrencies including Bitcoin, Ethereum, Litecoin, and more.

When you invest with Nexo, your interest is paid out daily and is compounded. Users gain access to the highest reward rates by holding the platform’s proprietary NEXO token. They can even earn an extra 2% interest when they receive it in NEXO. Other useful features on the platform include trading and Ethereum staking.

- High interest rates on crypto holdings

- Choice of flexible and fixed-term

- Compounding interest paid daily

- Wide choice of coins

- Custodial insurance

- Lower interest rates for non-NEXO-holders

- Not available in the US

2. Binance – Best for High-Yield Products

| Coins Available for Savings Accounts | 348+ |

| Stablecoin Interest | Up to 4.2% |

| Crypto Interest | Up to 32% |

| Payout Frequency | Daily |

| Term Length | Flexible / Fixed-Term (1, 2, 3 & 4 Months) |

Binance offers a number of different types of savings accounts with different rates and terms. There are hundreds of cryptocurrencies supported in Binance Simple Earn, which provides stable earnings and principal protection.

Interest payments are made on a daily basis and are automatically deposited into your account. What’s more, by turning on the Auto-Subscribe feature, you can automatically add tokens in your spot wallet to Simple Earn, thereby compounding your interest.

In addition to Simple Earn, there are also high-risk, high-yield products such as Dual Investment and Range Bound that offer potential interest of as much as 100% or more, as well as Launchpad which enables users to invest in new projects before they are listed on other exchanges.

Binance Earn isn’t available on Binance.US, but US users are able to stake a range of cryptocurrencies to earn interest.

- User-friendly UI and UX

- Diverse range of supported cryptocurrencies

- Daily interest payments

- Multiple high-risk, high-yield earning programs

- Insufficient insurance coverage

- Not as regulated as some other platforms

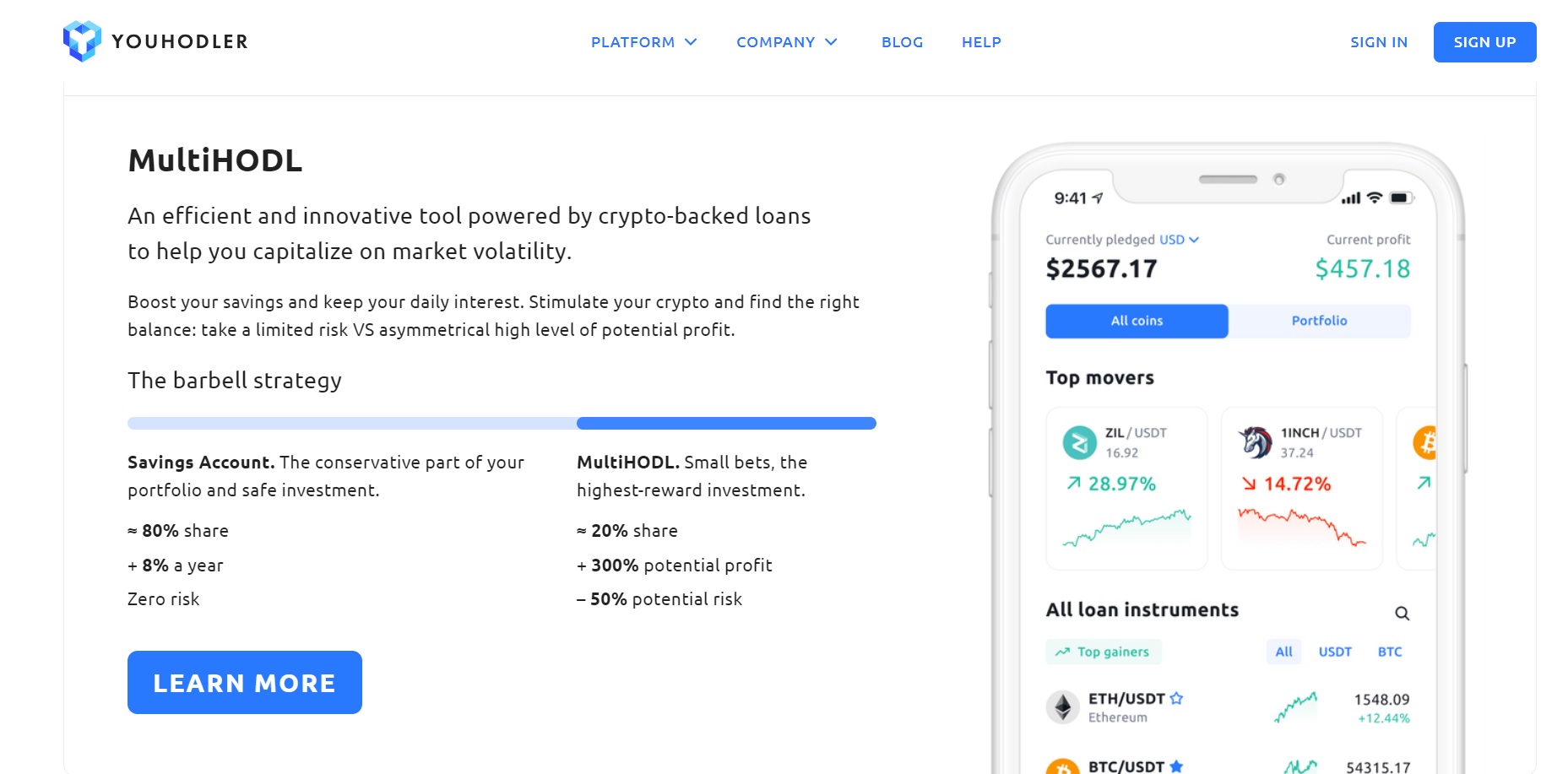

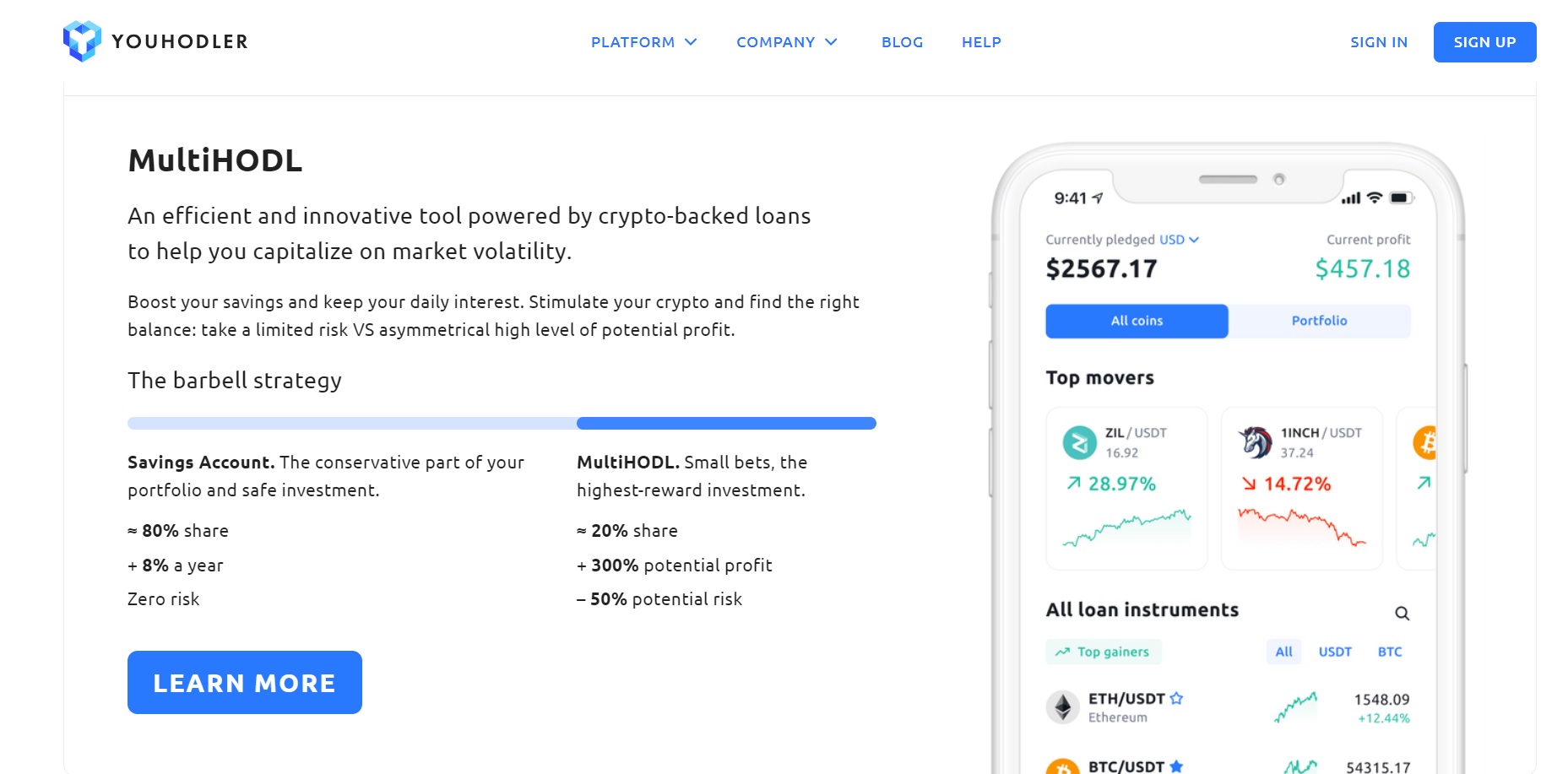

3. YouHodler – Best for Multiple Earning Opportunities

| Coins Available for Savings Accounts | 30+ |

| Stablecoin Interest | Up to 12% |

| Crypto Interest | Up to 15% |

| Payout Frequency | Weekly |

| Term Length | Flexible / Fixed-Term |

YouHodler offers some of the highest interest rates on the market as you can get 12% in stablecoins and up to 8% in other crypto. The platform is designed with simplicity and efficiency in mind. You can transfer your cryptocurrency, convert it to fiat, and hold the funds for investment purposes in your wallet with utmost convenience.

YouHodler offers a reward program where you can turn your cold assets into hot profits and earn rewards and compound interest on Bitcoin (BTC), Pax Gold (PAXG), and all major stablecoins. Crypto interest earnings are deposited directly into your wallet every week.

YouHodler has other earning opportunities such as crypto loans with 90% loan-to-value, Multi HODL to earn daily interest and Turbocharge for borrowing to get more crypto. YouHodler is an EU and Swiss-based brand with regulated institutions in Switzerland, Italy, and other EU countries. It is an active member of the Blockchain Association of Financial Commission and the Crypto Valley Association.

- High interest rates offered

- User-friendly wallet

- Multiple earning opportunities

- Wide range of supported currencies

- Regulated in multiple countries

- Not available in the US

- Limited free withdrawals

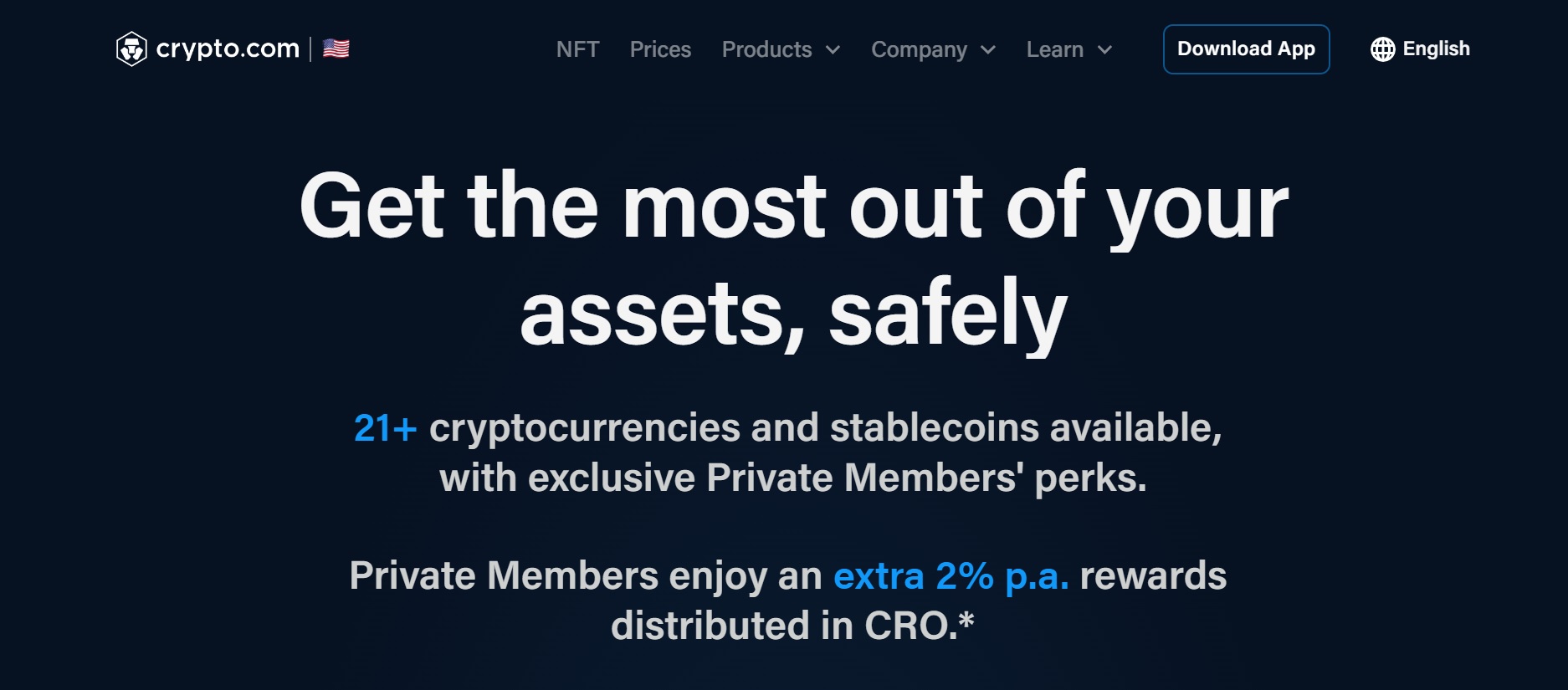

4. Crypto.com – Best for Diversity of Crypto Services

| Coins Available for Savings Accounts | 21+ |

| Stablecoin Interest | Up to 7% (+ 2% p.a. for private members) |

| Crypto Interest | Up to 12% (+ 2% p.a. for private members) |

| Payout Frequency | Daily |

| Term Length | Flexible / 1 month / 3 month |

The platform offers the ability to earn interest on crypto holdings at a higher rate than the best traditional savings accounts. This means that you can earn a significant return on your crypto assets simply by holding them in a Crypto.com savings account. Crypto.com has a Visa card that allows you to spend your crypto and earn rewards. This makes it easy to use your crypto in the real world, just like you would with traditional currency.

Rewards are paid in the same cryptocurrency that you deposit, but private members receive an additional 2% paid in Crypto.com’s proprietary CRO token. The rewards rates are also tiered according to the amount deposited, term length, and amount of CRO locked up.

In terms of licensing and regulatory compliance, Crypto.com has obtained licenses to operate in several jurisdictions around the world and complies with all the AML and KYC procedures.

- Moderate to high interest earnings

- Wide range of other crypto services

- Reliable and highly secure platform

- Extra rewards for private members

- Limited cryptocurrencies support

- Not available in the US

5. OKX – Best for a Variety of Savings Options

| Coins Available for Savings Accounts | 100+ |

| Stablecoin Interest | Up to 10% |

| Crypto Interest | Up to 11% |

| Payout Frequency | Daily |

| Term Length | Flexible / Fixed-Term |

OKX is a crypto platform for more adventurous digital currency enthusiasts who don’t just want to HODL but put their crypto to work. With OKX, you can earn on more than 100 tokens. The platform offers a number of savings accounts including Simple Earn and On-chain Earn allowing you to invest and earn on your crypto your way.

With the ability to invest and earn in both flexible and fixed terms, you have complete control over your trading. The overall interface of the platform is minimal to attract both beginners and seasoned traders.

Apart from the Simple Earn plan, OKX also offers Dual Investment for more adventurous crypto traders along with On-chain Earn and Shark Fin options. On-chain Earn enables users to participate in streamlined lending pools while Shark Fin is for those who want to gain USDT regardless of the market trend.

- Wide range of crypto trading services

- Easy-to-use platform for beginners

- Variety of savings features including staking

- Adheres to Proof-of-Reserves protocol

- Not available in the US

- Interest rates are not as high as other platforms

6. KuCoin – Best for Experienced Crypto Investors

| Coins Available for Savings Accounts | 80+ |

| Stablecoin Interest | Up to 6% |

| Crypto Interest | Up to 3% |

| Payout Frequency | Daily |

| Term Length | Flexible / Fixed-Term |

The savings feature is called KuCoin Earn. It provides products such as Flexible Savings, Lending, Polkadot slot auctions, and ETH 2.0 staking in both flexible and fixed terms so you can invest in the crypto as per your preferences and risk appetite.

The user experience can be a challenge for beginners as KuCoin offers a wide range of earning options along with a diverse variety of features that can be quite overwhelming for new traders and investors. Rewards payments are frequent but vary depending on the product you choose. Interest compounds for some products but may not for others.

KuCoin has one of the best, if not the best, staking programs that allow you to pool your crypto and gain a return on your investment. Apart from that, KuCoin offers Crypto Lending, Spotlight, KuCoin Wealth, Cloud Mining, and KCS Bonus for more earning opportunities.

- High flexibility for experienced users

- Wide range of earning programs

- Bonuses with regular returns

- Ability to trade staked tokens

- Comparatively low interest rates

- Not user-friendly for beginners

7. Ledn – Best for Crypto Investors Who Want Flexibility

| Coins Available for Savings Accounts | 2 |

| Stablecoin Interest | Up to 12% |

| Crypto Interest | Up to 6% |

| Payout Frequency | Monthly |

| Term Length | Fixed-Term |

Ledn is a financial platform that offers a savings account, Bitcoin loans, and the chance to double your Bitcoins with proof of reserves. Ledn has partnered with Genesis as the primary borrower for its Bitcoin and USDC savings accounts. The savings accounts offered by Ledn are backed by Genesis Capital and offer interest rates of up to 6% on Bitcoin and up to 12% on USDC.

Since the service is geared towards everyday consumers who may not be as technologically inclined, the interface is intuitive and friendly to use for beginners. The interest offered by Ledn’s savings accounts is compounded and paid out monthly. Ledn offers other earning products such as Bitcoin loans and B2X which is a Bitcoin Balance Doubling service that enables leveraged borrowing to increase holding assets.

Ledn’s savings accounts are unique because they offer interest rates that are higher than most traditional banks. Additionally, the platform is licensed and regulated by FINTRAC which makes it safe to use.

- Designed for everyday users

- Friendly and intuitive UI

- Moderate returns

- Partnered with Genesis

- No crypto variety

- Not as established as other platforms

Comparison of the Best Crypto Savings Accounts

| Coins available | Stablecoin interest | Crypto interest | |

|---|---|---|---|

| Nexo | 35+ | 16% | 15% |

| Binance | 370+ | 4.2% | 32% |

| YouHodler | 50+ | 12% | 15% |

| Crypto.com | 20+ | 7% | 12% |

| OKX | 100+ | 10% | 11% |

| KuCoin | 80+ | 6% | 3% |

| Ledn | 2 | 12% | 6% |

What is a Crypto Savings Account?

A crypto savings account is a kind of online savings account that pays interest on your cryptocurrency reserves. It functions similarly to conventional savings accounts, except that it trades in cryptocurrency rather than conventional fiat currency like dollars or euros.

Users can store their Bitcoin in an account offered by a cryptocurrency platform or service. In order to earn a profit, the platform either loans the money to borrowers or invests it. Investors get a portion of the interest generated by their accounts, providing a passive source of income from their Bitcoin holdings.

How Do Crypto Savings Accounts Work?

Cryptocurrency savings accounts are a great way to put your money to work for you by allowing you to accrue rewards. To use a crypto savings account, you usually need to follow these steps:

Register with a reliable cryptocurrency platform that provides a savings account.

Proceed with registration, and verify your identity if prompted to do so.

Put the cryptocurrency you’ve selected into a wallet linked to your savings account.

Information on interest rates and any other features or conditions of the account will be made available to you by the platform. When you deposit Bitcoin, you’ll get interest paid according to the conditions already specified.

When you keep money in a crypto savings account, the platform will often lend it out to other users of the cryptocurrency network, such as borrowers, institutions, or margin traders. Borrowers pay interest on the money they borrow, and the account holders get to keep some of that interest as a crypto reward.

The money you make on certain crypto savings accounts can be reinvested, resulting in exponential growth, since the account is eligible for compound interest. Because of this compounding impact, your funds can grow faster over time.

Crypto Savings Accounts vs Staking

Earning payouts on cryptocurrency assets is possible through both crypto savings accounts and staking, but the two systems are distinct.

When it comes to savings accounts, interest is earned by depositing money into a cryptocurrency savings account, which is then loaned out to borrowers or institutions. The platform and market circumstances establish the interest rates.

On the other hand, staking involves keeping a certain coin in a wallet and contributing to a blockchain network’s consensus process. Contributing to the safety of the network in this way will earn you tokens or reduced transaction costs in exchange. Unlike loan activities, staking benefits are exclusive to the network.

When compared to crypto savings accounts, which often allow for more frequent deposits and withdrawals, staking typically forces you to lock up your tokens for a specified duration. To guarantee the safety of your assets, you should always do your due diligence before trusting any platform or service with your crypto savings or staking activity.

Are Crypto Savings Accounts Safe?

There’s no right answer until you have evaluated some key factors that highlight whether a savings account feature offered by an exchange is safe or not. That’s why it is essential to consider the following risks.

Absence of Deposit Insurance – Unlike ordinary bank accounts, crypto savings accounts are not covered by deposit insurance. This implies that there is no assurance that you will be able to retrieve your funds in the event of a security breach.

No Access to Private Keys – You usually don’t have access to your private keys if you store your cryptocurrency in an exchange or wallet that doesn’t give you custody of your funds, which means getting your money back in the event of a hack or shutdown might be difficult.

Varying Withdrawal Restrictions – You may be subject to withdrawal limits or lock-up periods on the money in your cryptocurrency savings account. In such cases, you will be unable to access your money if they are subject to limitations designed to manage liquidity or minimize risks.

Interest isn’t Necessarily Compounded – Not all cryptocurrency savings accounts allow for interest to compound, despite the fact that doing so would greatly increase the value of your funds over time.

Price Volatility – Although the value of the rewards on a crypto savings account is intended to be steady in terms of crypto, there is always the risk of large price swings. The value of your savings might decline if your crypto experiences a significant decline in value.

Platform Bankruptcy – There is a chance that your crypto savings might be hacked or rendered unavailable in the event that the platform or service provider supplying the crypto savings account experiences bankruptcy or financial problems.

Regulatory & Legal Risks – There is the potential for trouble with the law since cryptocurrency regulation is still in its infancy in many parts of the world. The functionality and long-term survival of crypto savings accounts can be affected by regulatory shifts or government actions.

How Do I Choose a Crypto Savings Account?

Several considerations should be made while picking a crypto savings account to guarantee that you choose a service that fits your requirements. Some things to keep in mind are as follows:

Interest Rates – Your cryptocurrency savings can earn more interest if you deposit it into a platform that offers a higher rate of interest. That being said, be wary of very high rates, since they can signal increased risk or unsustainable methods.

Available Coins & Assets – Look at the list of supported coins and assets to see what kinds of digital currencies and assets are supported. Verify the coins you own or want to deposit can be used to accrue interest.

User Experience and Platform Friendliness – Think about the platform’s user interface, accessibility, and user experience. An easy-to-navigate and feature-rich savings account is more likely to be used regularly and efficiently.

Security & Insurance – Protect your data and your money by giving preference to platforms that use advanced security features like two-factor authentication, encrypted communication, insurance, and cold storage for your funds.

Regulation and Compliance – Check to see whether the platform is governed by any regulations and meets all compliance requirements. Credibility and dedication to best practices on the platform may be further bolstered by regulatory scrutiny.

Extra Features and Services – Consider any additional features and services the platform provides. Token sales and ICO participation could be available on certain platforms, as might the opportunity to stake coins.

Jurisdictional Availability – Ensure the platform is accessible in your region by checking its availability first. Check local legislation to ensure the platform you want to use is accessible in your country.

Pros and Cons of Crypto Savings Accounts

- Potential to earn a passive income

- Higher interest rates as compared to conventional accounts

- Diversification opportunities for all types of users

- Improved accessibility and greater flexibility

- Earn interest from anywhere in the world

- High risk and high volatility

- Lack of regulation and insurance

- Cybersecurity risks

Final Thoughts

Crypto savings accounts provide a great way for traders and investors to earn and put their tokens to work. There are many exchanges today that offer a range of earning programs along with robust support for a variety of cryptocurrencies and stablecoins. Having said that, it is important to ensure that you are taking all the features and concerns into account before investing your tokens.

Our in-depth research shows that if you are searching for the highest return, then NEXO, Binance, and YouHodler are your best bets. On the other hand, Crypto.com provides a wider variety of trading and investing services while OKX delivers a range of savings options.

FAQs

What is the safest crypto savings account?

Due to its high level of security, insurance, and regulatory compliance, Crypto.com is widely regarded as one of the most reliable platforms for crypto savings accounts.

What is the best high yield crypto savings account?

Both NEXO and Binance are well-known for supporting a wide range of cryptocurrencies and giving attractive interest rates for crypto savings accounts.

Is crypto better than a savings account?

Your own preferences and level of comfort with risk will determine whether you opt for a crypto or conventional savings account. When compared to more conventional savings vehicles, the volatility and risks associated with cryptocurrency savings accounts are greater but the rewards are also higher.

Can you lose money in a crypto savings account?

The short answer is that you could lose money in a cryptocurrency savings account. The value of your funds might be negatively impacted if you invest in volatile cryptocurrencies.

How are crypto savings taxed?

Tax rules for cryptocurrency holdings differ by country. Savings interest is generally taxed as income, but when you sell crypto interest, this will likely trigger Capital Gains Tax as well. If you need specific responses, a tax expert or regulations in your area can assist you.

Is it a good idea to have your savings in cryptocurrency?

It all depends on your level of comfort with risk and how well you understand the digital currency market. Cryptocurrencies are volatile and risky, but they also have the potential for large rewards. It’s wise to give some thought to your long-term financial objectives and diversify your funds around.

Are crypto savings accounts legal?

The answer is “it depends” on the laws of the nation in question. Some countries may have unique criteria or limits as cryptocurrency legislation develops. Select platforms that function inside regulatory frameworks and ensure you comply with local regulations.

Contributors