Two recent communications involving multiple members of both houses send a confusing message about the federal government’s stance on crowdfunding.

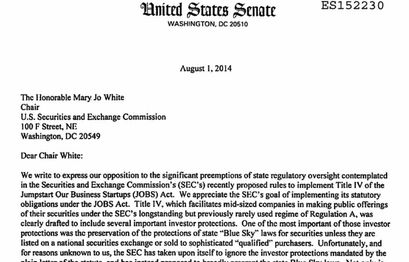

On Aug. 1 nine Senate Democrats sent a letter to SEC Chair Mary Jo White stating their objection to the “significant pre-emptions of state regulatory oversight” proposed by the SEC in the package of rules designed to oversee the implementation and management of Title IV of the JOBS Act. They disagreed with the removal of protections of state “Blue Sky” laws for securities unless they are listed on a national exchange or sold to qualified investors.

“Not only is that not consistent with the best interests of investors, it is simply and plainly inconsistent with the statue. It must be withdrawn,” the letter stated.

The group goes on to chastise the SEC for considering rules that are beyond its “very limited authority to issue rules exempting Regulation A+ securities from state ‘Blue Sky’ laws,” while also faulting the SEC’s proposed rules for in no way considering the qualifications of investors.

Strong language permeated the remainder of the three-page letter. By defining a qualified purchaser as anyone who buys an A+ offering, the SEC has committed a “stunning evasion of regulatory intent” which is in direct conflict with “pure common sense.” The SEC is also “eviscerating” the requirement for listing on a national securities exchange.

The SEC was also reminded some of the rules they are now contemplating are of a rationale previously rejected by Congress.

The letter goes on to give a history lesson on the origins of the Blue Sky laws which came into existence “over 100 years ago” Really? Is the world the same place it was in the late 1800’s and early 1900’s? Do they get around in a two-seater open-air plane or a car that maxes out at 10 miles per hour? Do they files their taxes by abacus?

The nine senators are listed below. Clicking on each one will take you to the comments space of their personal website.

Edward Markey Massachusetts

Jeff Merkley Oregon

Carl Levin Michigan

Tom Harkin Iowa

Elizabeth Warren Massachusetts

Mazie Hirono Hawaii

Christopher Murphy Connecticut

Barbara Boxer California

Al Franken Minnesota

Of the eight states represented, only Michigan has enacted an intrastate crowdfunding exemption according to Crowdcheck.com.

On Aug. 8, a group of 26 members of Congress sent Mary Jo White their own letter urging the rapid implementation of provisions related to Title III of the JOBS Act, “which was supposed to reduce the burdens and hurdles for US startups and entrepreneurs to gain access to critical sources of new capital from more modest investors.”

The group included 21 Democrats and five Republicans, with seven from California, and three each from Washington, Illinois, and Florida. They reminded Chair White that the SEC was supposed to have rules by the end of 2012 and that by the date of the letter the SEC was more than 500 days late on their pledge.

“There is ample evidence that the market and investors are ready and waiting for the SEC to finalize the rules in a manner that will allow new capital to efficiently find its way to companies,” the writers state, before noting that companies are beginning to find ways around the lack of regulation and delays by working with other companies exploiting loopholes. States are taking the lead in this void by passing their own laws. Congressional intent was to “build a new cutting-edge infrastructure that will provide innovative funding opportunities for startups and robust investor protections for decades to come.” The letter concludes by asking for a date by which Americans can reasonably expect federal guidance.

What a gulf between attitudes. On one hand you have nine senators who see the need to protect regular Americans from themselves. After all, if they do not want to allow people beyond those fitting the traditional definition of “qualified purchaser” to include what their own letter deems an “exorbitant class of people,” presumably Joe Main Street who spends his spare time playing with hair dryers in the bath tub and sticking his tongue on stop signs in winter. Keep in mind Mr. and Mrs. Main Street are limited to $2,000 or 5% of their annual income (whichever is greater) if they earn less than $100,000 so even if they lose it all, they won’t lose IT ALL.

On the other side you have a group of politicians who recognize the paucity of funding options available to startups and SME’s and the dire need for them to contribute to America’s economic revival. In the absence of federal leadership creative entrepreneurs are finding other limited ways to access that badly needed capital, often with the assistance of state legislatures who recognize the place crowdfunding can have in the enhancement of their state’s economic fortunes.

The JOBS Act brought hope that crowdfunding legislation would soon be passed which would boost an economy which desperately needed the help. Despite creating a majority of the new jobs in America and being cited as a key player in the coming economic revitalization, small and medium businesses have found it hard to get the capital needed to make that contribution. All the more need for crowdfunding.

Yet we wait more than two years later for some sort of national strategy to emerge. Many states choose not to wait and are enacting their own micro versions of intrastate crowdfunding. They admit they cannot take the place of a national system but in the absence of national leadership, they are doing what they can.

Hopefully the time is upon us when the SEC, Senate, and the remainder of Congress look around and see countries all around the world embrace crowdfunding for its ability to deliver badly needed capital to key economic drivers who cannot seem to find it anywhere else.